GDP growth in 1Q24 stood at 5.7% YoY and 2.4% QoQ.

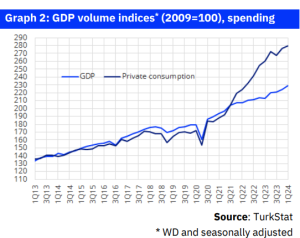

TurkStat revealed 1Q24 GDP growth as 5.7%, broadly in line with the median market expectation of 5.5%, although it remained somewhat below our 6.6% estimate. With this figure, 12-month rolling GDP growth improved to 4.9% from 4.5%. The WD-and seasonally adjusted GDP recorded a 2.4% increase compared to the previous quarter on top of the 1.4% QoQ growth in the preceding quarter, indicating an acceleration in growth momentum.

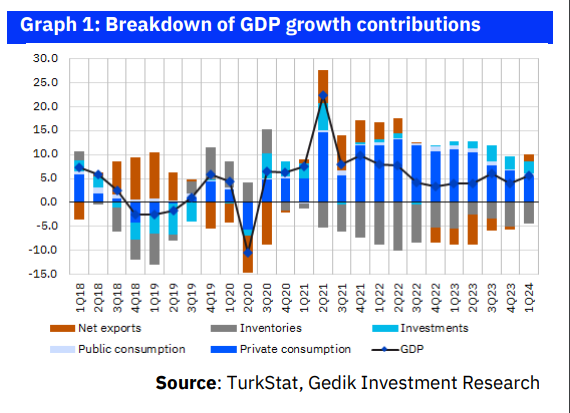

Domestic demand contribution turned out to be less than our expectation, but remained the main driver of GDP growth

Although the YoY growth rate in the private consumption expenditures somewhat moderated compared to previous quarters, it remained strong at 7.3%, contributing 5.5% to overall GDP growth. In fact, based on various indicators such as retail volume index, services production index, credit card spending, and real growth in VAT collection, etc., we were expecting a much higher private consumption growth (to the tune of 9.5-10%), which largely explains the deviation in our headline GDP growth estimate.

Investment side buoyant

Investment expenditures also contributed significantly to headline GDP growth with an annual growth rate of 10.3%, contributing 2.6% to headline growth, primarily driven by a 11.9% YoY increase in machinery and equipment investments. When the 0.5% contribution of final government consumption expenditures is added, the contribution of aggregate domestic demand to headline growth is measured at 8.5%.

The contribution of net external demand turned positive again (at 1.6%) after 6 quarters due to a slowdown in imports. Inventory accumulation continued to drag down headline growth as was the case for the past 13 quarters, with its impact on growth being -4.4% in 1Q24.

Looking at the production side, the added value from services sectors seems to be less than our expectations, with the YoY growth in services sectors ranging between 2.0% and 4.7%, which is well below the 7.3% YoY growth observed in the services production index, recently compiled by TurkStat. Meanwhile, YoY growth in the industrial sector at 4.7%, and at the construction sector at 12.0% turned out to be in line with our expectations.

Surge in domestic demand bodes poorly for disinflation

There was a significant surge in domestic demand in 1Q24, contrary to expectations of a slowdown. In summary, contrary to expectations of a domestic demand slowdown to control inflation, there had a notable acceleration in 1Q24. Despite a limited deceleration observed in April and May, we believe this is still far from sufficient for a sustained disinflation process. We have consistently emphasized the need for a sharp contraction in domestic demand to meet the inflation targets for 2025 and beyond.

In fact, our GDP growth forecast of 2.7% for 2024, which is significantly below market expectations of 3.0-3.5%, was predicated on such a slowdown. Yet, we should note that current growth trends, particularly the outlook for domestic demand, do not indicate a contraction of this magnitude. Accordingly, we are revising our 2024 GDP growth estimate to 3.0%, with the risks seemingly tilted to the upside at the current juncture.

Critical juncture in GDP to inflation nexus

If domestic demand does not slow down markedly, the pace of disinflation may remain sluggish. Should a significant slowdown in domestic demand do not materialize in the coming months, dragging overall GDP growth to levels around 2.0% or even lower, we believe that the pace of disinflation beyond 2024 may fall short of market expectations (median estimate is 26% for end-2025), despite the recent FX stability.

Gedik Investment Research

By Chief Economist Serkan Gonencler

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/