The Turkish government under President Recep Tayyip Erdoğan has refused to abandon a low interest rate economic model despite the pace of price rises hitting a 24-year high of above 83%.

While private consumption remained the main driver for economic growth in the first half of 2022, soaring inflation would take a toll on consumer spending the remainder of the year. A survey by Yöneylem Social Research Center in July to August 2022 showed that 69.3% of participants said they were struggling to pay for food.

Is a recession in Turkey imminent as soaring inflation is set to hurt consumer spending, the economy’s main growth engine?

Is Turkey recession happening now?

Turkey’s economic crisis in 2018 to 2019 was triggered by a large current account deficit, mounting foreign currency-denominated private debts, and Erdogan’s economic policy of advocating low central bank interest rates despite high inflation.

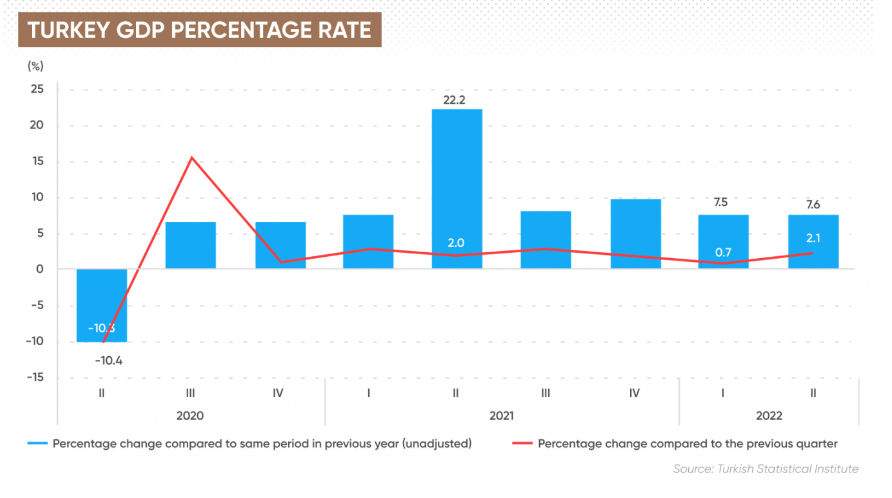

The economy started to recover in Q3 2019, recording modest growth of 1% and 6% in the final quarter of 2019. From 2020 to 2021, economic growth experienced a rollercoaster ride. The slowest growth was in Q3 2020, when the economy contracted 10.4%, and the fastest in 2021 when it grew 21.4%.

In 2021, Turkey’s annual GDP growth surged to 11.4%, from 1.9.% in 2020.

Entering 2022, the economy started to cool on external headwinds. These included rising commodity prices triggered by the war in Ukraine and the tightening cycle by central banks, which started to dent growth.

However, strong growth was still recorded compared to other developed nations. In April to June 2022 period, Turkey’s economy grew stronger than expected at 7.6%, despite soaring inflation and the weakening lira. It grew by 7.5% in Q1, according to data from the Turkish Statistical Institute.

WATCH: Is Turkey Headed For a Debt Crisis?

Private consumption had been the main driver in Q2, growing at 22.5% year-on-year (YOY), followed by exports which increased by 16.5%.

Muhammet Mercan, ING Group’s chief economist for Turkey, wrote on 31 August:

“This shows a continuation of robust household consumption driven by negative real rates, leading to fewer savings and supporting the consumption appetite.

“However, we see momentum loss in activity in the second half of this year on the back of deteriorating purchasing power, concerns about policy sustainability, as well as a less supportive global backdrop with tightening global central bank policies and elevated geopolitical risks.”

While not mentioning recession, global investment bank J.P. Morgan forecast Turkey’s economy could contract 2% in the third quarter and zero growth in the final quarter of 2022.

Can The Opposition Rescue Turkish Economy?

ING Group also forecast Turkey could slip to negative growth of – 1.8% in the first quarter of 2023, from 0.7% in the fourth quarter of 2022.

Factors causing Turkey’s recession

While the current crisis in Turkey is caused by multiple domestic factors, some are the legacy from 2018 to 2019.

Turkish inflation rate

For years, Turkey has struggled with inflationary pressure. However, due to stubbornly high energy costs, supply shocks to food and agricultural commodity prices, economic inflation reached new highs in 2022.

By September 2022, annual Turkish inflation indicated in the Consumer Price Index (CPI) had surged to a 24-year high of 83.45%, from 48.7% in January 2022. September’s CPI also beat the previous high of 80.2% in August.

Loose monetary policy

Despite the runaway inflation in Turkey, the central bank has continued its low interest rate policy.

CBRT has cut lending rates by a cumulative 850 basis point (bps), lowering the policy rate to 10.50% in October 2022 from 19% in March 2021.

In a statement on 27 October, the bank argued lower interest rate cuts were important to preserve the growth momentum in industrial production and the positive trend in employment amid increasing uncertainties with global growth and further escalation of geopolitical risks.

At the same time, other central banks are taking the opposite approach to taming inflation.

According to ING’s Mercan, the existing loose monetary policy will do little to address inflationary pressures.

“The current policy setting does not prioritise disinflation and inflation will likely remain elevated in the near term,” Mercan said on 22 September.

Weakening lira

CBRT’s rate cut has put downward pressure on the country’s currency, the Turkish lira (TRY) amid a strengthening US dollar.

As of 1 November, the USD/TRY rate had surged more than 94% to 18.6, from just 3.77 in November 2017, according to data aggregator TradingEconomics.

A weaker lira would inflate Turkey’s import bills of commodities which are priced in US dollars, making imported goods more expensive in the domestic market. Turkey is a net oil and gas importer with domestic production only meeting 7% of its consumption, according to the US International Trade Administration.

Fitch Ratings forecast USD/TRY could rise to 24.90 in 2023 and 27.70 in 2024 from a projected 20 in 2022.

Turkey economic forecast for 2022 and beyond

On 10 October, The World Bank projected Turkey’s economy to slow to 2.7% in 2023, from an estimated 4.7% growth in 2022:

“Economic activity is expected to weaken in the second half of 2022, as macroeconomic volatility intensifies, inflation erodes the purchasing power of households that can no longer front load consumption, and external demand weakens.”

J.P. Morgan’s Turkey economic forecast saw the economy to grow by average 4.5% in 2022, easing to 3.6% in 2023.

ING Group predicted the country’s GDP to grow by 3% in 2023 from an estimated 5% in 2022. The economy was expected to recover at 4% in 2024.

In September, Fitch Ratings revised its forecast for Turkey’s GDP for 2022 to 5.2%, compared to 4.5% in its June’s forecast, on the back of stronger growth in the second quarter. Turkey’s economic growth was expected to slow to 2.9% in 2023 and remain at the same level in 2024.

Trading Economics forecast Turkey’s GDP growth could reach 5.10% by the end of 2022, before slowing to 3.2% in 2023, based on its econometric models. The service projected the economy to rebound to 4.5% growth in 2024.

Excerpt only

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/