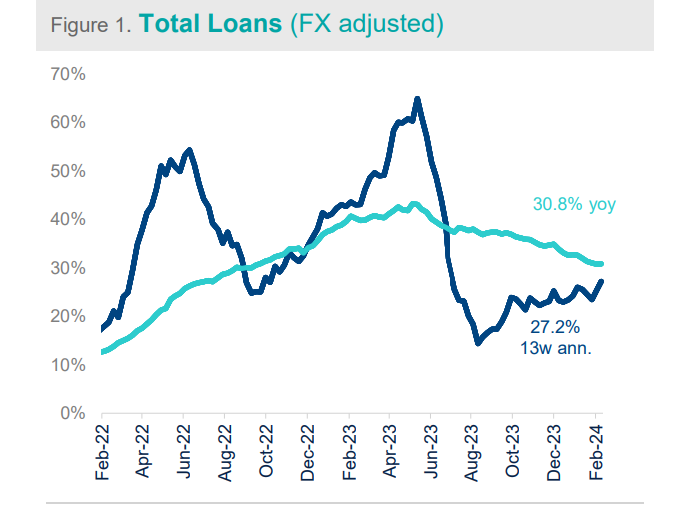

In the week ending by February 9, foreign currency adjusted weekly credit growth decelerated to 0.5% from 0.7% due to consumer credits in private banks. Total credits’ 13-week annualized trend rose from 25.4% to 27.2% due to carryover impact of the previous two weeks.

Among the sub-segments of TL credits, TL commercial credits’ weekly growth decelerated due to SME credits of public banks and non-SME credits of private banks. Deceleration in consumer credits was led by the general purpose loans and auto loans in private banks. Last week’s strong weekly growth in consumer credit cards decelerated sharply bringing down its trend rate.

FC credits continued to decelerate, caused by the SME lending of public banks.

In the case of deposits, TL deposits fell by TL 21bn due to outflows from official institutions’ TL time deposits. Residents’ FC deposits fell by $543mn due to decline in households’ USD and gold deposits. Adjusted from price effects, FC deposits fell by $146mn according to our calculations.

The FC protected scheme (in US dollar terms) fell to USD 77.7bn. The share of TL deposits excluding FC protected scheme in total deposits fell to 42.7% (vs. the CBRT’s target of 50% in 2024).

Commercial credit rates rose by 22bps to 53.3% and consumer rates rose by 38bps to 60% improving the spreads in both segments. Highest rise was in auto loan rates by 789bps with its rate rising to 48%. General purpose loan rates rose by 18bps to 61.4%. Housing rates continue their downward trend since the start of the year and fell by another 14bps to 40.9%.

As released by the CBRT, TL deposit rates fell by 15bps to 46.5%. Among the brackets, the highest decrease was in up to 1yr bracket with 238bps falling to 41.5%. The highest TL deposit interest rate remains to be in up to 3 months bracket with 50.9%.

On FC deposit rates, EUR rates fell by 3bps to 0.95%; and USD deposit rates fell by 33bps to 1.98%. The highest FC deposit rates stand at up to 3 months maturity bracket in EUR with 1%; and in up to 6 months in USD with 2.1%.

The Non-Performing Loans (NPL) ratio of the sector remained at 1.61% (1.2% in public; 2.2% in private).

By Garanti BBVA Investment Research Team

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/