“When in Rome, do as Romans do” is an old adage, which nowadays applies to Developing Nation Central Banks, which happily emulated the habits of Fed and ECB, that is to print money under various guises “to monetize” the fiscal deficits, bloated by the expense of fighting Covid-19 shock. While the New Normal does give license to many EM Central Banks (CB) to use the printing press, some of the “users” still suffer from fragile currencies or high inflation. In the latter kind of economic setting, money printing ought to be used extremely judiciously les it leads to higher current account deficits, inflation or a sudden depreciation of the currency. Central Bank of Turkey (CBRT) is one of those addicts, which doesn’t realize, it needs an intervention by friends to quit while it is too late.

Hurriyet Daily reports that CBRT will start to back private sector fixed investments that will reduce imports and increase exports, said Berat Albayrak, the country’s treasury and finance minister, on June 8.

Citing a recent announcement that the Turkish Central Bank would start reallocating its Turkish Lira rediscount credits for firms, Albayrak said a total of 400 million Turkish liras ($59 million) would be provided to companies with a maximum maturity of 10 years.

By the end of March, the bank announced that Turkish lira rediscount credits of up to 60 billion Turkish liras ($8.9 billion) would be extended to exporting and FX-earning services to contain the adverse effects of the global uncertainty caused by the novel coronavirus pandemic.

In a statement on June 5, the Central Bank said the country’s banking system had so far effectively met the credit needs for working capital.

What does this mean?

Essentially, CBRT will turn some TL20 billion of its TL60 billion export rediscount facility (which had been announced at end-March; to a new scheme dubbed “advance loans against investment” to be “extended through development and investment banks to firms that hold Investment Incentive Certificates and that will make investment in selected sectors”. With demand for export credit stagnating the CBRT is diverting this funding elsewhere to fulfill its TL60 billion quota, as if there has not been enough monetary expansion already.

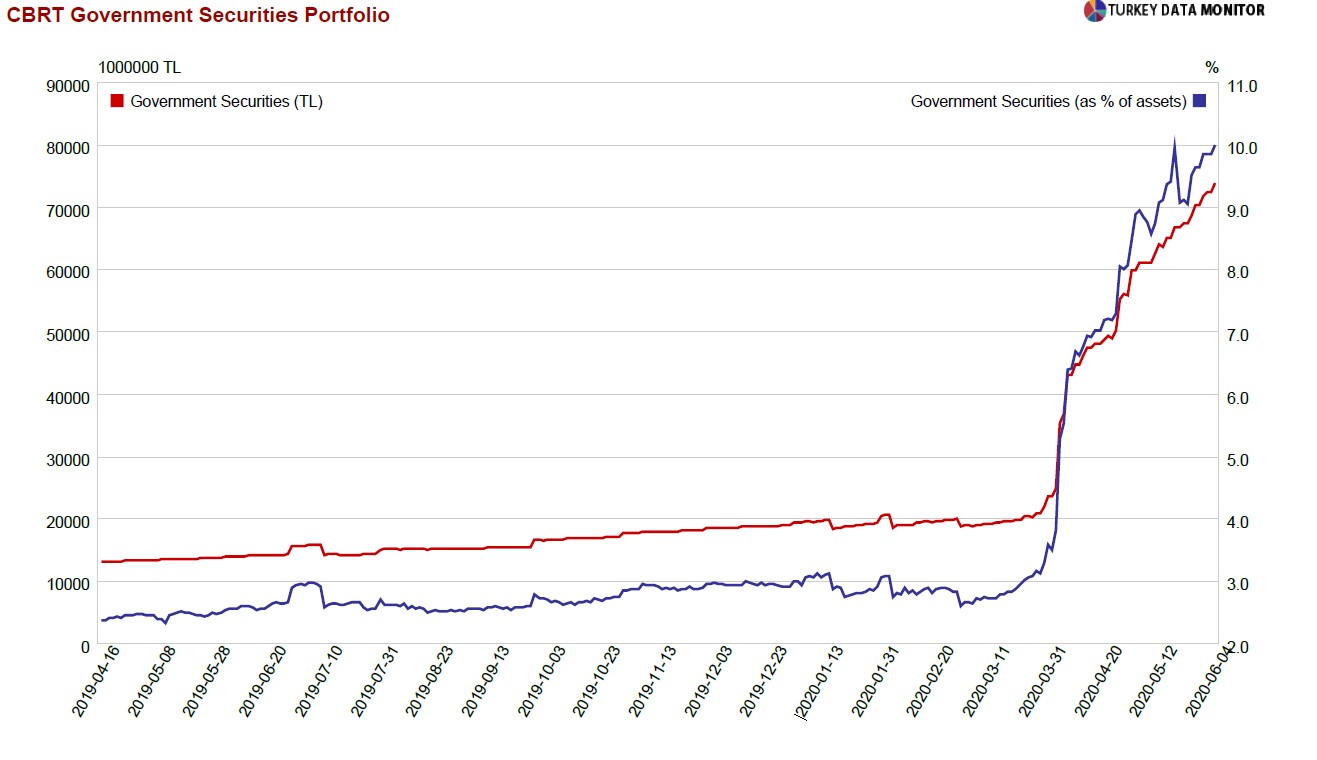

has created – since end-March–almost TL200 billion through three mechanisms, which correspond to a massive 80% expansion of base money. Of the three facilities , OMO stock rose by around TL105 billion since end-March, while another TL85 or so was created through direct government debt purchases –at around TL55 billion– and through the export rediscount scheme – at around TL30 billion.

Unintended consequences

In a country where CPI is 11.36%, while TL deposit rates dropped to 6.5% per annum after taxes, It is inevitable that the excess supply of money will leak to asset markets first. Indeed, TL has bene one of the few EM currencies which failed to benefit from the recent dollar weakness, while Turkish savers and corporates added ca $4bn in the last two weeks of May, for which data is available.

Eventually, as domestic demand recovers in response to the normaizatino of the economy, excess money supply could also give domestic demand an artificial boost, driving up inflation and current account deficits.

There is another old adage, “Cruising for a bruising”. Will that be the fate of Turkey, which gyrates from one bad addiction to another?

PATurkey Staff