TEPAV (Economic Policy Research Foundation of Turkey) has evaluated that raising the policy interest rate to 40% this year and 45% next year would be necessary to achieve a decrease in inflation.

TEPAV has initiated a new report series that examines Turkey’s economic outlook in the context of policies implemented in the recent period and those announced by the economic management, as well as global developments. The report will be published twice a year.

The report, prepared by Dr. Burcu Aydın Özüdoğru, Director of the Economic and Structural Policies Center at TEPAV, addresses global expectations, recent developments in the Turkish economy, the policy framework, economic growth, labor market, inflation, public finance, external sector, and risks.

Here are the highlights:

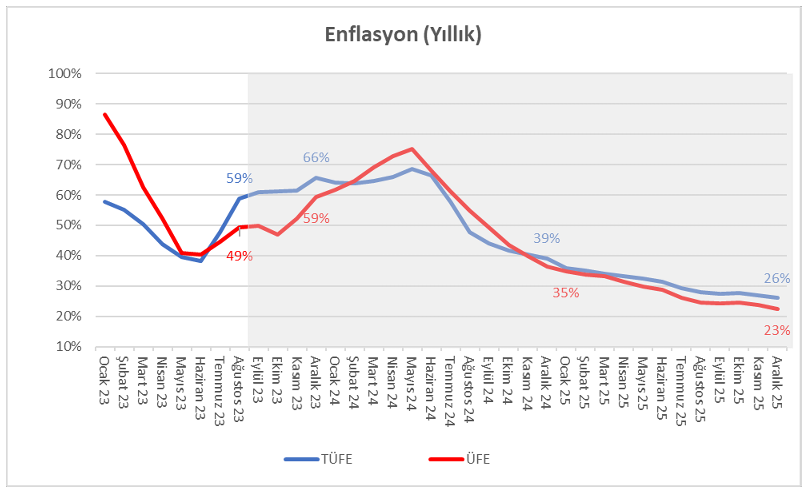

The steps taken in the right direction to ensure macroeconomic stability need to be followed by further actions. Inflation may remain high in the remainder of 2023 and the early months of 2024 due to deterioration in expectations, high exchange rates after the elections, and tax increases. In this context, it is evaluated that the policy interest rate should be raised to 40% this year and 45% next year to achieve a decrease in inflation. Technical model studies indicate that inflation will rise to around 66% at the end of 2023 and then decrease to around 39% at the end of 2024 with a tightening monetary policy, and to around 26% at the end of 2025.

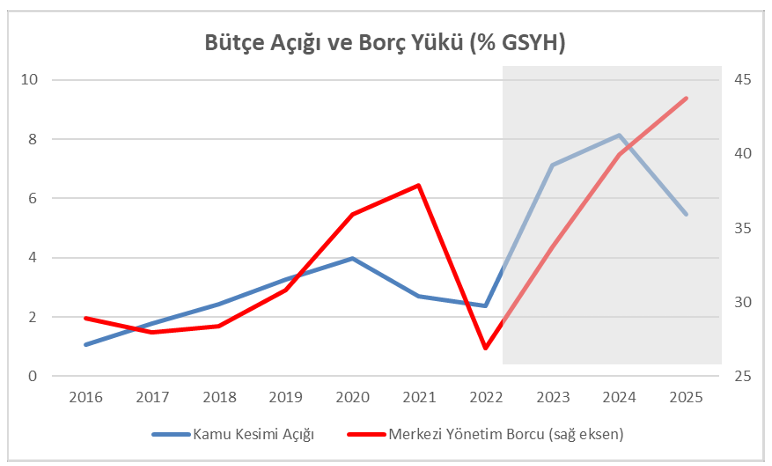

As a result of the slowdown in growth, the budget deficit may exceed current expectations.

According to the report, the budget deficit may result from expenditures, while public revenues may show limited increases depending on economic growth. In this context, it can be expected that the public sector deficit, estimated to be 7.1% of GDP in 2023, may be 8.2% in 2024 and 5.5% in 2025. The ratio of central government debt stock to GDP is projected to be 40% in 2024 and 44% in 2025.

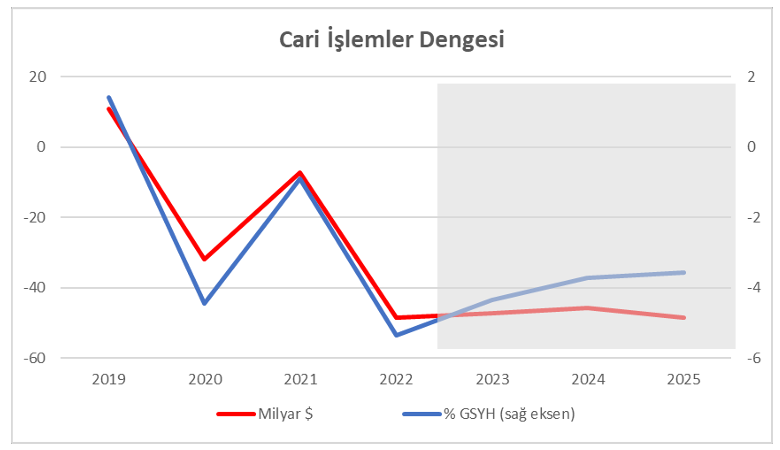

The current account deficit may fall below 4% of GDP in 2024 due to normalization in domestic demand.

TEPAV analysts expect a decrease in the current account deficit with the normalization of domestic demand. Simulations suggest that the current account deficit as a percentage of GDP could be around 4.4% in 2023 and about 3.9% in 2024.

Slower growth due to the restriction of domestic demand may limit employment opportunities in the short term.

Economic growth forecasts are stated as 3.7% for 2023, 2.9% for 2024, and 3.4% for 2025. Since growth will slow down with the control of domestic demand, it is estimated that the increase in employment will be restricted, and as a result, the unemployment rate is expected to be 11.7% in 2024 and 12.8% in 2025.

TEPAV