Inflation was 75.5 per cent in May, when almost everyone expected the highest annual consumer inflation of 2024. TURKSTAT stated that monthly inflation was 3.37 per cent. We expect inflation to fall rapidly from now on. Especially from July onwards.

There are three main reasons behind this expectation.

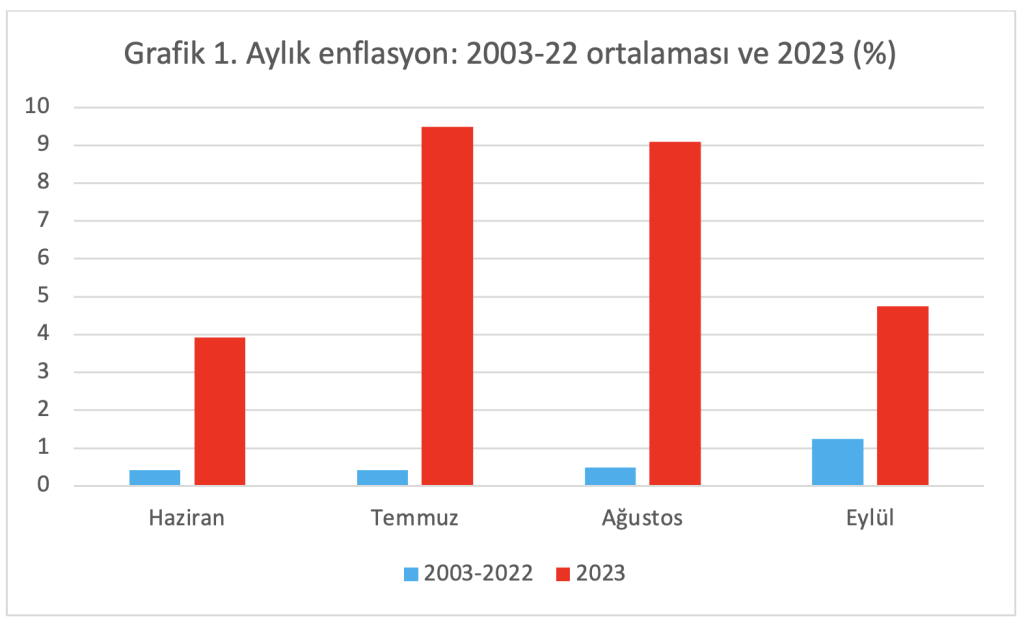

The first is a technical reason known as the ‘base effect’: In June-September 2023, monthly inflation was very high compared to the average monthly inflation in the same months of the 2003-2022 period. Chart 1 immediately shows that the differences between them are quite striking. For example, while the 2003-2022 average for July was 0.4 percent, it was 9.5 percent in 2023. For August, the 2003-2022 average was 0.5 percent. In contrast, the monthly price increase in August 2023 was 9.5 percent. These high monthly inflation rates of 2023 will be replaced by monthly inflation rates close to seasonal norms; annual inflation will fall.

The second main reason why inflation will fall rapidly from now on is exchange rate developments. For a long time, the increase in the exchange rate has been below inflation. Moreover, the exchange rate has not increased for two months.

Interest attractive for foreigners

So, is this development artificial? For three reasons, no it is not.

First, the policy rate has risen to a very attractive level for foreigners; there is capital inflow from abroad, albeit hot. The supply of foreign currency is increasing.

Second, the interest rate on lira-denominated deposits is now above expected inflation over the term of the deposit, encouraging residents to return to lira. Demand for foreign exchange is relatively lower, while the supply of foreign exchange is rising.

Third, the Central Bank has repeatedly stated that the lira will appreciate in real terms for some time. This both encourages foreign inflows and residents to hold lira-denominated financial assets.

Is the course of the exchange rate sustainable?

So, is this course in the exchange rate sustainable?

There is no doubt that exporters in particular suffer from the real appreciation of the lira (exchange rate appreciation below inflation). But we are here as a result of the absurd monetary policy between September 2021 and May 2023, which caused inflation to explode and disrupted many balances. It is not possible to go anywhere with such high inflation.

If one does not complain about that monetary policy and the subsequent policy of loan rates far, far below inflation, one has no right to complain about the real appreciation of the lira, which is a sine qua non condition for bringing down inflation. Moreover, it is not possible to achieve everything at the same time.

After all, you have to give from one side and take from the other; optimization is required. A little patience is needed here. If those who complain show patience, those who allow the current policy to be implemented do not revoke their permission, and the budget deficit can be brought under control, there is little reason for the exchange rate to reverse course – unless there is a dramatic change in external conditions.

Impact not yet activated

In terms of external conditions, crude oil prices and interest rate decisions of major central banks are important. Crude oil prices are hovering close to the 2023 average level; there are no negative developments. The European Central Bank will start cutting interest rates soon. The Fed’s interest rate cuts are also imminent. These are also positive developments for us.

The third main reason for disinflation is the very high lending rates and Turkish lira deposit rates, which are now at a reasonable level. These are expected to reduce demand. But this effect has not yet kicked in. First quarter growth was quite high: 5.7 percent year-on-year and 2.7 percent quarter-on-quarter. Moreover, the increase in private consumption expenditures is also high.

