Speaking at an investor meeting at JPMorgan Chase & Co.’s headquarters in New York, Turkey’s central bank told that interest rates are nearing the levels necessary to establish a disinflationary trajectory and that it aims to conclude its tightening cycle as swiftly as possible. Governor Erkan and Deputy Governor Cevdet Akcay addressed investors in person, while Finance Minister Mehmet Simsek spoke via an online session.

As of September, the central bank noted a significant improvement in inflation expectations and a decrease in underlying trends, according to the person, who requested anonymity as the meetings were not open to the press.

Central Bank Governor Hafize Gaye Erkan reportedly informed investors that the policies were proving effective but emphasized that the bank’s mission is not complete until price stability is achieved. She also discussed the bank’s efforts to accumulate reserves and increase the share of lira deposits in the banking system.

The central bank declined to provide comments.

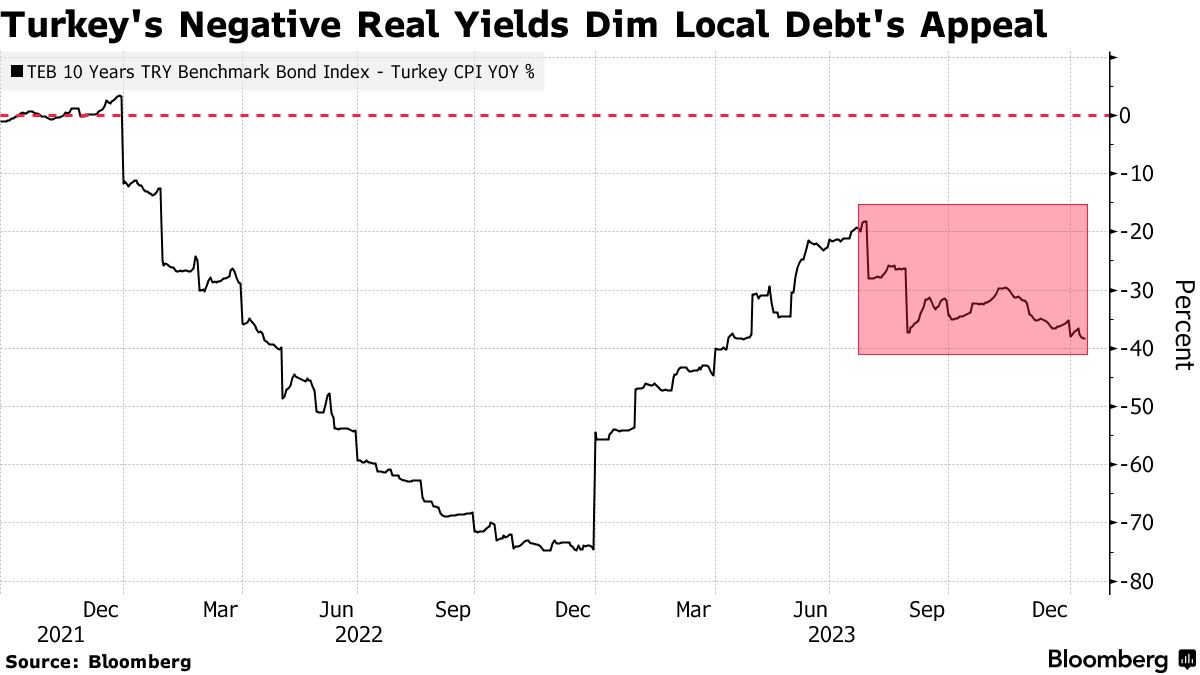

Investors have expressed reservations, including concerns about the high costs of hedging currency risk and the sustainability of the economic team’s policies, hindering further allocation to Turkish assets. In a recent report, JPMorgan suggested that investors should either wait for Turkish yields to rise or for inflation to fall before considering investments in lira bonds.

Governor Hafize Gaye Erkan has previously advocated for investors to buy local bonds, anticipating that both inflation and monetary policy will likely become more “moderate” by the end of this year.

Inflation in Turkey accelerated to 65% in annual terms last month, and the central bank anticipates further increases in the coming months, with a projection for deceleration starting in the second half of 2024.

Turkey currently offers the highest local-currency yields among major developing nations, according to the Bloomberg Emerging Markets Local Currency Government Index, which tracks 18 countries. Governor Erkan has increased the benchmark interest rate from 8.5% to 42.5% since taking office last year.

Before the news from the meeting on Thursday, investors surveyed by Bloomberg expected the central bank to implement another interest-rate hike this month and to reach a terminal rate of 45%.