Turkey’s banking regulator warned lenders not to provide lira liquidity to companies looking to speculate in the offshore money market, according to a document seen by Bloomberg, an apparent attempt to curb short sellers.

The banking watchdog, known as BDDK, asked lenders to scrutinize requests for loans from Turkish companies, saying the financing could be used for arbitrage opportunities, according to the document. Interest rates offshore can be far higher than local borrowing costs because the supply of liras is limited.

The banking regulator declined to comment.

The offshore money market is a key source of lira liquidity for foreign investors. Authorities have put in place a series of restrictions designed to curb the supply of liras since a rout in 2018, periodically driving up the cost of betting against the Turkish currency.

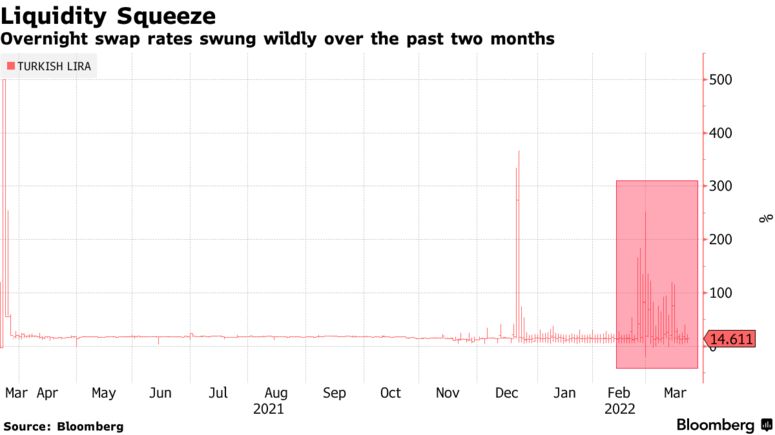

Over the past two months, the overnight offshore lira rate has swung wildly. It climbed above 250% in February — making it prohibitively expensive for funds outside of Turkey to borrow the currency and sell it — before plummeting toward 14% this week.

The lira has lost more than 10% of its value against the dollar this year, the worst-performing emerging-market currency after the Russian ruble, amid concern monetary policy in Turkey remains far too loose to contain inflation. The central bank’s one-week repo rate stands at 14%. Consumer prices rose an annual 54.4% in February, the most in 20 years.