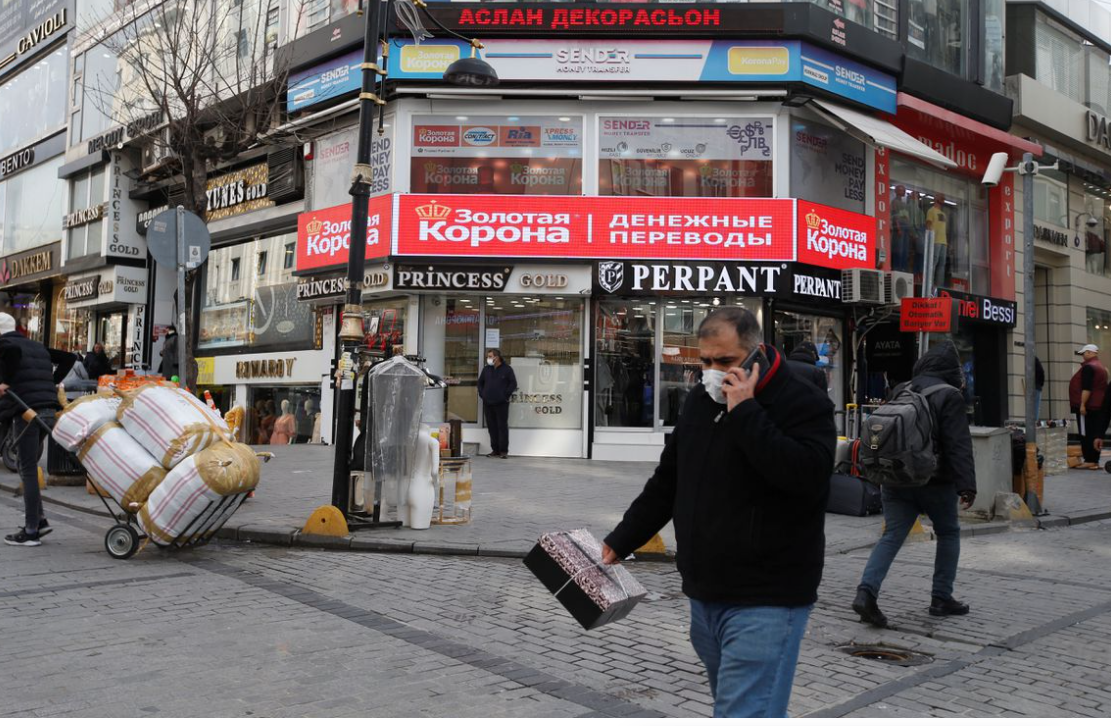

Cover picture: Istanbul’s “luggage trade” center Laleli District

The fallout of the Russia-Ukraine conflict and expected interest rate hikes by the U.S. Federal Reserve in March may put extra pressure on the vulnerable Turkish economy, which is battling high inflation and a weak currency, experts said.

“It seems that the Russian military operation in Ukraine will not be a swift one and will drag on for some time,” Turkish economist Yalcin Karatepe told Xinhua. “This will have consequences for the fragile Turkish economy.”

Reuters just issued a piece to document the fallout from the Ukraine War and sanctions against Russia: “Textile and leather goods’ makers in Istanbul’s garment district are feeling the impact of Russia’s invasion of Ukraine as customers in Moscow and Kyiv have cancelled $200 million in orders in the past week, industry officials say.

The loss of trade adds to strains on Turkey’s economy, with officials estimating that more than $1 billion is directly at risk to the textile industry alone if the conflict in Ukraine continues.

Mustafa Senocak, head of the Istanbul Leather and Leather Products Exporters Association, said orders for “hundreds of thousands of pairs of shoes and thousands of leather jackets” have been cancelled.

“Some Russians say they can pay with the former rouble exchange rate. Otherwise they can’t make payments,” he said.

Russia and Ukraine accounted for more than $1 billion in Turkish exports of leather shoes, jackets and finished and unfinished clothing last year, and nearly three times that much in the unofficial “suitcase trade” centred in Istanbul, officials say.

The hit to trade puts further pressure on Turkey’s economy after a currency crisis in December and resulting inflationary spiral. Falling export income adds to the Turkish current account deficit, which is swelling following Russia’s invasion of Ukraine last week due to soaring energy prices and an expected hit to tourism this year.

Professor Karatepe argued that the West’s financial and economic sanctions imposed on Russia would also imperil the Turkish economy. As energy prices are surging, he stressed that collateral damage is a cause for concern.

Turkey’s Energy Shortage Reaches Critical Point

Given that almost all the country’s energy use relies on imports, Turkey’s finances will be hit hard at a time when inflation is already high, Karatepe said.

It’s not just about energy. According to Hurriyet Daily News, Turkey has close trade ties with both Russia and Ukraine in construction, tourism, wheat imports, and fresh fruit and vegetable exports.

“Imports from Russia were 29 billion U.S. dollars in 2021, up from 18 billion dollars a year earlier,” said the Turkish media outlet.

As noted by the Ahval news website in a recent report, Ankara expected tourism revenues this year to equal or exceed the record 35 billion dollars earned in 2019, helping to support the lira and finance the country’s current account deficit, which is driven by the cost of imported energy and other goods.

But that prediction now looks unrealistic, seeing as Russian and Ukrainian tourists totaled more than a quarter of all visitors in 2021, the report said, adding that Turkey’s proximity to the conflict in Ukraine may also deter European and other Western tourists.

Fed threat on foreign borrowing

Another challenge for the ailing Turkish economy comes from the United States. Following a January increase of 7.5 percent in year-on-year consumer prices, the Federal Reserve is expected to raise interest rates in its March meeting in a bid to tame inflation.

Fed Interest Rate Hikes Will Hurt Turkish Economy (And Other Emerging Markets) Badly

The move raises the specter of foreign funds flowing to the United States. For emerging economies, particularly for Turkey, expected rate hikes are bad news and could trigger a further devaluation of the lira.

To prop up the lira and curb dollarization, local authorities introduced a series of measures in December, including a state guarantee to compensate lira depositors for any declines the currency may suffer.

A rise in the dollar may put pressure on already low public finances, specialists warned.

Enver Erkan, chief economist at Istanbul’s Tera Securities, pinpointed some possible outcomes of the Turkish economy if the Ukrainian crisis endures.

If the military conflict becomes permanent, “it includes the possibility of deterioration of Turkey’s macroeconomic balances through foreign trade, current account balance, exchange rate and inflation,” he said in a note to investors.

“While Turkey has a trade volume of 22.9 billion dollars with Russia and 5 billion dollars with Ukraine, Russia supplies 39.4 percent of Turkey’s total refined oil and 56.2 percent of total crude oil,” the analyst said.

He further emphasized that the negative impact of tourism revenues may further strain Turkey’s foreign exchange needs. With rising geopolitical risks, the expected money inflow from the tourism sector may fall below expectations, and the negative pressure on the lira may increase in the short term, Erkan added.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng