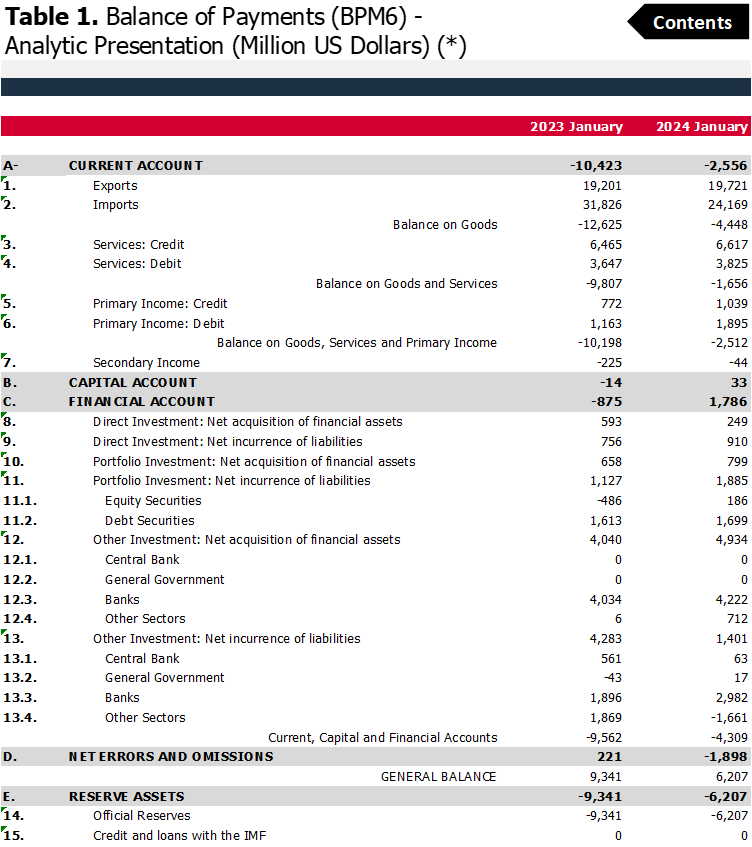

Central bank of Turkey (CBRT) announced Turkey’s current account balance at a deficit of USD 2,556 mn in January which compares well with the USD 10,423 mn deficit in January 2022. Including the minor monthly revisions, Turkey’s 12-month CAD is now at USD 37, bn that roughly corresponds to 3.5% of GDP down from the 2023YE level at USD 45.4 bn; or 4.3% of GDP.

Stripping the CAD from its energy component, the surplus is now higher at USD 12,8 bn up from USD 7.4 bn a month ago. The core CAB, that is the CAD free of energy and gold now posts a surplus of USD 34.6 bn versus USD 33.03 bn in December 2023, all in 12-month terms.

The preliminary February foreign trade deficit f USD 5.1 bn compared to USD 11.9 bn recorded in last year’s February signals that strong correction in Turkey’s CAD will continue.

The financing side matters: Burden on CBRT reserves again

In January, portfolio inflows amounted to 1.1 billion USD as USD 186mn inflows were recorded in equities and USD 264mn USD were invested by foreigners in government bonds. Bank bond issues were more significant at USD 1,426 mn.

Direct investments were muted again with USD 661 mn and USD 415 mn of it was foreign real estate purchases.

Banks borrowed USD 912mn net in short-long term loan renewals, while the corporate sector made net repayments of USD 890mn. Deposits, which show large fluctuations every month, showed an outflow of 1.9 billion dollars this month.

The net errors and omissions item also witnessed a large outflow of USD 1.9 bn and the outflow in the last five months added to USD 9.1 bn.

As a result of all these developments, CBRT foreign exchange reserves melt by USD 6.2bn, carrying the 12-month change in reserves to a mere rise of USD 1.1 bn.

Looking forward, the government’s efforts to combat high inflation is set to slow GDP growth, hence CAD is expected at USD 30-33 bn by 2024YE.