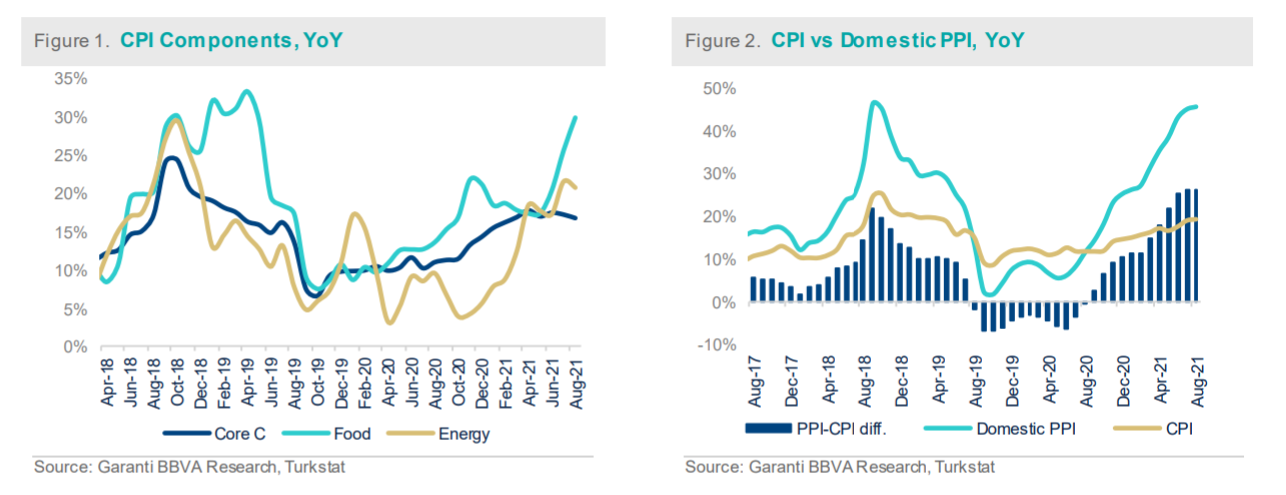

Consumer prices increased by 1.12% in August, again being realized above expectations (BBVA Research 0.9%, Consensus 0.7%) on the back of a higher than expected food inflation. Thus, annual consumer inflation rose to 19.25%, up from 18.95% the month before. Core inflation continued to weaken and declined to 16.76%, helped by the recent changes in the special consumption tax ranges in personal cars.

Though, other core prices still reflected the worsening in services prices and deepening cost-push factors as domestic producer prices still rose by 2.8% (45.5% in annual terms). Domestic demand stays relatively strong and inflation expectations keep deteriorating led by the uncertainty in domestic policies and other supply-side problems. Besides, historically high food inflation due to this year’s drought and losses on several natural hazards, and continuing cost-push factors maintain risks on the upside for inflation outlook in the near term.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

We expect consumer inflation to stay close to 19% till November and end the year at close to 17%, led by the decline on positive base effects in the last two months of the year.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

Upside risks on inflation on high food prices and further rise in cost push factors

Food inflation surprised again on the upside with 3.3% mom on the back of 10.1% mom increase in fresh fruit and vegetable prices, in contrast to its negative seasonal average (-5%). Processed food inflation also materialized as 2.2% mom. Therefore, annual food inflation jumped up to 29.8% from 25.5%.

On the other hand, energy inflation rose slightly by 0.6% mom, leading annual energy inflation to retreat to 20.7% from 21.5%. Also, core inflation remained relatively weaker with 0.38% mom increase on the back of recent changes in the special consumption tax ranges in personal cars despite still robust demand and ongoing cost push factors, and indicated an annual level of 16.76% (down from 17.22%). The decline in clothing and durable goods prices (-3.2% mom and -1% mom) was the supportive factors in basic goods. However, services prices inflation remained high with 1.3% mom due to the reopening of the economy, better tourism season and still strong demand, resulting in an annual inflation level up to 13.9%.

WATCH: Turkish Economy: The Good, the Bad and the Ugly | Real Turkey

Cost push factors strengthened further as producer prices increased by 2.7% mom, bringing the annual figure to 45.5% and the gap between CPI and PPI remains at record levels. All in all, according to our calculations, trend CPI (adjusted from cyclical and seasonal factors) continues to deteriorate with a level of above 16%, reinforcing stickiness over inertia for the future inflation outlook.

Inflation risks on the upside, rate cut in 4Q still on the table as the CBRT signals

Although recent stable levels of the exchange rate provide some relief, cost push factors remain on track due to strong commodity prices and supply side problems. Also, still growing domestic demand and worsening inflation expectations facilitate pass-thru over the consumer prices, keeping the risks on the upside for inflation. We expect consumer inflation to stay close to 19% till November and then decline to near 17% at the end of the year, which leaves almost no room for an easing from the CBRT. But, given the recent CBRT communication, we still expect rate cuts in November and December, ending up with a policy rate of 18% at the end of the year.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/