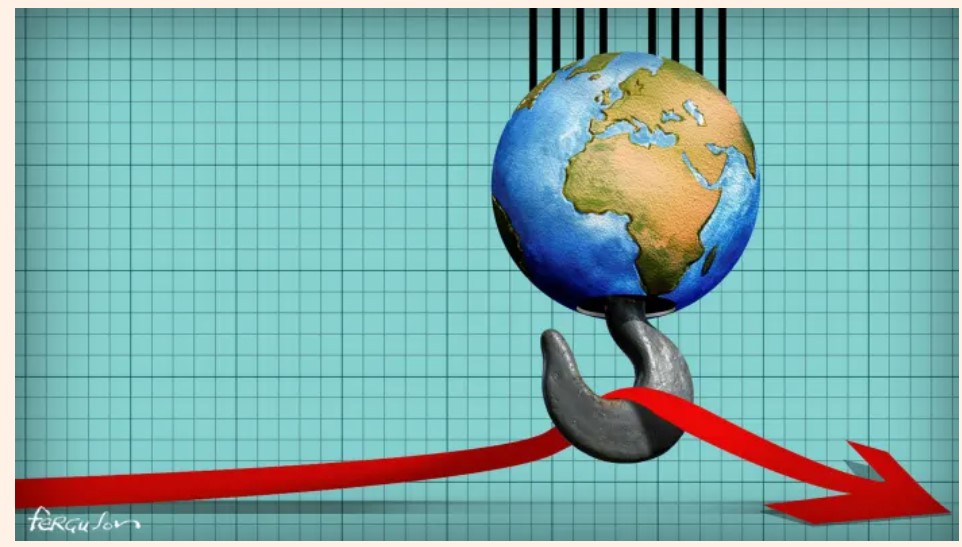

Even as the U.S. and European economies bounce back from the depths of last year’s pandemic-induced recession, businessmen and economists are increasingly concerned that no country can count on a return to prosperity until the coronavirus is beaten back everywhere.

Nongovernmental organizations, such as the World Health Organization, have for months been sounding the alarm about the lack of access to vaccines in the developing world. The growing concern about the impact of a new surge of the virus on the global economy, though, is now is driving U.S. businesses to plead with the Biden administration to prioritize the provision of COVID-19 vaccines to hard-hit developing nations that play a key role in the global supply chain.

“I am writing to urge you to immediately ramp up distribution of excess U.S. vaccines to Vietnam and other key partner countries,” wrote Steve Lamar, president and chief executive of the American Apparel & Footwear Association, in a letter recently sent to the White House.

“This distribution should focus on key populations in these countries, particularly those populations that are critical to the economic success of these countries to quickly foster recovery from this humanitarian crisis, and ultimately, long-term health and stability. Without such a surge in targeted distribution of vaccines, COVID will instead destroy the very industries that these countries depend on for their economic livelihoods.”

US economy still strong

The U.S. Commerce Department reported Thursday that the nation’s trade deficit for June hit an all-time high of $75.7 billion, signaling continued strength of U.S. demand. But a constellation of factors, including massive supply chain disruptions within U.S. borders, rising cases of the coronavirus throughout China and Southeast Asia, and extreme weather in the South China Sea, threatens to disrupt a thriving exchange of goods and services.

Railyards and ports in the U.S. are choked with shipping containers that can’t be delivered to consumers fast enough; factories across Southeast Asia are being idled, as the delta variant of the coronavirus sends case counts soaring across the region; and the beginning of what promises to be a heavier than usual typhoon season already has caused multiple port closures in southern China.

Coronavirus surge hitting Asia

Part of what has allowed the economies of the United States and Europe to rebound as they have over the past six months is widespread vaccination against the coronavirus. Even as the delta variant surges through the U.S., for example, areas with high levels of vaccination are not experiencing the overloading of hospitals and the business closures that marked the early days of the pandemic.

The story is very different across much of Asia, where vaccination levels are far lower. The percentage of the population of Thailand that is fully vaccinated, for example, is just 5.7%. Taiwan’s rate is even lower, at 1.8%, and Vietnam has fully vaccinated just 0.8% of its populace.

One result is that Malaysia, Indonesia, Vietnam, and other countries in the region are being forced to respond to the surging coronavirus caseloads with factory shutdowns and stricter lockdown and social distancing rules.

