Turkey’s year-to-date credit growth reached 22% (numbers differ from report to report, as there is no unique method to adjust for the changing book value of outstanding FX loans), despite what is expected to be a severe contraction Q2. The government is jaw-boning private banks to increase loans to “troubled industries”, at a time when macro-credit risk is rising sharply. State banks have been brought under total command of the Treasury, loaning at will, and if the opposition is to believed to corporates close to AK Party. Central Bank’s favored method of measuring loan momentum, namely 13-week moving average annualized loan growth is bordering to 70%, which shall constitute a credit boom. All readers of financial history know how credit booms end. In busts.

TL loan growth continues at 1% weekly pace

Yatirim Finans Investment Group Research Department commented on weekly and annual loan developments. According to BRSA weekly bulletin for the week of June 26, total loans were up by 0.8% in TL terms. TL loans increased by 1.5%, while FX loans were down by 0.4%. Growth of TL loan book reached 28% y-t-d, with state and private banks TL loan growth reaching 40% and 18%, respectively.

Recent surge in state banks’ TL lending has increased the gap in growth versus private peers, which we relate to more favourable rates offered by state banks versus competition. Retail loan growth reached 19% y-t-d, while FX loan contraction is at 1.7%. Total loan growth in TL terms is 22.4% y-t-d.

TL88.6bn increase in TL deposits in the last three weeks

Total deposits in TL terms were up by 0.7% w/w. TL deposits increased by 1.3% w/w (state: +1.2%, private: +1.3%), implying a rise of TL88.6bn in the last three weeks. FX deposits increased by 0.2% w/w. FX deposits reached a peak of USD229bn on the week of 6 March and now stand at USD226bn, above the 2019 year-end level of USD220bn. TL deposit growth reached 20.9% y-t-d (state: +38%, private: +8%), while FX deposits increased by 2.6%.

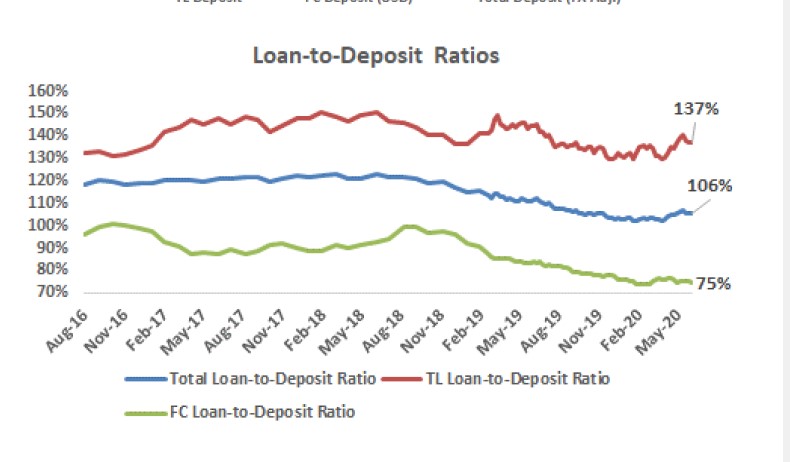

The share of FX in total deposit was flat at 50% comparing to the week of June 19. Total loan-to-deposit and TL loan-to-deposit ratios stand at 106% and 137%, respectively. FX loan to deposit ratio is 75%.

We view the 2Q acceleration in TL deposits as a positive development (1Q at 5.7%) as it helps to prevent higher TL loan-to-deposit ratios, given the sharp increase in TL loan growth. Recent capital increase in state banks further support the banking sector funding dynamics. TL deposits move to state banks that offer more favourable rates and need higher funding growth, parallel to the same trend in loans.

NPL ratio flat at 4.5%; stage II loans likely to increase

Sector’s NPL ratio was flat at 4.5%, while NPL provisioning ratio remained unchanged at 71%. We do not expect a major change on this front in 1H20 despite the macro downturn, as the negative impact on asset quality is likely to come with a certain lag –extended further by recent BRSA measures that eases NPL recognition rules. In the meanwhile, stage II loans are likely to increase.

Dr Fulya Gürbüz, an economics professor and PA Turkey contributors notes that banks’ loan-los reserves exceed bad loans ratio by 1 percentage point, suggesting that banks have dim view of the future repayment conditions.

Indeed, if Finance Minister Berat Albayrak’s “go for broke” economic stimulation fails to revive the economy, bad loans could increase to double digits in 2021, impairing banks’’ ability to make new ones. Turkey is spending all of its ammunition for next quarter’s growth, at the expense of sustainability

Contributions by Y.F. Securities Research, Dr Fulya Gurbuz

You can follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/