Turkey’s central bank kept interest rates unchanged for a third month on Thursday, but adopted a more hawkish tone as a weak lira and higher global commodity prices continue to cloud the inflation outlook.

The Monetary Policy Committee left its key rate at 19% as forecast by all 25 analysts in a Bloomberg survey. Inflation snapped seven months of increases in May, but the unexpected decline was likely the result of a strict lockdown imposed throughout the month after coronavirus cases surged.

The central bank did, though, make a hawkish change to the statement that accompanies its rate decision, once again describing its monetary stance as “tight,” after replacing the term with “current” last month. It also added the word “decisively” to its pledge to keep policy intact until a meaningful drop in inflation.

“Taking into account the high levels of inflation and inflation expectations, the current tight monetary policy stance will be maintained decisively until the significant fall in the April Inflation Report’s forecast path is achieved,” the bank said.

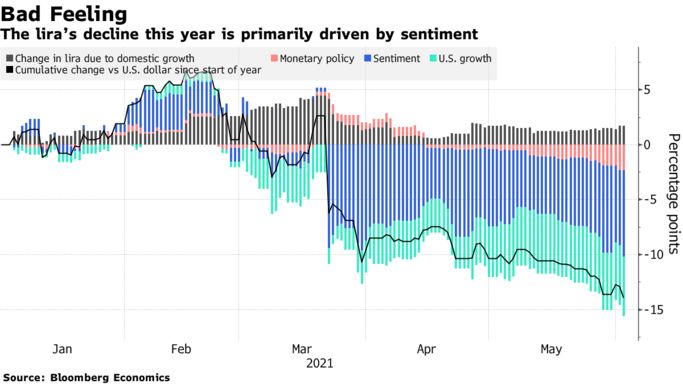

The lira’s status as this year’s worst-performing emerging markets currency, coupled with rising oil prices, could see inflation accelerate in June, economists said, making it too early to start lowering borrowing costs.

Central bank Governor Sahap Kavcioglu has said the pace of price gains peaked in April and is expected to drop to 12.2% by the end of 2021. This month, President Recep Tayyip Erdogan renewed his calls for lower interest rates with July or August as a target date, but Kavcioglu pushed back against “expectations for an early easing of policy.”

The lira has weakened more than 15% against the dollar since the governor took over in March, even though he’s pledged to work toward a positive real rate when adjusted for realized and expected inflation, and to maintain tight policy until the bank’s 5% inflation target is achieved.

Turkey’s key rate adjusted for realized price growth data stands at 2.41%. While global supply issues continue to have a negative impact on producer inflation, which reached an annual 38.3%, a fuel tax hike that came into effect in late May is expected to affect consumer prices this month.

Some economists say the central bank can start delivering a reduction in the benchmark as early as the third quarter, while others argue it may have to wait until the final three months.

Rest of the article is here.