Anemic QoQ growth in 3Q

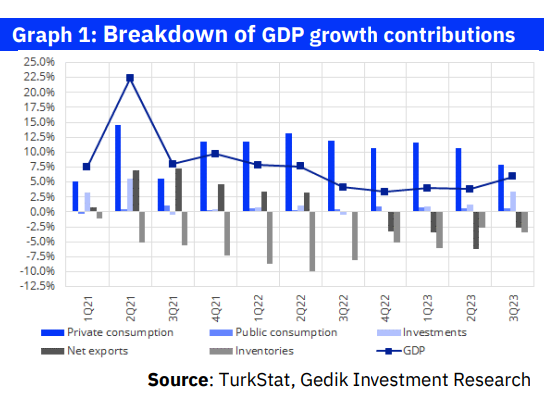

GDP growth turned out to be 5.9% YoY in 3Q23, despite a moderation in QoQ growth to 0.3%. TurkStat revealed 3Q23 GDP growth as 5.9%, slightly higher than our 5.6% estimate, which was also the median market expectation. The working-day (WD) adjusted YoY GDP growth was 5.1% (considering the 2.5 additional working days compared to the same quarter of the previous year).

Meanwhile, the WD-effect and seasonally adjusted GDP growth on a QoQ basis eased significantly to 0.3% from the 3.3% sequential growth in the previous quarter.

Despite a slight slowdown in domestic demand in 3Q23, it remains as the main driver of growth

Although private consumption expenditures, which rapidly accelerated since 4Q20, experienced a QoQ deceleration for the first time in 11 quarters, this decline appears to be very limited at -1.7%. Despite this pullback, private consumption expenditures continued to be the largest contributor to GDP growth with a YoY growth rate of 11.2%, contributing 7.8% to overall GDP growth.

A noteworthy positive development in 3Q was the annual growth of investment expenditures by 14.7%, making a significant contribution of 3.4% to headline growth. This contribution can largely be attributed to a 23.7% YoY in machinery and equipment investments. When the 0.7% contribution of government final consumption expenditures is added, the total contribution of aggregate domestic demand to headline growth is measured at 11.9%.

Due to a slowdown in imports, the negative impact of net external demand decreased from 6.3% in the previous quarter to 2.6%. Inventory accumulation has been continuously pulling down headline growth for the past 11 quarters, with its impact measured at -3.4% this quarter.

Analyzing from the production side, although we see a limited slowdown in the service sectors, they continue to make a strong contribution to headline growth. This is in fact in line with the modest slowdown in domestic demand. Apart from that, there is a recovery in the industrial sector with a 5.7% YoY and 2.0% QoQ growth rates. Note that the industrial sector had contracted on an annual basis for the past four quarters. The construction sector witnessed a 8.1% YoY growth rate, supported by the low base effect.

The limited slowdown in private consumption suggests that there should be additional increases in deposit interest rates

In summary, today’s GDP data suggests that the slowdown in the consumption trend remains very unsatisfactory in 3Q23, despite the ongoing policy rate hikes since June, and the rise in loan and credit card rates.

Monetary and credit policy need more tightening to balance the economy

Leading indicators such as credit growth and credit card expenditures suggest that the slowdown in consumption continued in October and November. Yet, we believe that this pace of slowdown is not yet sufficient to trigger a sustained disinflation process. Hence, for a significant domestic demand slowdown, in addition to a moderation in loan growth, we continue to advocate significantly higher deposit rate levels (e.g.: 50-60%), which may induce savings tendency.

In the meantime, our preliminary rough calculations point to a YoY GDP growth of around 3.0% in 4Q23, which would keep 2023 GDP growth at slightly above 4.0%.

Serkan Gönençler, Chief Economist Gedik Investment

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/