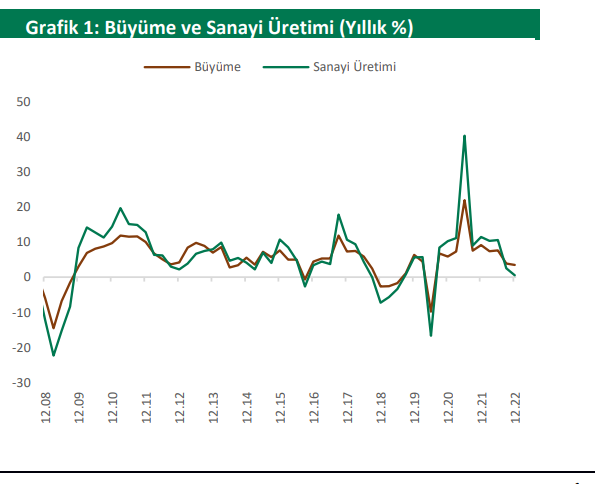

“According to Industrial Production Index, seasonally and calendar adjusted production contracted by 0.4% monthly in July and increased 7.4% annually. Despite the expectation of a contraction in the market, we had a limited positive increase expectations”, writes Seker Yatirim analysts in their note sent to clients.

The course of monthly production data shows that although there are periodic fluctuations, the production momentum has not increased at the desired level. The slowdown in orders due to the expectation of global recession, earthquake disaster and tight liquidity in the country are the most important dynamics behind the slowdown in production momentum.

As updated in the medium-term economic plan, while 2023 is dedicated to macro financial stability, it may bring production data below potential growth in the short term. Both the upward pressure on the exchange rate and the tightening in financing conditions support this thesis.

Sectors with liquidity and easier financing conditions come to focus in terms of stock selection in the coming period. In particular, companies whose cash flow is not sensitive to cyclicality in the economy will diverge positively from the main indices.

In July, the mining and quarrying sector index increased by 1.7%, the manufacturing industry index increased by 7.4% and the electricity, gas, steam and air conditioning production and distribution sector index increased by 4.1% compared to the same month of the previous year.

In terms of monthly changes, the mining and quarrying sector index increased by 10.5% compared to the previous month, the all-important manufacturing industry index decreased by 1.4% and the electricity, gas, steam and air conditioning production and distribution sector increased by 3.7%. While the strong trend of annual increase in the manufacturing industry continues, the monthly contraction is a reflection of the tightening macro financial conditions.

Legend: GDP growth vs industrial production

,

Seasonal effects came into play in energy production, bringing about an increase in the u unusually hot summer season.

Although the tightening in liquidity conditions affects production data, the government’s promise of monitoring the impact of the monetary policy stance on indicators such as production and current account balance limits the potential for a sudden stop or slowdown in the system.

Our expectations for further softening in growth and production indicators continue for the second half of the year.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel