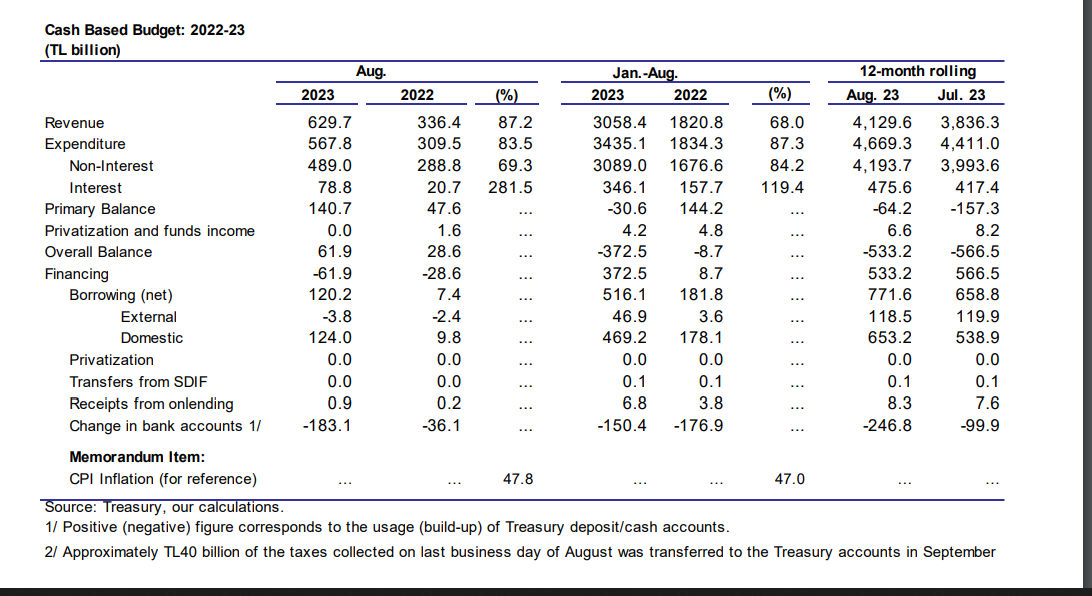

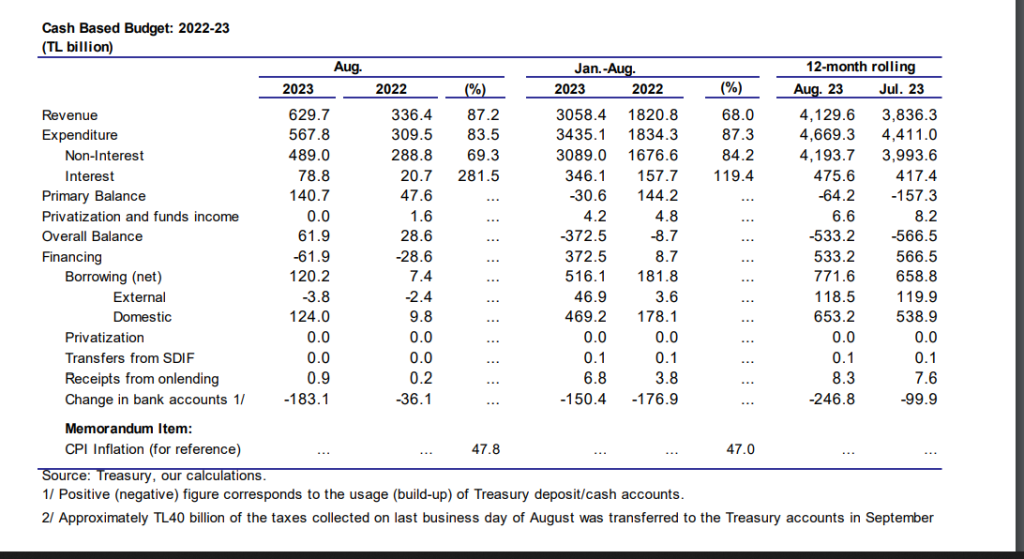

The high expenditures and lackadaisical tax revenues which marked the pre-election period gave way to a more balanced performance in July and August, according to cash budget data for August released last Friday. While expenses increased by 83.5% in August compared to the same month of the previous year, the revenue increase was a substantial 87.2%.

Non-interest expenses are the area where the budget performed extremely well, with an increase of 69%. On the negative side, the 281.5% expansion in interest expenses does not seem to go unnoticed. As a result, the cash budget balance was announced as 61.9 billion TL and the primary balance as a surplus of 140.7 billion TL.

Since TL40 billion tax revenue is deferred to September, the cash budget performance is actually much more successful than it seems.

Analysis: Medium Term Program – Government aims to bring down inflation without sacrificing growth

It should be emphasized that the 12-month cash budget deficit decreased from 566.5 billion TL to 533.2 billion TL. However, the government’s announcement in its MTP that the budget deficit will be 1.6 trillion at the end of the year (the budget deficit will be 6.4% of GNP) shows that it is only a matter of time before expenditures will be ramped up.

It is possible that the government, which has made a point of outperforming its own budget deficit targets for a while, thanks to massive tax hikes and the automatic increase in collections during periods of accelerated inflation, will perform better than the deficit projection market by the MTP at the end of 2023. Likewise, inflation, which is around 48%, will reach 68% at best by the end of the year. Of course, 75% is a more realistic expectation.

For the rest of the year, turnover inflated with inflation and relatively higher taxes to be collected from incomes (automatic stabilizers) may also contribute to performance.

Whether or not the 2024 targets mentioned in the MTP will be achieved will primarily depend on personnel expenses. If, as Mehmet Simsek wants, the New Year’s raises are made according to the inflation expected in the future rather than the past, it will be easier to meet the budget targets.

Funding coming from abroad, especially the World Bank, to heal the wounds of the earthquake are also important. In particular, grants may reduce the TL1 trillion allocated from the budget to earthquake expenditures.

The most important unknown will be the financial costs. During the Sahap Kavcioglu period, financial expenses were kept artificially low by making banks buy long-term and low-interest government bonds through regulatory pressure. However, during the Gaye Erkan era, 2-10 year maturity government bond interest rates increased in parallel with the CBRT policy rate. The extent to which this rise will continue will also determine the financial expenses in the 2024-2025 period. If government bond interest rates are determined according to market conditions, deficits far beyond the budget targets may create a new problem for Mehmet Simsek.

By Güldem Atabay – Atilla Yesilada

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel