CPI inflation was 3.28% in November, well below market expectations, yet leading to a rise in YoY terms to 62.0% from 61.4%. TurkStat revealed November CPI inflation at 3.28%, which is considerably below the 3.8% median market expectation (Bloomberg HT survey) and our 4.2% estimate. With this result, YoY CPI inflation rose slightly to 62.0% from 61.4%. Core CPI inflation (group C) was 2.0% MoM, leading to a very slight rise in YoY terms to 69.9% from 69.8%.

Finally, the D-PPI inflation was 2.81% MoM (pointing to a slight acceleration compared to the previous few months), which led to a rise in YoY terms to 42.3% from 39.4%.

The decline in the underlying monthly inflation trend accelerates in November

Recall that, after seeing the details of October CPI inflation, we had highlighted signals of a slowdown in the inflation trend. We now observe that the improvement in underlying inflation seems to have strengthened as of November, which the CBRT for some time has been emphasizing. To be more precise, the decline in monthly inflation (from 3.43% last month to 3.28% this month) was realized despite the contribution of approximately 1.5 percentage points due to the application of he “zero price” method in natural gas (which had led to some 2.5% points decline in headline inflation back in May).

Th

e so-called improvement seems largely attributable to core inflation components, which is a more welcome development. For instance, MoM inflation in the durable goods category realized at only 0.7%, a point expressed by Gaye Erkan in her speech at the Istanbul Chamber of Industry last week, where she referred to the slowdown in automotive and white goods prices.

The service inflation, as the most rigid component, fell below 3.0% in MoM terms, which indicates a significant softening when considering that the average monthly service inflation was about 9.0% between July and September.

Yet, despite this softening, YoY service inflation continued to ascend (to 89.7% from 88.6%), and remained as the largest contributor to the headline CPI inflation (contributing roughly 23.5% points). Beside these positive developments mentioned, the rapid price increases in the processed food category and the other core goods component (predominantly consisting of fast-moving consumer goods) seems to have persisted. In particular, it should be noted that processed food inflation realized at 4.9% MoM.

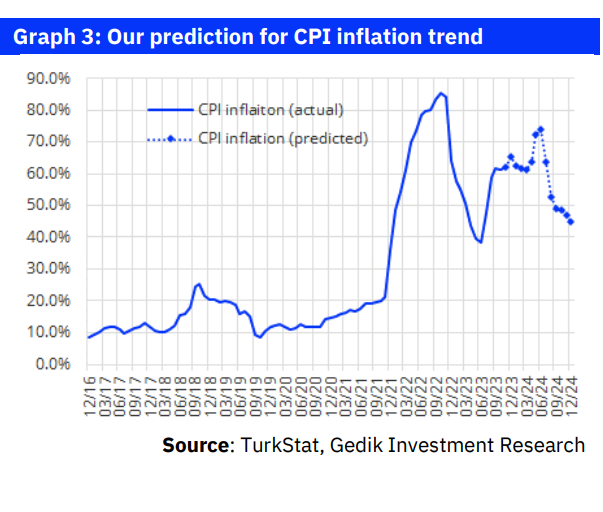

CBRT’s 65% year-end CPI inflation estimate now seems plausible to us

All in all, we generally evaluate today’s data positively despite some glitches. Recall that, we had previously shared our year-end CPI inflation expectation as around 70% levels. Yet, with today’s inflation figure (and the details) at hand, the CBRT’s 65% projection seems plausible to us. In summary, the CPI inflation has been moving in tandem with the CBRT’s latest inflation path (revealed at the Inflation Report on 02-Nov), which would also be supportive of market expectations that the rate hike cycle would end in December or in January at the latest.

Serkan Gonencler, Chief Economist, Gedik Investment

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/