Continuing with low interest rates post-2023 elections implies higher inflation and slowerrowth, with risks of a disorderly adjustment. A return to orthodoxy within a credible macro programme can rebalance the economy and achieve lower inflation and higher growth from 2024.

The outlook depends on how monetary and fiscal policy will pan out post-elections:

Extremely negative real interest rates coupled with global headwinds have led to a rise in macro stability risks. Despite inflation at 85.5%Y, the CBT is on course to cut its policy rate to 9% in November following President Erdogan’s call. While the CBT continues rate cuts to support growth, it relies on unconventional instruments such as the FX-protected TRY deposit scheme, indirect FX sales and restrictions on loans to contain pressures on FX and inflation. But high external finance requirements, a low level of CBT reserves and an increasing fiscal burden keep risks of a market-driven disorderly adjustment alive.

Continued muddle through is our base case, but a bull case with a return to orthodoxy is equally likely

We do not expect a major shift in policies until the elections in May/June 2023. The recent increase in the CBT’s gross reserves (+US$15 billion since end-July thanks in part to Russian Rosatom’s FX transfers) and FX inflows from errors and omissions in the balance of payments have increased the likelihood of muddle through until the elections, in our view. We think that there are two equally likely policy paths from 2H23, one in which the preference for low interest rates continues, accompanied by stricter controls on locals’ credit and FX flows. The policy rate stays at 9% through the forecast horizon but overall financial conditions remain tight. We name this the base case. The second scenario involves a return to orthodoxy within a fully fledged macro stabilisation programme. We call this our bull case, as it leads to higher growth from 2024. In this case, we see policy rates rising to 35% in 2H23 along with a gradual phasing out of banking sector regulations and resumed portfolio and investment inflows from abroad.

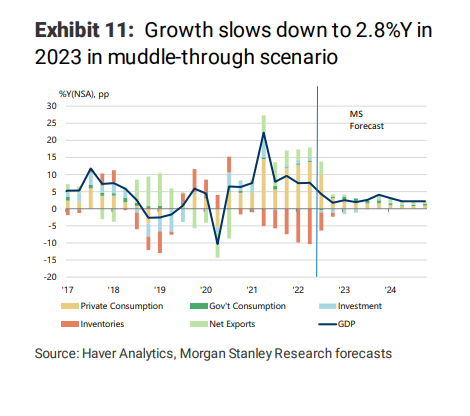

Growth slows in 2023 in both scenarios, but recovery would be stronger in the bull case: Growth has started to slow as of 3Q22 on the back of weakening external demand and declining loan growth. We see a lower contribution from net exports but a higher contribution from domestic demand due to pre-election stimulus measures. In our view, muddle through requires pre-election stimulus to be constrained by available external finance, and the currency to be allowed to depreciate to contain reserve losses and to prevent real appreciation. We see growth slowing to 2.8%Y in 2023and 2.4%Y (from 5.0%Y in 2022) in the base case, as a means of rebalancing in the absence of policy normalisation.

Our bull case also sees growth slowing notably in 2H23 due to rate hikes (3.5%Y in 2023), but it envisages a stronger recovery in 2024 (5.5%Y), as macro stability risks decline, paving the way for stronger capex.

Inflation remains elevated and prone to upside risks in a muddle-through scenario

Inflation is likely to have peaked at around 85-86%Y in November. Assuming TRY remains on a gradual depreciation path supported by restrictions on loans and indirect FX sales, strong base effects related to the FX shock of 4Q21 should drag inflation down from about 70%Y in December to around 47%Y by May 2023 (around the time of the elections). We expect a minimum wage hike of around 60% in January to put upward pressure on headline inflation, especially in 1Q23, but this is likely to be offset by administered price caps until elections as well as a slowdown in demand. In the absence of new cost-push shocks, we expect the underlying inflation trend (SAAR) to pick up in 2H23 compared to 1H23 as lira depreciation accelerates and delayed adjustments in administered prices come through post-elections.

Hence, we see annual inflation at 53%Y at end-2023 in the absence of a notable tightening in the monetary stance post-elections.

WATCH: Is Turkey Headed For a Debt Crisis?

The bull case sees a more notable fall in inflation in 2024

This is conditional on a reversal in the monetary stance, with the policy rate reaching 35% and an improvement in CBT credibility. We think that FX reserve accumulation by the CBT would limit the appreciation in the Turkish lira and delayed adjustments in administered prices would imply a slower pace of disinflation, especially in 2H23. High initial levels of inflation and financial stability concerns, i.e., interest rate risk on bank balance sheets, as well as municipal elections in March 2024 are likely to bring a more gradual approach to disinflation, in our view, with inflation staying above 20%Y until end-2024.

WATCH: Can The Opposition Rescue Turkish Economy?

Budget deficit likely to increase further

The budget performance so far this year has been supported by a strong increase in revenues, boosted by high inflation. The 12-month budget balance/GDP ratio stood at -1.4% as of September but the government’s forecast in the Medium-Term Programme suggests a significant widening in the deficit in 4Q22 (of around TRY 416 billion) to reach -3.5% of GDP in December. Subsidies on natural gas and electricity as well as other administered prices, fiscal costs of KKM and increases in public sector workers’ salaries and pensions ahead of the elections should lead to a widening in the budget deficit next year. We forecast the budget balance/GDP to widen to -4.1% in 2023 from -3.5% in 2022, below the government’s -3.4% target.

What are the risks?

The main downside risk to a muddle-through scenario, in our view, is related to the FX financing gap and a low level of FX reserves. Our base case sees the current account deficit at US$53 billion (6.5% of GDP) in 2022 and US$39 billion (4.1%) in 2023. The projected decline in 2023 largely reflects a decline in imports (due to a fall in energy prices and the projected slowdown in demand). A stronger push for credit and fiscal stimulus measures ahead of elections could lead to a wider current account deficit. Allowing further real appreciation to bring a faster decline in inflation in 1H23 would also widen external imbalances.

On the global side, a more aggressive Fed and a larger global recession are the biggest risks that could bring about a disorderly external adjustment with a sharp depreciation in the currency, a level shift in inflation and a deep recession.

Where do we differ?

In terms of growth, we are slightly below the Bloomberg forecast which sees growth at 3%Y in 2023. Our CPI forecast (year average) is above the consensus of 43%Y in 2023. This largely reflects the fact that our base case assumes muddle-through while Bloomberg forecasts see the policy rate at 17.45% in 2023 (which is below the average of our bull and base at 22%).

Source: Morgan Stanley CEEMEA Report, Dealing with Dual Headwinds

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/