The Turkish central bank kept its base rate unchanged today versus consensus expectation of another rate cut. The MPC statement appeared to acknowledge deterioration of the inflation and current-account outlook, which is a positive sign. Nevertheless, the statement hinted at rate cuts resuming once more during H2. When this became clear, the lira reversed its rally.

Surprise surprise!

Like most market participants, we were surprised that CBT did not cut rates today. We forecast 7.5% base rate by the end of the year, versus the current 8.25%, hence we have been expecting rate cuts to continue. The lira rallied following the decision as market participants debated the meaning of CBT’s signal.

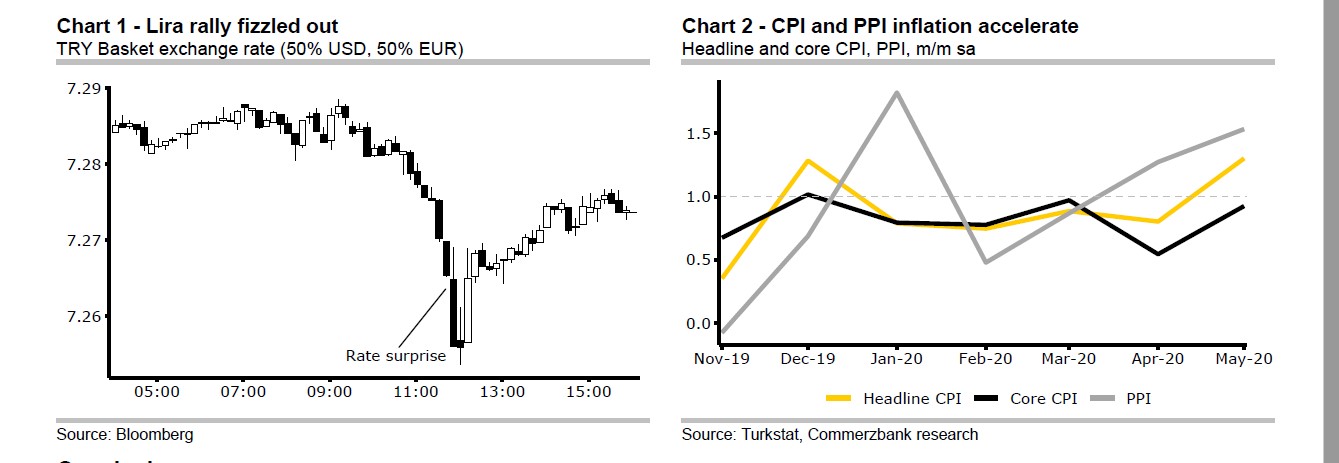

But, it soon became clear from the statement that this was only a brief pause. CBT acknowledged the worsening of the inflation outlook recently, and removed a sentence from its statement about inflation developments being in line with projections. Still, CBT appeared to point to food price and other temporary factors as the main responsible drivers, asserting that disinflationary forces will take over again during H2. This remark makes it pretty clear that today’s outcome was a brief pause, and that the central bank will return to cutting rates. Once this information was digested by the market, the lira reversed its rally (see chart 1—cover photo).

We are definitively more pessimistic than CBT about the inflation outlook. We do not see inflation converging towards the target by the end of next year, for example. Following the May data, we wrote that the month-on-month rate of increase in (seasonally-adjusted) prices – CPI and PPI – had reaccelerated after initially falling when activity was shut down (see chart 2-see cover photo). Some temporary factors may have been responsible. But in our view, the re-acceleration highlights the powerful FX passthrough which Turkey is susceptible to. This is why the credibility of CBT’s monetary policy, which is crucial for the stability of the exchange rate, matters above all.

Given Turkey’s double-digit (and accelerating) inflation rate, the 8.25% policy rate is anyway too low. Had CBT signalled strongly that rates would be cut no further, that would qualify as a positive signal – but even then, the market would have been sceptical that such guidance could stand up to President Tayyip Erdogan’s inevitable criticism.

Conclusion

CBT’s reference to inflation moderating in H2 means that we have not yet reached the end of the easing cycle. This is why the lira reversed its rally. The size of rate cut on any given day does not matter much, unless the move signals something different about the rate path in the medium-term.

In this case, it does not. The market will now watch for critical remarks from the president; and even if these did not come, the market will soon debate the timing of the next rate cut. This hardly makes for a supportive lira backdrop. We forecast USD-TRY to surpass the 7.00 mark in coming months.

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/