The central government budget gave a deficit of 83.3 billion TRY in October. In October, the central government budget deficit rose by nearly 4 times on an annual basis, reaching 83.3 billion TRY, the highest level of this year. In this period, budget revenues increased by 96.6% to 224.2 billion TRY, while expenditures expanded by 133.9% to 307.4 billion TRY. In October, the primary budget balance gave a deficit of 22.1 billion TRY. The budget deficit in the first 10 months of the year, expanded by 64% compared to the previous year and reached 128.8 billion TRY due to the rise in current transfers and compensation of employees.

In October, SCT and VAT on imports supported the budget

Tax revenues increased by 89.2% yoy in October and amounted to 181.8 billion TRY. In this period, revenues from VAT on imports and SCT, which constitute half of tax revenues, reached approximately 2.5 times the level of the previous year. The positive course in motor vehicle sales was effective in the rise of SCT revenues. The revenues from PE’s and public banks, which were at the level of 621.6 million TRY in October last year, rose to 16.9 billion TRY in the same period of this year, making a positive contribution to the increase in budget revenues.

Turkey’s Kurds Will Determine the Outcome of 2023 Elections

Current transfers expanded by 136.4% yoy

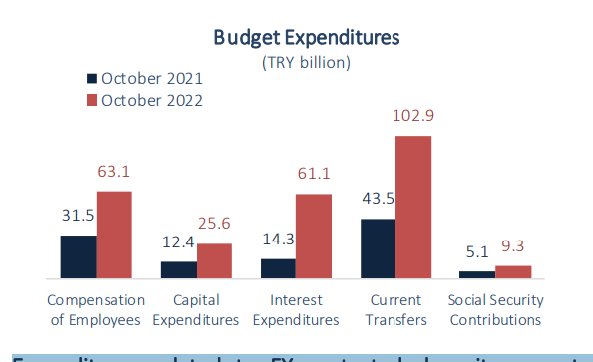

In October, non-interest expenditures continued to rise in real terms, increasing by 110.3% yoy. Current transfers, which rose by 136.4% in this period, contributed 45.2 points to the expansion in budget expenditures. The increase in current transfers was driven by the annual 6-fold increase in other transfers to households, reaching 26.2 billion TRY.

In October, capital expenditures reached 25.6 billion due to the increase in real estate construction capital expenditures. In this period, interest expenses reached a record high level of 61.1 billion TRY with the effect of 40 billion TRY annual increase in domestic debt bond interest payments.

WATCH: Turkey’s Intractable Refugee Problem

Expenditures related to FX protected deposit accounts reached 91.6 billion TRY

In October, payments in domestic debt transfers to PE’s amounted to 9.7 billion TRY (6.5 billion TRY to BOTAŞ). Thus, in the first ten months of the year, domestic debt transfers to PE’s reached 160.1 billion TRY (121.4 billion TRY to BOTAŞ). In addition, expenses related to FX protected deposit accounts were recorded as 6.7 billion TRY in October. Thus, the aforementioned expenditure reached 91.6 billion TRY in the March-October period.

Expectations…

The slowdown in economic activity tempered the year’s strong performance in budget revenues in the fourth quarter of 2022. On the expenditure side, the expansion in the budget deficit is being driven by an increase in interest expenditures and current transfers.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/