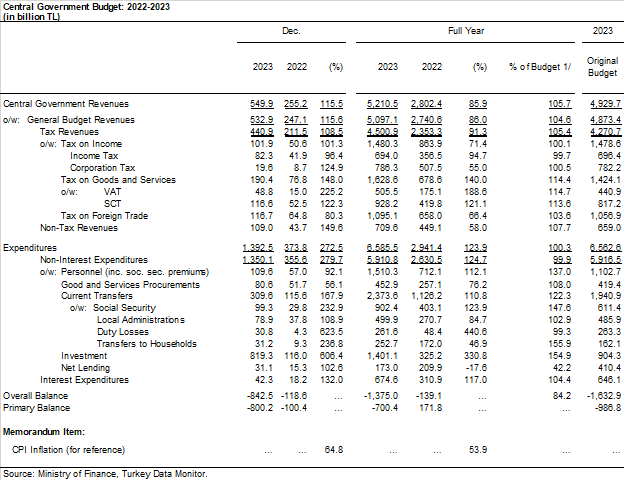

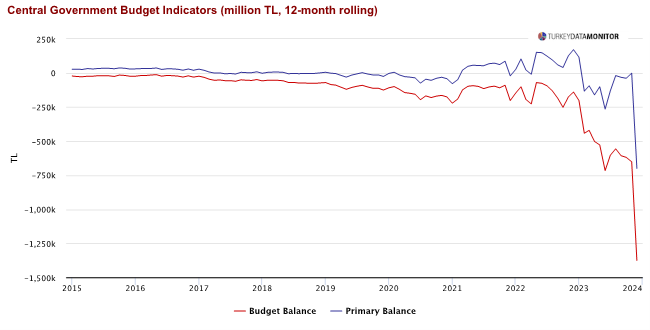

The central government budget balance, which posted a deficit of 75.6 billion liras in November, posted a record deficit of 842.5 billion liras in December. Hence the total budget deficit posted a spike to 1.37 trillion TL in 2023 in the year of the earthquake, widening 864% yoy from 139.1 billion recorded for the whole of 2022.

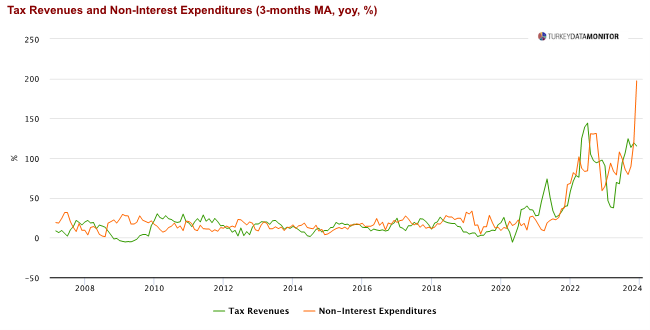

The record deficit was driven by budget expenditures reaching 1.39 trillion liras in December up by 272 percent. In the same month, budget revenues amounted to 550 billion liras up by 115,5 percent.

In January-December period, budget expenditures amounted to 6.59 trillion liras and budget revenues to 5.21 trillion liras. The growth in expenditures was 124 percent while the rise in revenues was limited to 85,9 percent.

In the Medium-Term Program, the central government budget balance was projected to run a deficit of 1 trillion 633 billion TRY in 2023. In the MTP, the budget deficit was projected to realize as 6.4 percent of GDP in 2023.

The announced January-December 2023 deficit accounts to 5.4 percent of GDP and falls short of the 6.4 percent expectation. Finance Minister in fact notes that eliminating the expenses related to reconstruction of the quake hit region, the budget deficit to GDP ratio is as low as 1.7 percent.

Turkey’s budget deficit ot GDP ratio was high as 5.4 percent was last seen back in 2003.

While the central government budget balance posted a deficit of 142.7 billion TRY in 2022, the ratio of budget deficit to GDP was recorded as 1 percent.

Large transfer payments the reason for the strong spike in deficit: AFAD and Currency protected deposit scheme

In the record deficit in the December budget, the transfer of 632 billion TL under the heading ‘Capital Transfers to Other Institutions, Enterprises and Households Not Classified by Classification’ drew attention.

Economist Uğur Gürses also underlines the same. With the December budget deficit of 842 billion TL, the whole year deficit soared to 1.374 billion TRY. He informs based on his Ankara contacts that of the 842 billion TL in December, 622 billion TL came from capital transfers, and much of it was carried out to AFAD (Disaster and Emergency Directorate).

He also notes that without this 622 billion TL transfer due to the earthquake, the year would have ended with a budget deficit of around 750 billion TL which is again 5 times higher than the 2022 budget deficit of 139 billion TL.

Recently, Central Bank of the Republic of Turkey’s 2023 balance sheet was under discussion. The bank’s valuation account for 2023 showed a negative balance of 800 billion TL as the bank’s payments for currency-protected deposit scheme (transferred from Treasury to the CBRT) was an important factor in this loss. The figure is not made public yet.

Implications of inflation

Turkey aims to slash the 2023YE CPI inflation of 65 percent to 36 percent by 2024YE. The CBRT expects the yoy CPI inflation first to peak at 70% in May 2024 and then start rolling down fuelled by rate hikes and strong base year effect. The market currently expects 2024YE inflation at around 42-45%. The central bank is expected to deliver a final round of rate hike to bring the policy rate to 45 percent at its January meeting due later in the month, on the 25th.

Hence with a rather ambitious target of lower inflation, the tighter monetary policy necessitates a tighter fiscal policy as well. As domestic demand will tur weaker down the year following the rate hikes, the state spending will remain escalated. Whether due to earthquake or not, such level of public spending will necessitate extra monetary measures and spending cuts to compensate for the inevitable reconstruction efforts.

Now that the 2024 adjustments of public prices to past inflation and wage hikes piled up in January, the monthly CPI inflation is not expected any lower than 5-6 percent. the stimulus to prices from state spending will add inertia to an already very high inflation.

GA.