1Q21 GDP growth at 7.0% slightly exceeds market expectations

TurkStat announced that 1Q21 GDP growth reached 7.0%, which is slightly above the 6.7% median market expectation, which was also our estimate. The working-day and seasonally adjusted GDP pointed to a 1.7% QoQ improvement (on top of the 15.9% and 1.7% QoQ recovery in the previous two quarters). Meanwhile, 12-month rolling GDP growth increased to 2.4% from 1.8% in 2020.

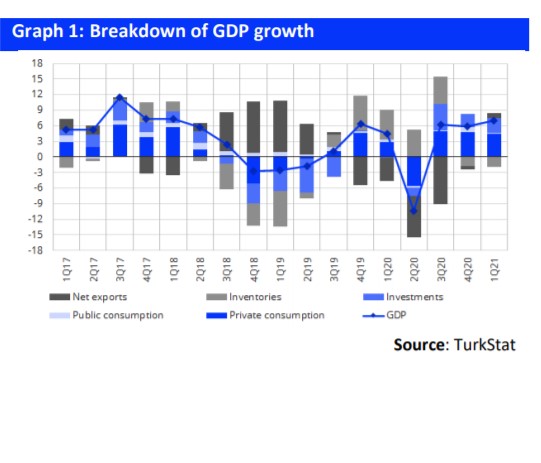

Expenditures: Domestic demand drives growth

Analyzing from the expenditure side, domestic demand continues to be the major driver. The reflections of the massive credit stimulus lingered into 1Q21 and led to a 7.4% YoY growth in private consumption (following the 8.5% and 8.2% growth in the previous two quarters) and making a 4.4% contribution to the headline growth. Gross fixed capital formation growth was also very strong at 11.4% YoY, making a 2.9% contribution, and this was mainly attributable to the 30.5% YoY growth in machinery-equipment investments, while construction related investments were down by 4.7% YoY. With this result, the contribution of investments reached 2.9%. The contribution from government expenditures stood at a mere 0.2%.

WATCH: Turkey’s Convoluted Foreign Relations | Real Turkey

Combining these, we can conclude that domestic demand made some 7.9% contribution to the overall GDP growth. With strong export performance and some moderation in imports, the contribution from net exports also turned to positive to the tune of 1.1%, after five straight quarters of negative contribution. As a result, we calculate that the contribution of inventory accumulation to overall GDP growth as -2.0%.

GDP growth is attributable to strong manufacturing and trade activity, despite weakness in tourism and construction

Analyzing from the production side, it is quite evident that breakdown of GDP growth continues to be uneven, as the weakness in construction and the shrinkage in tourism related sectors were more than offset by the strong growth in manufacturing and retail and wholesale trade sectors (largely automotive sales). The main driver of 1Q21 GDP growth was the roughly 11.7% YoY growth in the industrial sector, which is in line with expectations. Furthermore, the services component (trade, transportations and tourism sectors combined) and other services sectors (information, financial services, and administrative services, etc.), with 5.9% and 5.4% YoY growth rates, also made significant contributions.

WATCH: Turkish Economy IS in Crisis | Real Turkey

Yet, the YoY growth in the services component was somewhat lower than our expectations (which is based on the monthly turnover indices). TurkStat does not reveal the breakdown of the services component, so we cannot clarify the major factor behind this discrepancy. The construction sector remains weak with a mere 2.8% YoY growth. Yet, this points to some improvement compared to the 12.5% YoY contraction in 4Q20. It also points to a better outcome than suggested by the construction turnover index.

Agriculture’s boost surprises us

Finally, we are also perplexed by the 7.5% YoY growth in the agricultural sector, which actually contradicts with anecdotal evidence and the agricultural production estimates released by the Ministry of Agriculture and Forestry.

2021 projection upgraded

We revise our 2021 GDP growth estimate to 4.5% from 3.5%. Although we expect that the contribution of domestic demand is likely to retreat going forward, a favorable base effect is likely to lead to a double-digit GDP growth in 2Q, in excess of 15% (probably to the tune of 16-17%). We continue to expect that GDP growth may turn to negative in 2H21, particularly in the final quarter of the year. Yet, considering the stellar YoY GDP growth performance in 1Q21 and in 2Q21, we now revise our GDP growth estimate to 4.5% from 3.5%.

Serkan Gönençler, Economist

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/