The central government budget posted a deficit of 64 billion TRY in July

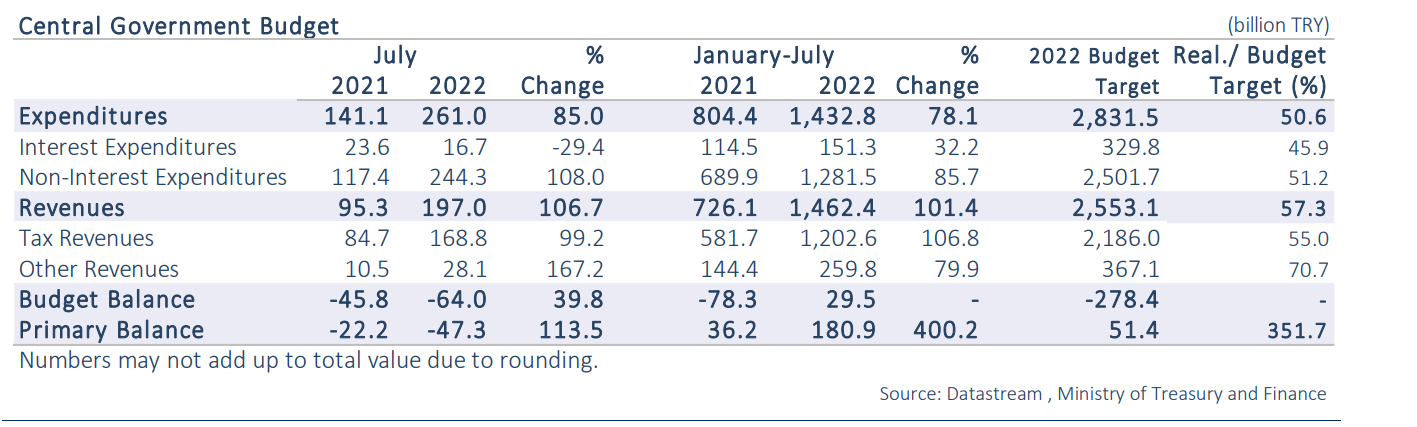

In July, central government budget revenues expanded by 106.7% yoy and reached 197 billion Turkish Lira (TRY), while budget expenditures increased by 85% to 261 billion TRY. Thus, the central government budget gave a deficit of 64 billion TRY in July, and primary budget deficit became 47.3 billion TRY with an annual expansion of 113.5%.

In the January-July period, budget revenues doubled compared to the same period of the previous year, while the increase in budget expenditures was 78.1%. Thus, the central government budget, which posted a deficit of 78.3 billion TRY in January-July 2021, gave a surplus of 29.5 billion TRY in the same period of this year. In this period, primary surplus was realized as 180.9 billion TRY.

Revenues from interest, participations and fines supported the budget

In July, tax revenues increased faster than annual inflation by 99.2% to 168.9 billion TRY. VAT on imports, which expanded by 146.2% on an annual basis due to rapid increase in foreign trade volume as well as rising exchange rates, contributed 30.2 pts to the annual growth in budget revenues. In this period, Special Consumption Tax (SCT) revenues, which doubled on an annual basis due to price developments, also contributed 18.6 pts to the increase in budget revenues.

It was observed that interest income, which were followed under the interest revenues account, share dividends and fines, increased 9.3 times in July, making a significant contribution to the surge in budget revenues with 7.3 pts.

Expenses related to FX-protected Turkish Lira deposit accounts continued to rise

In July, current transfers rose by %118 yoy to 127.3 billion TRY. The treasury aid, which went up by 91% yoy due to the rapid increase in health, retirement and social aid expenditures, played an important role in this expansion. In this period more than 9 times increase in the transfers to households drew attention as well. In July, primary expenditures surged by 108% yoy and remained above the annual CPI inflation. In July, sharp decline in interest expenditures was mainly due to the base effect of high domestic debt payments in July 2021.

WATCH: Turkish Economy Won’t Survive The Winter

In July, payments made within the scope of domestic debt transfers to State Public Enterprises (PEs) increased nearly 6 times and amounted to 8.1 billion TRY. The resources transferred only to BOTAŞ in this period were 4.5 billion TRY, while the total resources transferred to aforementioned institution reached 75.9 billion TRY as of the first 7 months of the year.

Thus, the total funds transferred to PEs reached 87.6 billion TRY in the January-July period. In addition, expenses related to FX protected deposits accounts were recorded as 23.4 billion TRY in July. The YTD expenditure reached 60.6 billion TRY in the March-July period.

Expectations…

Despite the deterioration in budget indicators in June and July, the central government budget figures continued to present a positive outlook as of the first 7 months of the year. Considering that the leading indicators point to a moderate slowdown in economic activity, we anticipate that tax revenues may lose momentum in the rest of the year. In addition, we foresee that interest expenditures, resource transfers to PEs and expenses related to FX protected deposits accounts will remain influential on the budget performance in the upcoming period.

On the other hand, budget figures in the January-July period indicate that the yearend budget deficit forecast of 278.4 billion TRY is within reach. In this context, the budget is expected to give a deficit of at least 307.9 billion TRY in the rest of the year.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/