Knock-on effects

The interconnectedness of the region’s economy means that shutdowns in one country have knock-on effects in others. Toyota, for example, had to indefinitely shut down assembly plants in Thailand because it cannot get necessary parts from other countries across the region.

After a strong surge in productivity in the first half of the year, even China, the region’s economic superpower, appears to be stumbling. A key indicator this week showed that growth in manufacturing in China has slowed to a crawl. Similar reports from across the region point to a wider slowdown that will only be exacerbated by rising COVID-19 caseloads.

Africa’s woes complicate picture

While the business world is focused on Asia, Paul Baker, chief executive of International Economics Consulting, which has offices in London and Mauritius, said via email it is an open question as to “how Asia’s disruptions will affect the rest of the world when we look at the dependence of the rest of the world on Asia for supplies.”

.

He added it is a mistake to look solely at Asia as the source of potential disruptions, however, with cases rising in other parts of the world as well, such as Africa, which has the world’s lowest regional vaccination rate at just 5.4%.

“One could also argue that Africa’s current predicament will reverberate into Asian markets, as it is a supplier to Asia of raw materials, and then Asia’s predicament will affect many industries in the U.S./EU [the end consumers],” Baker wrote.

Latin America, too, is still battling the scourge

Another major supplier of raw materials to Asia’s voracious mill of manufactures is Latin America, where political instability and the Covid-19 outbreak is wreaking havoc among the workforce.

With the exception of Chile, Latin America is once again becoming a global hotspot for Covid as the Delta variant takes hold. Peru is battling several coronavirus variants at once. Colombia is facing the longest wave of Covid so far, with ICUs at 95% capacity. Across Latin America and the Caribbean, nearly 1.4 million people have been killed by Covid-19, while vaccines ordered through the COVAX program have yet to arrive, according to DW.

At the same time, Latin America is experiencing a surge in political volatility as Covid has exacerbated many of the region’s economic vulnerabilities. Brazil, Argentina, Cuba, Venezuela, Bolivia, Colombia, Chile, Paraguay, and Guatemala have all seen major demonstrations in the streets, as reported by The Guardian.

US/EU recoveries untested

Baker also said it may be too soon to diagnose the real status of the U.S. and EU economies, given that they are both in the early stages of a recovery that was, in a way, “artificial.” Both, he said, relied on “massive borrowing” and a decline in COVID-19 infections. Now, much of that fiscal stimulus is ending, and COVID-19 cases are rising again.

They also benefited from a large digital sectors, which “are not disrupted in any significant way by COVID.”

But sectors that are very much affected by COVID-19 are entering into what is normally the busiest part of the year, and they will face serious challenges.

Empty shelves in the future?

From back-to-school sales, through Halloween, Thanksgiving and Christmas, an outsized share of U.S. consumer spending occurs in the last one-third of the calendar year.

This year, though. there’s real danger that U.S. consumers could be confronting bare shelves.

This is partly because of a massive logistical problem. Major railroads stopped transporting shipping containers to the interior of the country because railyards were too full to accept them. As a result, ports found themselves filled with stacks of containers that couldn’t be moved, and they began refusing access to ships.

Is inflation really temporary?

The break-down of vital supply chains begs the question of whether the current bout of global inflation is temporary. Only 15% of the global population has been fully vaccinated to date. While nearly 4.5 billion doses of the Covid-19 vaccine have been administered worldwide, only 1.1% of people in low-income countries have received at least one dose.

As global herd immunity is delayed, the virus will find ways to evolve further, possibly into deadlier forms. The world conveyor belt of production means deadlier variants will spread from Africa and Latin America to Asia, where led by China many nations chose quarantines and lockdowns to rapid vaccination campaigns.

China is paying the price of this strategy dearly, as Wuhan is locked down again, which threatens to prolong supply chain break-downs.

There are domestic factors which drive inflation in Developed Nations, such as rent and home prices in the USA, but import prices could remain elevated longer than Fed or ECB imagine, unmooring expectations. The result will be a rush to tighten monetary policy and a world-wide weakening of non-commodity EM FX.

Sources: VoA, DirectRelief.org, Commentary by PATurkey staff

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/