Turkish officials are considering extending a closure of the Istanbul stock market past Wednesday, after imposing a halt following a pair of devastating earthquakes in the nation’s southeast last week according to Bloomberg.

Market regulators could delay the resumption of trading after the initially announced Feb. 15, according to two people with direct knowledge of the discussions. No decision has been made yet, they said, also declining to provide additional details on what options were under discussion.

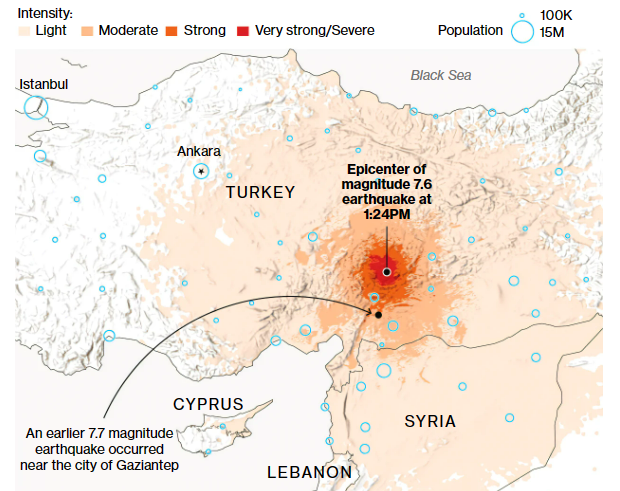

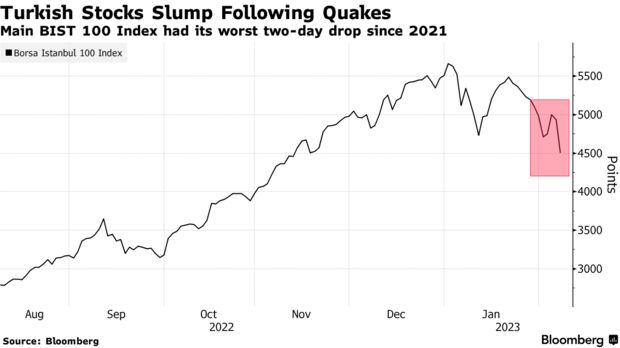

The bourse suspended trading on Feb. 8 and canceled trades made that day after the earthquakes on Monday devastated 10 cities in the worst natural disaster in modern Turkish history. The benchmark Borsa Istanbul 100 Index, which was already the worst-performing equity market in the world this year, erased tens of billions of dollars in market value over the two days it stayed open last week.

The Capital Markets Board, stock exchange, and Treasury and Finance Ministry declined to comment on potential extension of the closure when contacted by Bloomberg on Monday.

Market Regulators

Turkey’s main opposition party filed a criminal complaint against top market regulators last week, alleging the Capital Markets Board and the Borsa Istanbul failed to fulfill their duties by allowing the exchange to stay open. Hakan Atilla, the exchange’s previous chief executive, said healthy price formations under the circumstances would be “impossible.”

Local investors’ participation in Turkey’s stock market surged over the past year as stocks became favorite hedges against rampant inflation, while foreign ownership sunk near record lows of 30%.

The total number of equity investors from cities affected by the earthquakes was around 380,000 as of January, according to statistics from the Central Securities Depository of Turkey. That’s about 10% of all equity accounts.

For the full article pls click here.