Prelude

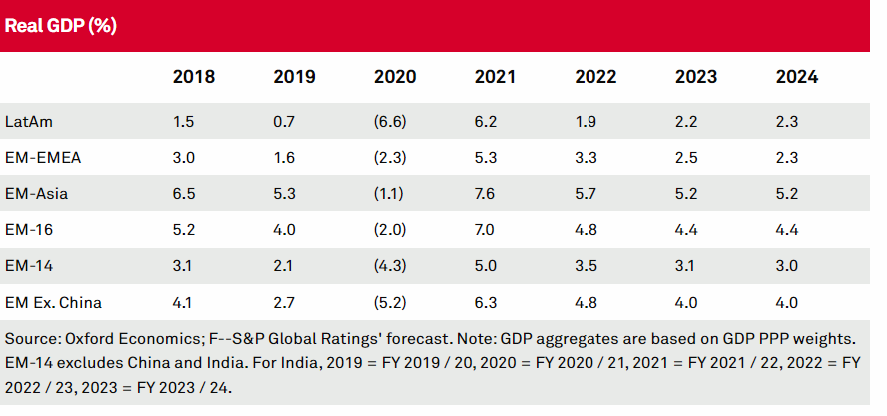

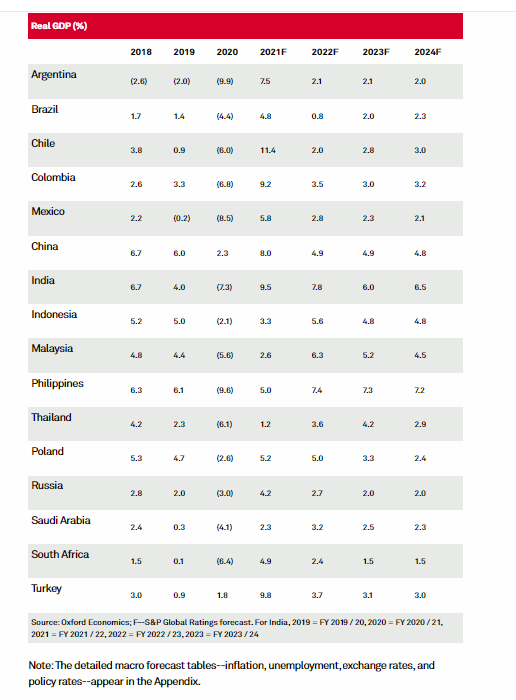

S&P Global Ratings lowered its 2022 real GDP growth forecast for emerging markets (EMs; excluding China and India) by 0.1 percentage point (ppt) to 3.5%, largely reflecting a 0.5 ppt downward revision to Latin America’s growth. Forecasts for 2023 and 2024 remain broadly unchanged, averaging 3.1%.

Most economies in EMs should grow at above-trend rate in 2022, given that recovery from the COVID-related downturn isn’t yet complete, and some sectors continue to operate below capacity.

Risks to our growth outlook are squarely on the downside and include a delayed exit from the pandemic, a deeper slowdown in China, and bumpy transition from recovery-related ultra-accommodative policies to generally tighter steady-state expansion policies.

EM EMEA (Poland, Russia, Saudi Arabia, South Africa, And Turkey)

We forecast GDP growth in key EMEA emerging economies to average 3.2% in 2022, broadly unchanged from our September forecast. We expect a slower growth than the regional average of 5.2% this year, due to a number of factors:

Normalization of growth rates after a strong rebound linked to reopenings of the economies;

Softer global demand for manufactured products and commodities;

A gradual withdrawal of fiscal support; and

Tighter and more volatile external and domestic financing conditions.

Still, most economies in this region should see above-average growth in 2022, given that the recovery from the COVID-related downturn hasn’t run its course, and some sectors continue to operate below capacity.

The pandemic’s recent resurgence in emerging Europe is weighing on near-term growth prospects in the region. South Africa moved to a level 1 lockdown on Oct. 1, 2021–the lowest level of restrictions–but a new COVID-19 variant (Omicron) brings a risk of stricter lockdowns. While we observe a smaller economic damage from new waves, the worsening pandemic situation can still undermine confidence and spending, even in the absence of widespread lockdowns. Insufficient progress in vaccination remains a key risk to the outlook. In some countries in EMEA, vaccination rollout is low or has stalled. While Poland was initially was ahead of other EMs in terms of its vaccination levels, over the past few months progress has slowed. The share of vaccinated population has increased by only by 2 percentage points (ppts) over the past two months, and the total level is relatively modest at 55%–significantly below the 67% level of the EU. In Russia and South Africa, vaccination levels are even lower, but we have seen some progress over the past couple of months.

Among key EMEA emerging economies, we expect the strongest growth in Poland, with growth averaging 5.0% next year, on par with an expected 2021 output of 5.2%. Our 2022 growth forecast is 0.3 ppts lower than our September baseline, mainly because of a somewhat less bullish view on fixed investment growth in the context of the increasing tensions between the Polish government and the EU concerning the Polish judicial system reforms. We expect the Russian economy to grow by 2.7% in 2022, down from a projected 4.2% in 2021, as domestic demand moderates amid policy tightening. Oil exports should rise in line with the OPEC+ agreement, and we also see an upside in gas exports. Meanwhile, geopolitical risks have flared up.

Recovery in Turkey is well ahead of those in other EMs, but risks to macroeconomic stability have risen amid the volatility in financial markets. Our baseline assumes a stabilization in financial markets and a slowdown of GDP growth to 3.7% in 2022 from an expected 9.8% this year. But there’s a very high uncertainty around this scenario, given that sharply different outcomes for the exchange rate, inflation, interest rates, and ultimately growth, are possible next year and in 2023.

WATCH: The Aftermath of Currency Collapse: Sudden Stop Syndrome

Inflationary pressures persist across most key EMEA emerging markets, with recent readings at multi-year highs amid strong demand, ongoing supply disruptions, high food and energy prices, and tight labor markets in Poland and Russia.

Several EMEA central banks have brought forward or accelerated policy tightening. Central banks in Poland and South Africa started normalizing rates this quarter, while Russia’s central bank raised the key rate by 75 basis points (bps) to 7.5% in October, further into restrictive territory. Turkey’s central bank, on the other hand, slashed the policy rate by cumulative 300 bps in October and November, after a 100 bps cut in September. These frontloaded rate cuts, which accelerated after a dismissal of top central bank officials in October, undermined market sentiment and triggered a selloff in Turkey’s currency markets, with the lira dropping 20% versus the U.S. dollar since mid-November.

We believe that many of inflation drivers, such as high energy prices and supply bottlenecks, are temporary, and expect them to subside in the coming months. Our baseline is for annual headline inflation to start declining gradually across EMEA emerging markets, which in many cases is already occurring in the fourth quarter. Nevertheless, inflation is likely to remain elevated throughout the first half of 2022, and above the target in most cases. Heightened uncertainty about domestic and global inflation outlook and the speed of U.S. monetary policy normalization will continue to keep central banks on a tightening bias.

The direction of Turkey’s monetary policy is unclear at this point. The rapid depreciation of the lira will add to already significant inflationary pressures, raise the risks of deposit dollarization, and strain corporate balance sheets. This can lead to an eventual reversal of the easing cycle, and even a sharp hike in the policy rate. At the same time, recent developments suggest a bigger tolerance for lira depreciation and preference for lower rates.

WATCH: Turkey’s Conundrum: How robust growth and poverty go hand in hand?

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng