CPI inflation at 79.6%…

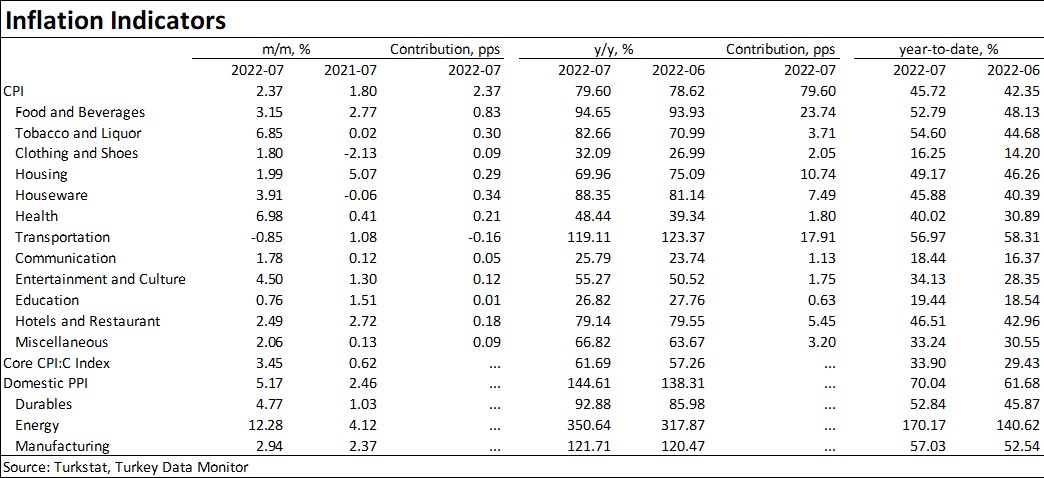

CPI inflation in July came in at 2.37%, well below the market expectation of around 3.0% and our expectation of 3.3%. Accordingly, y/y inflation rose from 78.6% to 79.6%. The transportation item, which decreased by 0.85% on a monthly basis, seems to have been influential in the lower-than-expected inflation. Core inflation, which excludes food and energy, beverages, tobacco and gold, continued to rise in July. According to the B and C indices, core inflation rose from 64.4% to 68.46% and from 57.26% to 61.69%, respectively. Following 8.1% rise in the basket exchange rate in June, 1.1% additional depreciation in July will lead the exchange rate pass-through to continue in the coming months. We expect CPI inflation to end the year at 68.2% at the end of the year, with the peak in consumer inflation to be seen in September-October, as the minimum wage hike announced in July and the interim hikes made by private sector companies are likely to feed the demand pull inflation.

The highest contribution is from food…

Food and beverage inflation in July contributed 0.83 pps to the headline inflation with 3.15% monthly inflation. On an annual basis, food inflation continued to increase and reached 94.65%, up from 93.9% in the previous month. Houseware, an item significantly affected by exchange rate movements, made the second highest contribution with 0.34 pps. On the other hand, transportation item dragged inflation down by 0.16 pps, while the contribution of hotels and restaurants to July inflation, which is one of the highest contributing items that in the past months, was 0.18 pps.

Erdogan’s Lethal Economic Legacy

Services inflation continues to rise…

Services prices increased by 3.2% in June, causing annual inflation to rise from 48.7% to 51.4%. While rent inflation rose from 22.8% to 26.8%, transportation services inflation, one of the main items pushing up the prices of services, rose from 81.8% to 90.7%. The restaurant and hotel services inflation, which remained high due to the lively tourism season, showed a slackening for the first time since September 2020, and annual inflation decreased slightly from 79.55% to 79.14%. High input costs, exchange rate pass-through and deterioration in pricing behavior continue to push up services prices, especially through the secondary effects of food and energy price increases. Since we do not expect these factors to disappear in the short term, we think that higher levels of services inflation may be seen.

A new record in PPI inflation…

PPI inflation, the most important indicator of cost push inflation, has led annual inflation to rise from 138.3% to 144.6% on a monthly basis of 5.2%. Energy inflation broke a new record, rising from 317.8% to 350.6% compared to the same period last year, while manufacturing industry inflation rose from 120.5% to 121.7%. The highest contributions to monthly inflation came from energy and food again. Electricity and gas production and distribution contributed 2.46 pps to monthly inflation, while food production prices contributed 0.95 pps. Despite the ease in commodity prices, we expect the increases in PPI inflation will continue, albeit at a slower pace, as no broad based deceleration is seen in energy and raw material prices especially considering the rise in natural gas costs.

Özlem Derici Şengül

Spinn Consulting Founding Partner

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/