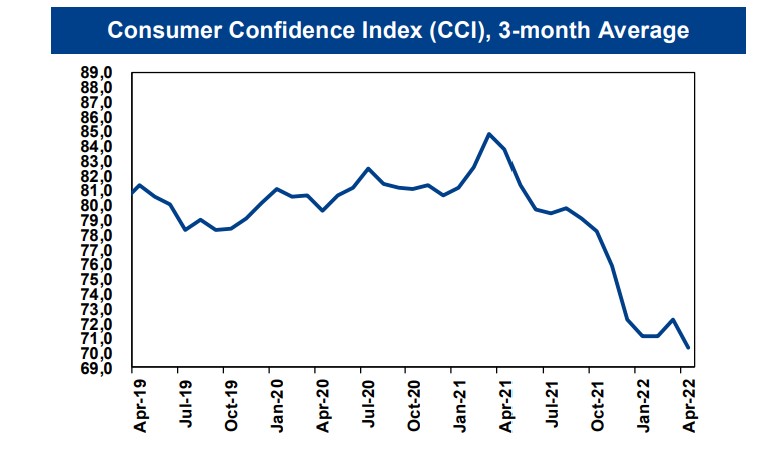

Turkstat (official) Consumer Confidence Index (CCI) decreased by 7.3% to 67.3 in April (March: 72.5, +1.9% MoM). There was no consensus available for the data, however BloombergHT CCI Index, which is a leading indicator for the data, had increased by 17.9% to 54.6 in April. Both surveys revealed a slight degree of optimism, probably driven by the stable exchange rate about future economic conditions. On the other hand, rising inflation and expectations have a perverse impact on spending behavior. Households intentions to increase spending despite poor financial well-being to avoid higher prices in the future.

The details of the index, as reported by Yatirim Invest economics team are as follows:

In monthly basis, all main sub-indices recorded decreases. Expectations for wage change and assessment of spending on semi-durables were over the critical value of 100 which indicates positive sentiment about future economic conditions.

15 of 18 sub-indices recorded monthly decreases. Highest monthly decreases were seen on economic situation at present, financial situation of household, and financial situation of household vs last 1 year whereas. The highest monthly positive changes were seen on expectations for wage changes, current financial situation of household and probability of buying a car.

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit | Real Turkey

According to 3-month average figures, downward trend on financial situation of households sustained as probability of borrowing money for the consumption expenditures increase. In other words, despite lower disposable incomes, household project higher prices for the future, preferring spending to saving. This trend is accentuated by artificially low loan rates, currently about 20% per annum, which encourages households to borrow to buy homes and durables. In other words, households understand that it makes sense to borrow at deeply negative real interest rates, with a view on acquiring real assets, the value of which is likely to increase in the future.

3-month average figures indicate that saving and buying of durables intentions increased as the assessment on consumer prices changes starts to deteriorate.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng