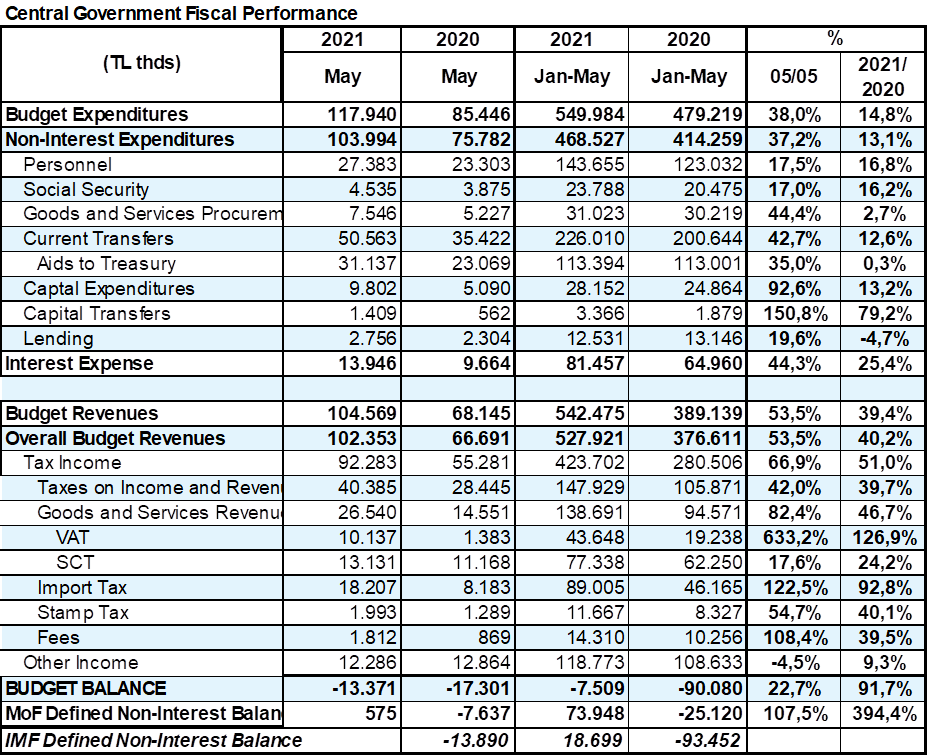

According to the Ministry of Treasury and Finance, the central government budget posted a deficit of 13.4 billion liras in May carrying the year-to-date deficit to 7.5 billion liras. In the first five months of last year, the deficit stood at 90.1 billion liras. In May 2020, the non-interest deficit of TL 7 billion 637 million turned to a surplus of TL 575 million in May 2021. Thus, in the first five months, the non-interest surplus reached 73.9 billion liras. There was a non-interest deficit of 25.1 billion liras in the first five months of last year.

Budget revenues increased by 53.5 percent to 104.5 billion liras in May, while budget expenses increased by 38 percent to 117.8 billion. Thus, the budget deficit decreased from 17.3 billion liras in May last year to 13.4 billion liras this year.

There was a remarkable 67 percent increase in tax revenues in May. With 633 percent growth in the value-added tax revenue 10.1 billion liras was eye-catching thanks to last year’s deferred taxes. Also last year, the value-added tax on imports, which was affected by the decline in imports due to the closure, rose by 122.5 percent and generated 18.2 billion lira revenues.

While the Special Consumption Tax increased by 17.6 percent, SCT from motor vehicles increased by 197.3 percent to 4.2 billion liras. SCT from alcoholic beverages increased by 68.7 percent.

The strength of budget revenue performance and the relative decline in the budget deficit owe to the receipt of taxes deferred last year. In fact, revenues performed better in May 2021 than in April 2021 and the same period last year, as yje lockdowns this time around were partial.

As for the spending, the total expenses , the monthly increase of 38 per cent is well above inflation, and the 44.4 per cent increase in purchases of goods and services and the 42.7 per cent increase in current transfers should be carefully monitored in the coming months as they might be pointing to a spending spree. Yet for the five month’s expenditure performance the 14.8 percent increaseis in line with inflation and a sign of a controlled trend in state spending.

The positive performance of the budget can be expected to continue as vaccination is accelerated and pandemic-era measures are beginning to return to normal. However, the slowdown in domestic demand will start to have a monthly impact on tax revenue performance, especially in the last quarter of the year.