Our position in the inflation league

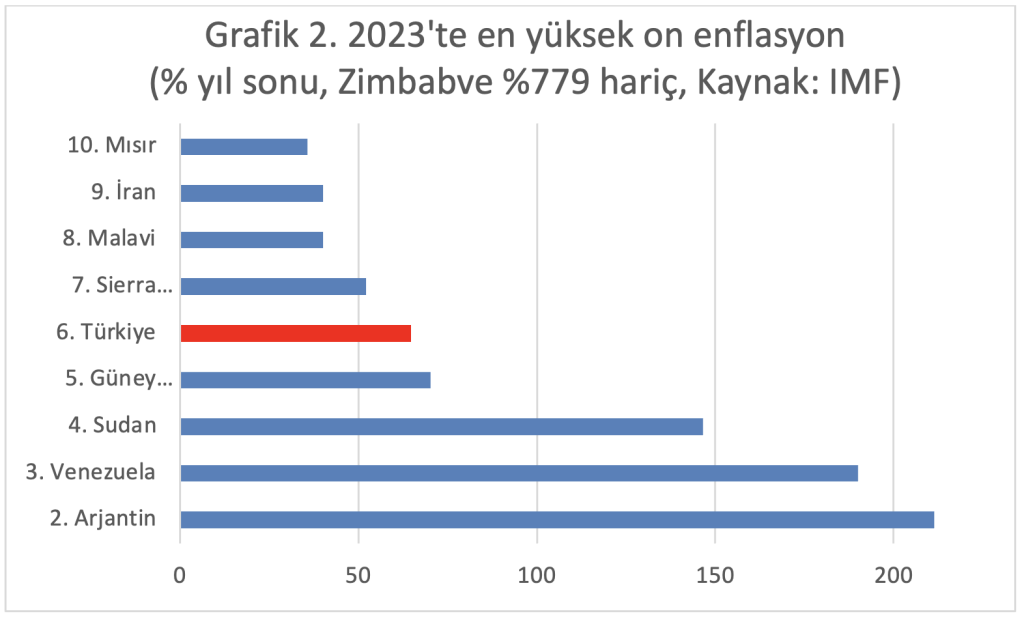

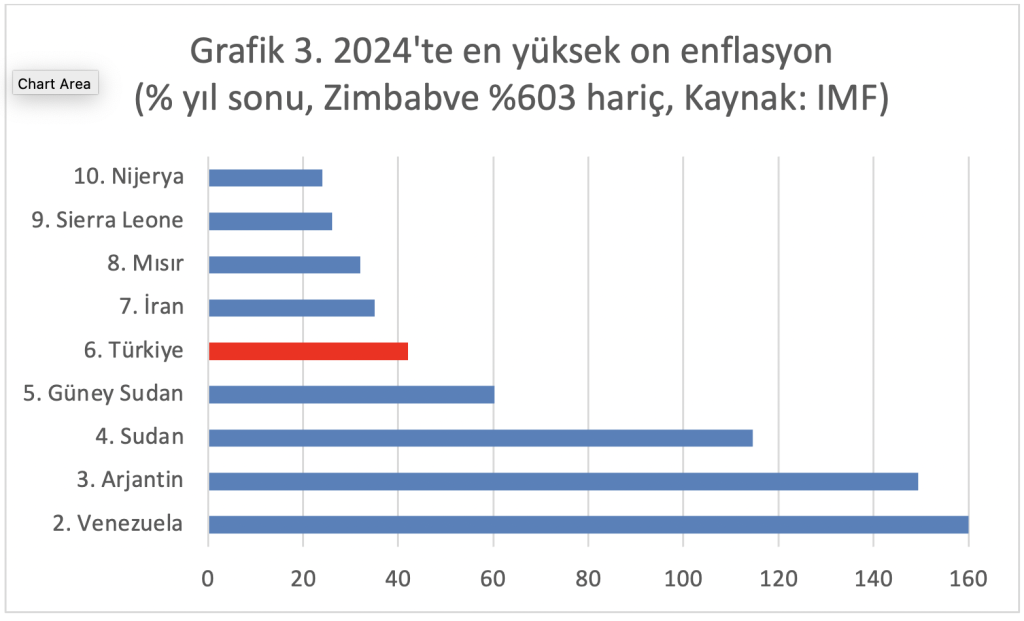

When all this is added up, even if the Central Bank’s revised target (38 percent) is not reached, there is a possibility that inflation will remain slightly above 40 percent at the end of 2024. So, if inflation falls to 42 percent, will we be happy? The shortcut to an objective answer to this question is to look at our position in the inflation league among countries. The second graph shows the ten countries with the highest inflation rates at the end of 2023. The third graph shows the highest inflation forecasts for 2024.

Zimbabwe ranked first in both years: 779 and 603 percent. I show the remaining nine highest inflation rates so as not to ‘spoil’ the graph. Turkey is sixth in both years. In other words, even if we bring inflation down to 42 percent by the end of 2024, we will still be the sixth country with the highest inflation in the world. Moreover, if the 2024 projections are realized, the ninth and tenth-ranked inflation rates are below 30 percent: Sierra Leone and Nigeria. Another striking value: The end-2025 inflation target is 14 percent. Suriname, which has 14 percent inflation in 2024, ranks nineteenth in the league. If your inflation is 14 percent, 171 out of 190 countries will have lower inflation than you. Is that good?

No wage increase in July

This is serious. It’s no joke.This is no joke, as the minimum wage was already below the hunger threshold in April. If there is no increase in the minimum wage in July and food inflation is in line with the Central Bank’s forecast, the unpleasant relationship between the minimum wage and the hunger threshold announced by Türk-İş will be as shown in Graph 4.

I guess I don’t need to say much.