Turkish Treasury announced that as part of the 2021 external borrowing program, Ministry of Treasury and Finance has mandated Citi, J.P. Morgan, and Société Générale for a Dollar denominated dual-tranche bond issuance consisting of the reopening of its bond due October 2028 and a new bond due 2033.

The sale was completed.

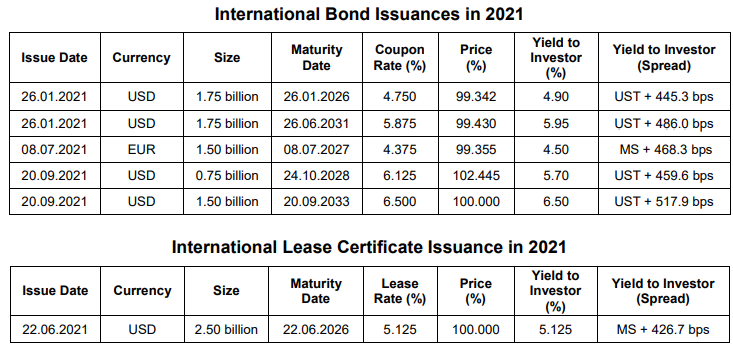

The transaction was finalized with a total issue size of USD 2.25 billion. The proceeds of the issue will be transferred to the Treasury accounts on September 20, 2021.

The October 2028 bond has a coupon rate of 6.125%, a yield to investor of 5.70%, and a tap size of USD 750 million. The September 2033 bond has a coupon rate and a yield to investor of 6.50%, and an issue size of USD 1.5 billion. The offering attracted an orderbook of more than 4 times the actual issue size from over 200 accounts.

37% of the issue has been sold to investors in the UK, 31% in the US, 16% in other European countries, 9% in Turkey, and 7% in other countries.

With this transaction, the amount of funds that have been raised from the international capital markets in 2021 has reached a total of USD 10 billion.