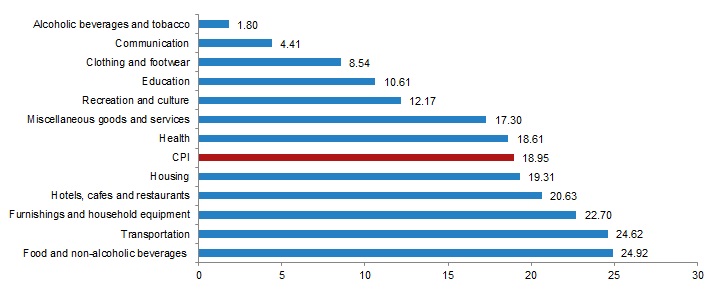

Consumer prices rose by 1.80% month-on-month in July, bringing annual CPI inflation to 18.95% from 17.53% in June. As of sub-items, clothing prices with seasonal sales and service sector prices, which are most severely affected by COVID-19, remain below the headline CPI inflation of 18.95%. Yet again, the lifting of pandemic bans shows the services sector price inflation is set to catch up inb the months ahead.

If the value of TL remains stable from August and on, it is inevitable that this process will continue beyond the end of the year since the gap between PPI and CPI has now reached 26 points. Domestic demand remains strong thanks to the current conduct of monetary policy and unconvincing inflation data. The lifting of pandemic bans also accelerates service sector inflation.

CPI annual rate of changes in main groups (%), July 2021

Food price inflation is at the top of the pyramid with 24.92%. Both the production challenges created by global warming, Turkey’s lack of an intact agricultural policy and import food price inflation pressures foretell that more food inflation is to come in the months and years ahead. Now especially following the devastating wildfires in Turkey’s southern costs.

Moreover, core inflation (B-Index CPI excluding unprocessed food products, energy, drinks, tobacco and gold) increased by 1.0% month-on-month to 18.51% annually in July from 18.16% in June. This, contrary to central bank rhetoric, will be prevented a decline beyond the base year effect in late 4Q21 and suggests that inflationary pressures continue to strengthen.

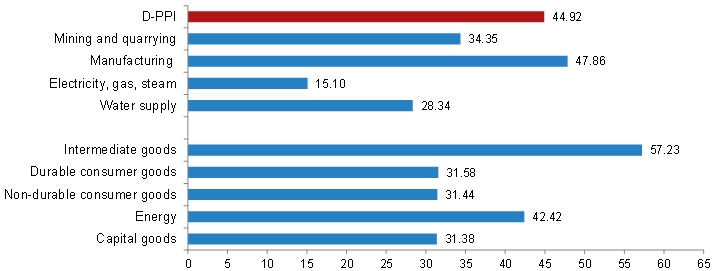

Domestic producer price index (D-PPI) increased by 44.92% on annual basis as it posted 2.46% jump on m-o-m basis. D-PPI in four main sectors of industry increased by 34.35% for mining and stone quarrying, by 47.86% for manufacturing, by 15.10% for electricity, gas, steam and air conditioning, by 28.34% for water supply, annually.

The indices of main industrial groups; increased by 57.23% for intermediate goods, by 31.58% for durable consumer goods, by 31.44% for non-durable consumer goods, by 42.42% for energy and by 31.38% for capital goods, annually.

D-PPI annual rate of changes (%), July 2021

The figures speak for themselves. The gap between PPI and CPI has increased to 26 points. As PPI rises, it continues to push the CPI inflation up. Will continue to do so in the coming months as the monetary policy is far from being tight.

ENAGroup Consumer Price Index calculated using daily price data increased by 4.89% in July 2021. Such a figure means that the annual CPI inflation is close to 50%.

While the official inflation data hovers between 18-20%, it is not possible for annual inflation to fall below 20% by the end of the year. The central bank just recently had revised up its 2021 year-end CPI inflation estimation from 12.2% to 14.1%. Both fail to meet the market criteria for credibility. The expected Fed move to commence tapering in late 4Q21 will inevitably make a new wave of devaluations in the TL. Such pressures render the monetary policy ineffective in lowering Turkey’s inflation.

The central bank’s current approach to monetary policy and TUIK data show that inflation is just as out of control as it was in the 1990s. President Erdogan’s pressures for a rate cut ahead of the general elections combined with weak monetary policy conduct translate to weaker Turkish lira and higher inflation to a tune of 20-25% in 2022.

With the political interventions in the central bank, a rate hike- unless forced by the market appears not feasible either placing TL in a vulnerable situation given the absence of foreign investments flows.

GA.