- Despite stronger price pressures and tighter global liquidity, the CBRT, once again, kept rates unchanged at 14.0%

- The CBRT again cited global supply-side factors as the main cause of inflation

- We see rates unchanged for the rest of the year

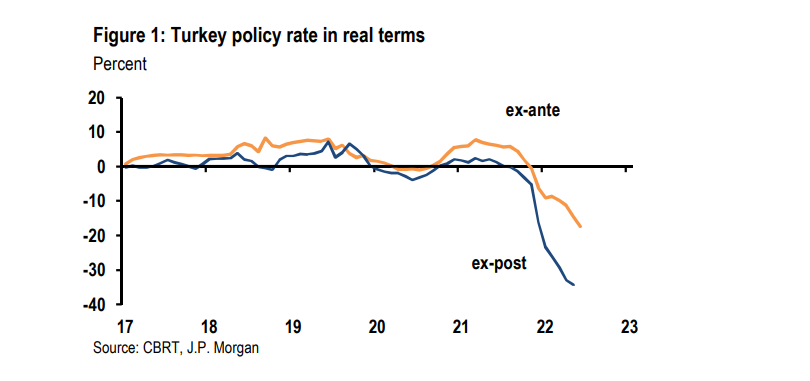

Unfazed by the tightening in global financial conditions and by the strengthening in price pressures globally and at home, the CBRT kept its key policy rate unchanged at 14.0%. Given the consistent increase in inflation and the worsening in inflation expectations, the policy rate in real terms has become even more deeply negative. The interest rate announcement note was not different from the recent notes in a meaningful way. Despite the persisting surge in inflation, there was still no reference to the need for orthodox policies and in particular to the need for higher rates.

The CBRT vowed to “continue to implement the strengthened macroprudential policy set decisively and take additional measures when needed.” There was no reference to when and how this need could arise and what additional measures could be under consideration. The important thing was the reference to macroprudential measures rather than orthodox monetary tightening as the means to respond to price pressures. Today’s decision supports our view that the policy rate will remain unchanged until the end of the year.

Erdogan’s Lethal Economic Legacy

The language used in the interest rate announcement note shows no change in the dovish policy stance of the CBRT. As has been the case in recent months, the CBRT has put all the blame of higher inflation on supply side global factors (geopolitical developments, higher energy prices, etc.) and has made no reference to demand-led pressures and policy credibility. The CBRT remains optimistic about the disinflation path, stating that global peace, along with the measures already taken to fight inflation (not elaborating on what exactly these measures were), will start a disinflation process. Finally, in contrast to the tightening in global financial conditions, the CBRT referred to the “supportive measures” introduced by core central banks, again not elaborating on what these measures were.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/