On the Market

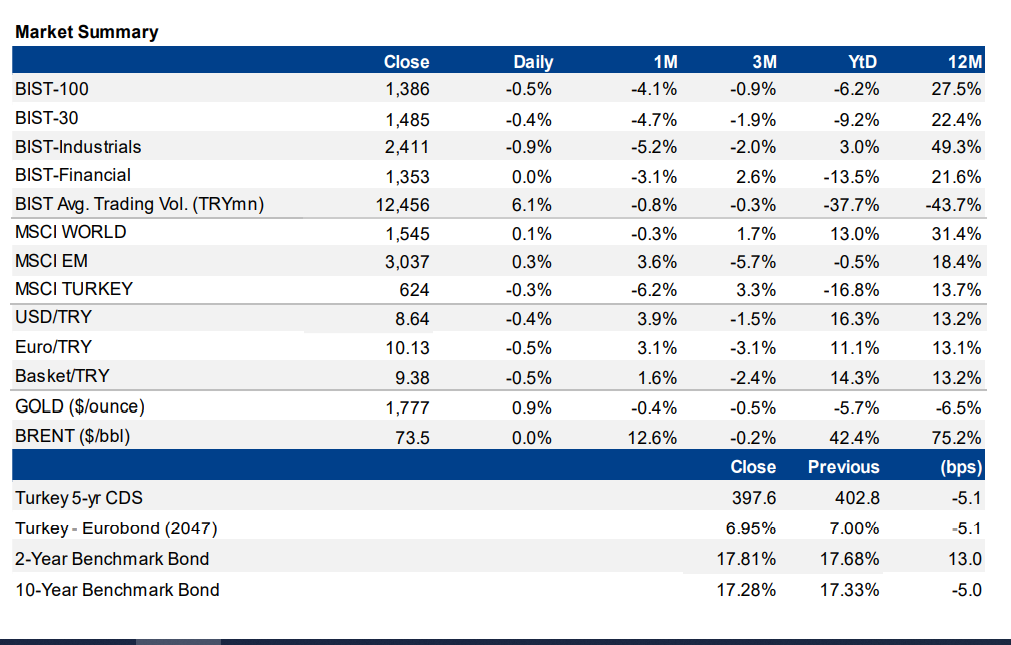

MSCI Turkey underperformed the MSCI EM by 0.5% yesterday. BIST-100 lost 0.5%, closing at the level of 1,386 with a trading volume higher than the last 5 days’ average. Banking index gained 0.4% and industrials index lost 0.9%. Interest rate on 2-year benchmark bond rate jumped to 17.81% (up 13bps) while 10-year bond rate inched down to 17.28% (down 5bps). TRY appreciated by 0.4% vs USD to 8.64 yesterday, while trading around 8.62 this morning. In terms of local dataflow, CCI (September), Treasury Redemption: TRY20.5bn (TRY17.2bn) would be watched today. We expect a positive opening for Turkish equities.

President Erdogan said Paris climate agreement to be presented to Turkish parliament

Speaking at the United Nations General Assembly President Erdogan said on Tuesday that the Paris climate agreement would be presented to the Turkish parliament for approval next month, which would make Turkey the last G20 country to ratify the deal. He added that Turkey aims to complete the approval process before the UN climate conference in November. Some of the worst wildfires in Turkey’s history killed eight people and devastated tens of thousands of hectares of forest in the southwest this summer. The fires were followed closely by floods that killed at least 77 people in the north.

WATCH: How Bad is Fed Taper for Turkish Assets?

OECD revised their economic growth and inflation forecasts of Turkey upwar.

Organization for Economic Co-operation and Development (OECD), unveiled their interim economic Outlook report of September 2021 which named as “Keeping the Recovery on Track”. Key messages of the report are given below:

- Global economy recovered fast due to the incentives, vaccination and easing on pandemic related restrictions. Despite that this condition supported employment, the recovery is uneven for economic growth, employment and vaccination. Governments need to vaccinate globally to ensure a more sustained and balanced recovery.

- The openings of the economies and the speed of the recovery has increased inflationary pressures. Despite short term risks continue to seem upward, inflation is projected to moderate.

- Central banks should set out their plans for the recovery.

- The world is emerging from the recovery with higher debt levels. Policy makers should build on their good initial crisis management and ensure fiscal policy is focused on investing to sustainably raise potential growth.

- The difficult policy choices faced by some emerging-market economies with high debt and rising inflation are also a potential downside risk.

OECD’s global economic growth estimate is at 5.7% for 2021 (May interim report: +%5.8) and 4.5% for 2022 (May interim report: +%4.4). OECD also revised their projections on Turkey:

- Economic growth estimate increased to 8.4% from 5.7% for 2021 whereas decreased to 3.1% from 3.4%.

- Headline CPI increased to 17.8% from 16% for 2021 and increased to 15.7% from 12.8%.

- Core CPI increased to 17.3% from 16.3% for 2021 and increased to 15.8% from 12.8%.

WATCH: Turkey’s New Economic Program Explained | Real Turkey

Treasury borrowed TRY10.4bn (includes non-competitive bidding) from the market via two auctions and a direct sale

Treasury concluded 9-month T-bill (TRT150622T19) and 7-year floating coupon G-bond (TRT130928T12) auctions and direct sale of 5-year lease certificate (TRD160926T19).

Treasury borrowed TRY725mn from the market via 5-year lease certificate issuance. The settlement date is on September 22 whereas the maturity date is on 16 September 2026 (1820 days) and 6-month term rent rate is at 8.4%.

The accepted average interest rate on the 9-month T-Bill was 18.54%. The sale amount was TRY1.6bn (sale/demand ratio: 42.9%).

Treasury also sold TRY900mn (sale/demand ratio: 67.9%) to the primary dealers prior to the auction in the non-competitive bidding (else TRY2.8bnn –sale/demand ratio: 100% – sold to public institutions). Accordingly, the total amount of the borrowings via this issuance was TRY5.3bn (sale/demand ratio: 51.9%).

The accepted term rate on the 7-year floating coupon G-bond was 9.4%. The sale amount was TRY926.4mn (sale/demand ratio: 49.6%). Treasury also sold TL1bn (sale/demand ratio: 70.9%) to the primary dealers prior to the auction in the non-competitive bidding (else TRY2.5bn –sale/demand ratio: 100% – sold to public institutions). Accordingly, the total amount of the borrowings via this issuance was TRY4.4bn (sale/demand ratio: 60.6%).

Therefore, the total amount of the borrowings with 8 of 8 planned auctions for September reached to TRY33.9bn, covering around 94.5% of the TRY35.9bn redemption (also, 84.8% of domestic borrowing projection of TRY40bn for September completed).

Domestic debt program for October-December period to be announced at the end of the month.

Courtesy of Yatirim Finansman Securities

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/