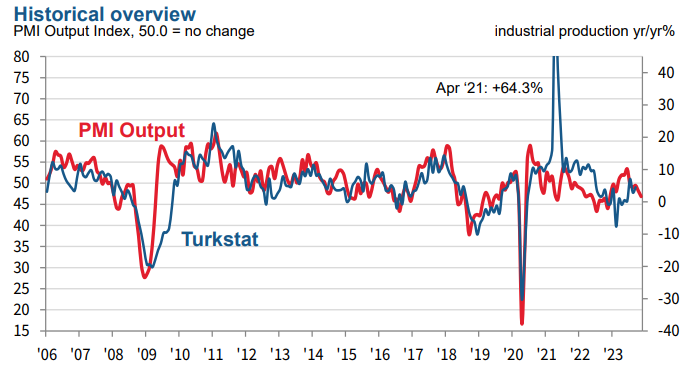

The slowdown in the Turkish manufacturing sector became more entrenched in November, according to latest PMI data. Output, new orders, purchasing and employment all moderated to larger extents than in October. Meanwhile, currency weakness again caused increases in input costs and output prices.

The headline PMI dropped to 47.2 in November from 48.4 in October, below the 50.0 no-change mark for the fifth consecutive month and pointing to a solid moderation in business conditions. In fact, the latest slowdown was the most marked for a year.

Subdued market conditions both at home and abroad meant that new orders eased again midway through the final quarter of the year, and to the greatest extent since November 2022.

Production was also scaled back to the largest degree for a year as manufacturers responded to demand weakness. Conflicts around the world and difficulties securing raw materials also contributed to the moderation of production, according to respondents.

Reduced output requirements meant that manufacturers scaled back their staffing levels for

the second successive month, with resignations and retirements also contributing to the modest easing of employment. The latest slowdown was the most marked since October 2022.

Purchasing activity and inventories of both inputs and finished goods were also lowered during the course of the month.

The rate of input cost inflation eased to a sixmonth low in November, but remained marked

amid widespread reports that currency weakness had pushed up prices for materials.

Manufacturers subsequently increased their own selling prices, with the rate of charge inflation unchanged from that seen in the previous survey period.

Economics Director at S&P Global Market Intelligence, said:

“The latest Türkiye manufacturing PMI data makes for concerning reading as it shows the slowdown in the sector gathering momentum as the year draws to a close. Widespread demand weakness, both at home and abroad, is making it increasingly difficult for firms to secure new business and leading to the scaling back of output, employment and purchasing.”