With Fed turning decidedly more hawkish on Wednesday, the other highlight of the week is the meeting of the Central Bank of Turkey’s (CBRT) rate-setting committee on Thursday. Many analysts in Ankara believe that there will be an additional 100 basis points cut — a prediction that is shared by the median of the estimates of 19 economists surveyed by Bloomberg.

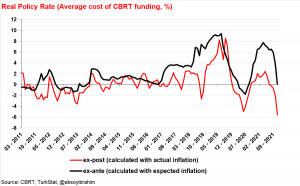

With official inflation running at 21%, and public perception about it being much higher, new rate cuts threaten further dollarization of the bank deposits and the non-financial segments of the economy. Despite the very deeply negative ex-ante real rates on financial assets, Turkish economists debate whether the terminal rate for CBRT is 12% or 9%.

Nureddin Nebati, Turkey’s new finance minister, said Monday that Turkey is determined “to not raise interest rates.” In a phone interview with Haberturk columnist Sevilay Yilman, Nebati was asked whether there would be further rate cuts this month. Nebati, who is not a member of the committee but has influence over the monetary authority, replied, “We are determined not to raise rates.”

The lira weakened 2.4% to the dollar on Wednesday over prospects for another Turkish interest rate cut the next day, and ahead of a key policy decision by the U.S. Federal Reserve that might draw more funds out of emerging markets. After the Powell speech, dollar/TL stabilized at 14.80 in thin NYC trading. Turkish economist expects more currency volatility, if CBRT were to cut rates further today.

HSBC Turkey economist İbrahim Aksoy pointed to the real reason for prolonged currency volatility:

“A possible pause tomorrow would only provide temporary relief for the Lira. The problem of the currency is the deeply negative real yields, and a pause would not change this. In fact, with the rising inflation, the real policy rate will likely decline below -10% in Dec”.

Mohammed al Arian commented on his linked-in feed: “With central bank fx intervention failing to have more than a fleeting influence, the Turkish Lira continues to be under pressure –another 2% weaker so far today to just over 14.70”.

WATCH: The Aftermath of Currency Collapse: Sudden Stop Syndrome

“Judging from the experience of other countries, I would expect that the pace of dollarization is accelerating”

Some analyst claim further rate cuts could trigger a bank run, necessitating some form of currency controls. A law professor, alleged to be “close to” President Erdogan called upon the government to declare an economic State of Emergency which may have contributed to the last leg of TL weakness. His proposal was batted down by both AKP and MHP spokespersons. However it is clear to everyone, save Erdogan, that the experiment with ever-lower interest rates and benign negligence on currency weakness is a recipe for disaster.

In an economy where annual imports are roughly 30% of GDP, FX uncertainty is causing many industries to halt transactions. Certain food items are becoming difficult to find, as gas and heating fuel or LPG canisters are in scarce supply.

Several international investment banks predicted large rate hikes early in 2022, based on Erdogan’s previous bouts of pragmatism. However economists close to the opposition claim that Erdogan has lost his political agility and is being shielded by his sycophantic advisors from the harsh realities of the economy.

WATCH: 2022 Predictions For Turkish Politics

At the end, not only monetary policy settings, but any policy is impossible to predict, simply because there is no valid explanation of Erdogan’s motivations.

Imagine living in a country where the world you are used to is disrupted by arbitrary presidential decisions each day. This is Turkey now, and unless something, perhaps a miracle compels Erdogan to change his mind once again, allowing rate hikes to stabilize the currency, it will soon become a nightmare.

It may come tomorrow, it may never come.

Comments by Atilla Yesilada

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng