Turkey’s August central budget reported a soaring TL 40.8 billion, or ca $5 bn, thanks to the low base effect and Ankara stopping all cash aid to the victims of the epidemic. The increases in personal and corporate income taxes drove the surplus. On the expenditure side, increasing current transfers dominated the outlook, as the deadline for subscribing to and paying the first installment of a general Tax and Social Security Arrears Amnesty was postponed to end-September. Is Bank Research Department and YF Finance researchers assert that end-2021 targets spelled out in the recent Medium Term Economic Program are within reach.

Isbank Research: Central government budget yielded a surplus of 40.8 billion TRY in August

In August, budget revenues increased by 35% yoy to 146.5 billion TRY, while budget expenditures expanded by 31.6% yoy to 105.7 billion TRY. Thus, the central government budget surplus, which was 28.2 billion TRY in August 2020, rose to 40.8 billion TRY in the same month of this year. In August, interest expenditures went up by 14.8% compared to the same period last year, while the primary surplus increased by 14.4 billion TRY yoy to 54.5 billion TRY.

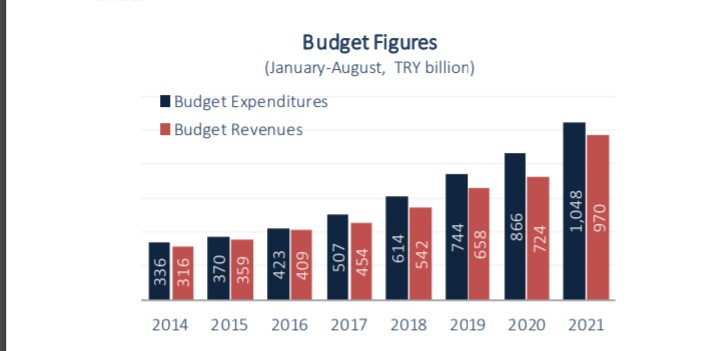

Compared to a 19.5% increase in budget expenditures in the January-August period, budget revenues expanded by 34.1% with the significant contribution of the low base created by the same period of last year. Thus, the budget deficit, which was 110.9 billion TRY in the January-August period of 2020, shrank to 37.5 billion TRY in the same period of this year. The primary balance, which reported a deficit of 19.3 billion TRY in the first 8 months of 2020, posted a surplus of 90.6 billion TRY in the same period 2021.

Tax revenues rose rapidly in August

Tax revenues increased by 33.2% yoy to reach 131.1 billion TRY in August. In this period, rapid rises in corporate tax and VAT revenues on imports reflected positively on budget performance.

Rising by 64.2% yoy corporate tax revenues contributed 16.2 points to the increase in budget revenues , while VAT on imports went up by 8.8 billion TRY yoy as a result of exchange rate and foreign trade developments. The decrease in SCT revenues in July continued in August as well. Due to the ‘echelle mobile’ system implemented to compensate the rise in fuel oil prices, the decrease in SCT revenues from oil and gas products reached 5.1 billion TRY in August compared to the same month last year, limiting the increase in budget revenues by 4.7 percentage points.

In January-August, budget revenues rose by 222.1 billion TRY (34.1%) compared to the same period of last year, thanks to the increase in tax revenues. In this period, domestic VAT and VAT on imports contributed to the rise in budget revenues by 14.7 points. On the other hand, the 17.6 billion TRY (40.3%) decrease in the SCT on oil products in the first 8 months of this year limited the rise in budget revenues by 2.7 points.

WATCH: Turkey’s New Economic Program Explained | Real Turkey

The increase in current transfers among expenditures stand out

In August, budget expenditures rose by 25.4 billion TRY yoy, led by the increase in current transfers and capital expenditures. Due to the rapid increase in health, retirement and social aid expenditures, current transfers made the highest contribution to the rise in budget expenditures in August with 12.1 points. Having increased by 3.3 billion TRY (81.9%) yoy, capital expenditures pushed the budget expenditures up by 4.1 points. This increase was driven by the rise of 2.6 billion TRY in contracting expenditures. It was noteworthy that the “lending” item went up by 2.6 billion TRY (278%) on an annual basis.

In January-August period, the increases in current transfers and personnel expenses were decisive in the rise in budget expenditures.

WATCH: Turkish Economy: The Good, the Bad and the Ugly | Real Turkey

Expectations…

The research analysts at YF Finance wrote: “The Medium-Term Programme, announced on September 5th, set the ratio of budget balance to GDP at 3.5% for 2021, indicating that fiscal policy will continue to support the economy in the coming months. The fact that the budget deficit forecast for 2021 in the MTP, led by the increase in primary expenditures, is higher than the forecasts of the Public Finance Report published at the end of May also supports this view. While a rise in budget revenues is also predicted in the MTP, it is estimated that a significant part of the said increase will stem from the rise in other revenues.

Budget targets for 2021 still seems achievable

At the beginning of the year, 2021 year-end budget deficit and budget-to-GDP targets were TRY -245bn and -4.3%, respectively. These figures were revised as TRY-230bn and -3.5% with 2022-2024 Medium Term Program (MTP). In 8M21, the budget gave a deficit of TRY 37.5bn (8M20: TRY -110.9bn). Accordingly, 15.3% of annual budget deficit target of TRY 245bn has completed as of August 2021 (16.3% of TRY 230bn, revised target in MTP). Similarly, initial primary balance and primary balance-to-GDP ratio targets of TRY -65.5 and -1.2% revised as TRY -50.5bn and -0.8%, respectively. On the contrary of the deficit targets, primary surplus was TRY 90.7bn in 8M21. Despite ongoing pandemic related incentive needs, recent momentum loss in the economic activity, weak performance of SCT revenues due to the sliding scale system on oil and gas products, upward trend on interest expenditures could continue to put negative pressures on the budget figures, budget targets for 2021 still seems achievable. Under the lights of the recent realizations and current trend, we expect a TRY213.1bn of budget deficit at the end of 2021 which refers to 3.3% of budget-to-GDP ratio. But risks are downward on our estimate. Pace of the economic activity and developments related with the pandemic would continue be important determinants for the budget performance. Next budget data (September) would be announced on October 15.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/