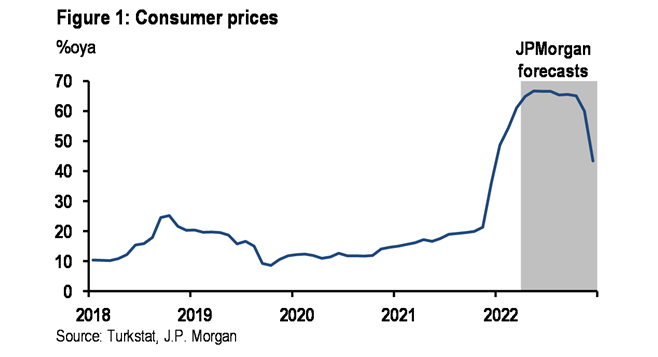

March CPI data provided fresh evidence on the sharp strengthening in price pressures that follow unorthodox policies, lira weakness, credibility collapse and a few exogenous factors like the rise in global energy prices. Consumer prices jumped 5.5%m/m, pushing annual inflation up to 61.1% in March. The result was slightly below the market consensus of 5.8%, but this was hardly a consolation.

Although the 11.0%m/m increase in energy prices was the main contributor, inflationary pressures were strong across the board with food prices up 4.7%, core CPI up 4.4% and services prices up 4.2%. The 9.2%m/m increase in producer prices reflected the strength of cost-led pressures.

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit

We see inflation peaking close to 70% in May and stay around 65% until December, when, due to a very strong base, it could fall to 44%. This is based on the assumption that the lira remains stable in real terms, helped by the FX protected TRY deposits scheme and by tourism-related inflows in summer months. The risk is for a higher figure.

Meet the Person Who Can Beat Erdogan: Kemal Kilicdaroglu

If you open a macroeconomics textbook and make a list of the factors that cause inflation, you will see the traces of almost all of these factors in recent Turkish CPI data: FX pass-through, elevated global commodity prices, poor weather conditions, robust domestic demand, administrative price hikes, easy monetary and incomes policies, unorthodox policy decisions (that create a positive feedback loop through loss of credibility, higher inflation expectations and a weaker currency).

True, some of these factors will lose momentum in the coming months. If the lira maintains its stability, FX pass through could diminish; higher inflation has eaten away the wage increases and this along with weaker sentiment (which at least partly followed the war in Ukraine) should lead to a weakening in demand pressures; and, strong precipitation points to better agricultural output and, hence, weaker prices in the coming months. However, global commodity prices are likely to remain high and the risk of supply disruptions continues. More importantly, weak policy credibility makes it impossible to anchor inflation expectations. This is evident in the sharp worsening in inflation expectations.

It is interesting and sad to see the CBRT showing no reaction to this surge in inflation. The CBRT seems to be putting all its emphasis on lira stability that could follow increased demand (local and foreign) for the FX-protected TRY deposit scheme. Setting aside the associated costs (such as increased FX exposure of the public sector), this scheme alone is unlikely to solve such a complex and difficult inflation problem. This suggests that until orthodox policies are introduced, inflation will likely remain much above global standards and the lira will remain vulnerable to shifts in local and global risk appetite.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng