Should we link the increase in the budget deficit only to the coronavirus?

After the central government budget posted a deficit of 44 billion TL in March, again in April, it had a deficit of 43 billion TL. The Treasury cash balance of April, announced on May 15, had signaled this data for us in advance.

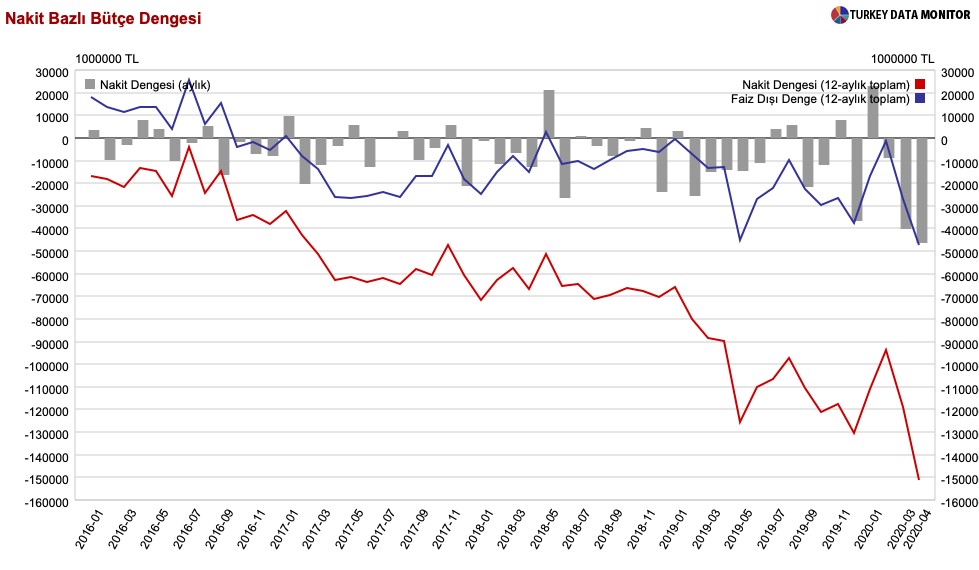

Since 2014, the opening of the gap between budget expenditures and revenues continued to increase, a pattern which reached a crescendo in March and April 2020, when the coronavirus effect became visible. I mean, the coronavirus did not trigger the budget deficit, the budget deficit has been accelerating in the last 5 years, especially in the 2016-2019 period:

The continuing increase in the budget deficit also brings an increase in the central government debt stock. The Fed’s and the European Central Bank’s low interest rate policy and downward trend in inflation led the CBRT to interest cuts since July 2019, leading to lower domestic borrowing costs. As borrowing costs came crashing down, the rise in CDS showing Turkey’s risk premium climbed unabated. The main reason for this is the decreasing foreign currency reserves of the Central Bank. Essentially, Central Bank sold FGX to slow the deprecation of the exchange rate, so that it can cut interest deeply into the negative territory without a crisis.

This strange policy mix begs the question of what happens if Turkey fails to secure new sources of foreign exchange? Historical data on the increase in Turkey’s risk premium shows that interest rate hikes are inevitable. As a matter of fact, international rating agency Fitch emphasized the same warning as reported by Turkish economics portal Paraanaliz.com. Again, a government official who spoke to Reuters on Paraanaliz.com said, “The talks are better with Qatar, China and the UK. I am optimistic that a certain amount of resources will be provided… it may not take long to reach an agreement.”

A possible SWAP agreement that will satisfy the markets will reduce the pressure on the Turkish lira, and will be the precursor of the improvement in CDS premiums, foreign borrowing opportunities and bond rates with increased confidence in the Turkish lira. This pursuit of high returns to investors overseas will support the entry to Turkey again. We hope the good scenario happens. Indeed, Turkey is a country with the potential to attract foreign direct investment, as long as we can create a sustainable growth image.

Dr. Fulya Gürbüz

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/