Turkish banks started 2020 with expectations of a strong recovery in earnings post the 2018-19 downturn. At the start of 2020, Turkish banks had budgeted for mid- to high-teens ROE for 2020 on the back of expectations of an acceleration in loan growth, margin expansion, and cost of risk normalization. Indeed, we expected average ROE to increase from c.10% in 2019 to c.13% in 2020.

However, amid the COVID-19 pandemic and the resulting economic impact, our economists have revised their 2020 real GDP growth expectation for Turkey to -5% (vs. +4% at the start of the year) on the back of lower exports to the Euro Area and a contraction in domestic demand. As a result, we believe ROE normalization has been pushed out beyond 2020.

While Turkey has not implemented a full lockdown similar to other countries, it has enforced a variety of social distancing measures, with the majority of the population in big cities working from home, no transport between big cities, and curfews during weekends and holidays. The government has also announced various measures to support the banking sector and the economy, chiefly among them changing the NPL classification criteria from +90 days past due to +180 days past due, doubling the size of the Credit Guarantee Fund (CGF) collateral from TL25bn to TL50bn, and providing additional liquidity facilities to banks.

In this report, we analyze the impact of the economic downturn on banks’ credit growth, net interest margin, and asset quality.

Loan growth

While we think that banks’ high-teens TL loan growth targets are now unlikely to be achieved given the expected contraction in economic activity and domestic demand, we note that the increase in the size of the CGF from TL25bn to TL50bn (which our discussions with banks suggest could guarantee up to TL250bn of additional loans) should support retail, SME and commercial loan growth and offset contraction in other loan book segments. Moreover, the regulator implemented a new asset ratio over the weekend, which further incentivizes banks to lend. We revise our average TL loan growth expectation from 20% to 12% for 2020, and expect FC loans to contract by 5% on average in U$ terms.

Net interest margin

Turkish banks ended 2019 with strong NIM expansion as deposit costs declined post interest rate normalization. Underlying NIM expanded by 130bps in 4Q on average, which sets a solid base for 2020. Our initial expectation was for margins to decline on a quarterly basis throughout 2020 as asset yields normalize following the decline in deposit costs, which would still result in 60bps yoy NIM expansion. While our economists expect 350bps of cumulative rate cuts during 2020, which should theoretically support margins, we reduce our NIM expansion expectation to 50bps on average, as we see limited downside to deposit costs post the sharp decline to below the policy rate. Moreover, we expect CGF-driven lending to take place at lower, affordable rates, which could further pressure asset yields for banks.

Asset quality

The regulator has implemented a variety of measures to mitigate the asset quality impact of the COVID-19 pandemic, including easing NPL and Stage 2 classification criteria and announcing debt holidays for borrowers. That said, banks have communicated that they intend to continue to provision for their loan books as per IFRS 9 standards. Banks already recorded a cyclically high cost of risk of c.240bps in 2019 (c.290bps for private banks) driven by sector-wide recognition of troubled loan exposures (particularly in the energy space). This is while the NPL ratio increased from 4.5% to 6.6% in 2019; we expect it to reach c.7.5% in 2020 and almost 8.0% in 2021. This drives our net cost of risk expectation of 260bps for 2020, which we expect to normalize to c.170bps in 2021 vs our previous assumptions of 190bps in 2020 and 150bps in 2021.

Our stock recommendations

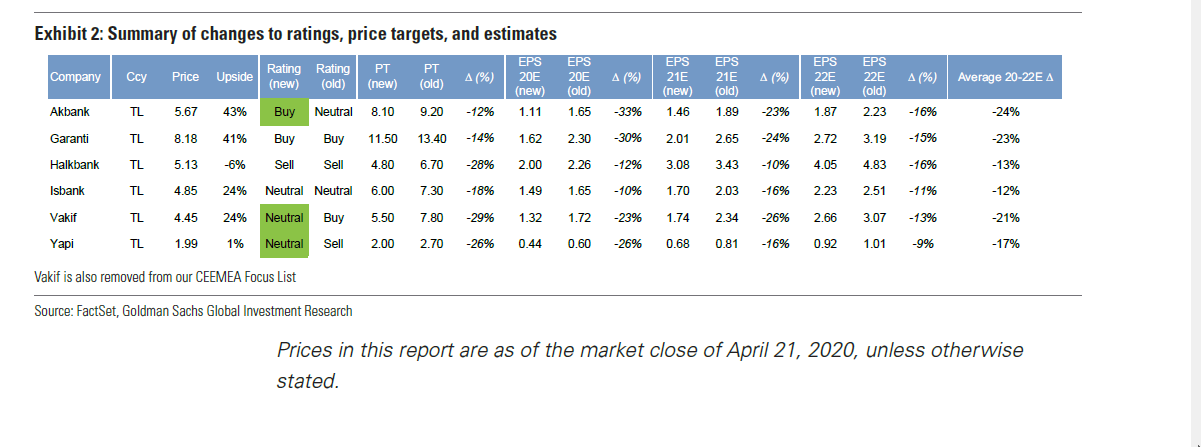

Our EPS estimates for 2020-22 decline by c.20% on average on the back of these changes. We also introduce 2024 estimates. We change the basis of our valuation methodology from 2020 ROE/COE to 2021 capital-adjusted ROE/COE, as we believe that investors place an increased emphasis on banks’ capital ratios during times of economic headwinds (such as during 2H18). Our 12-month price targets decline by c.20% on average. We upgrade Akbank to Buy from Neutral given its strong balance sheet buffers and close to trough valuation. We upgrade Yapi Kredi to Neutral from Sell given the bank’s improved buffers and following underperformance vs CEEMEA peers.

We downgrade Vakif to Neutral from Buy (off the CEEMEA Focus List) as we expect above-sector-average loan growth to weigh on capital. We reiterate our Buy on Garanti given the bank’s superior returns generation and strong balance sheet buffers. We remain Sell-rated on Halk, as we expect capital levels to remain meaningfully below peers given our expectation of strong loan growth this year. We also remain Neutral on Isbank.

Risks

Given the current backdrop, we note downside risks to current valuations for Turkish banks in the short term. In our view, a de-rating could be triggered by a meaningful macro slowdown (our economists forecast 5% real GDP contraction this year), concerns around private sector debt (particularly FC debt), potential external funding stress, ongoing Lira depreciation, and negative developments regarding the COVID-19 outbreak.

Excerpt from Goldman Sachs report

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/