“The decrease in income and interest rates does not affect every sector equally and symmetrically in the country; in fact, some sectors may increase their profitability.”

With the recent crisis, the interest of the public in the stock market has increased. Last year around this time, the number of investors in the stock market was 2,633,000, but as of September 15, 2023, this number has reached 7,318,000, which means the number of people investing in the stock market has roughly tripled in the past year. This rate of increase is unparalleled in the world, and it is important to examine the reasons for this growing interest in the stock market in order to make investments more informed.

The fundamental motivation behind any investment decision is to make a profit from the investment. Capital owners want to invest their savings in certain investment instruments with the aim of gaining more than the amount they invested in the future. If savings are not directed into investments, they lose value against inflation and purchasing power decreases. Therefore, one purpose of investments is to protect against inflation.

Investments can generally be categorized into two groups: real (direct) investments and financial (portfolio) investments. When individuals make a decision to invest, they want to invest in instruments that will yield the highest return with their existing savings. Since real investments require high capital, small investors generally turn to portfolio investments such as stocks, bonds, and foreign currency deposits. The crisis environment of recent times has brought about the significant interest in stock investments that we mentioned earlier, unlike in the past.

The most important difference between the current period and previous crisis periods is that the Central Bank, by keeping foreign exchange and interest rates under pressure, has adopted a policy that reduces the returns on bonds and foreign currency savings. This has reduced the interest in securities dependent on interest rates and the dollar. The most significant investment instrument left has become the stock market, and the demand for the stock market has strengthened as a result of the policy preferences of the Central Bank.

However, no matter how encouraging government policies are, such a large-scale investor interest cannot be explained by them alone. The primary factor attracting investors to the stock market is the increase in company profits in recent times. In inflationary periods, companies can generally increase prices more freely, so there is usually an increase in the income and profits of companies, which in turn raises stock prices. Therefore, it becomes possible, especially for small investors, to “make money from the stock market.”

The inflationary process in our country and the economic decisions to be taken to combat this inflation will directly affect the course the stock market will take. If the negative real interest rates, which are the most important reason for the increase in company profits, are abandoned, a slowdown in the rate of increase in profits may be expected. In addition, an increase in the exchange rate in the country will not only increase the costs of companies but also reduce the real income of the public. The decrease in income and interest rates does not affect every sector equally and symmetrically in the country; in fact, some sectors may increase their profitability.

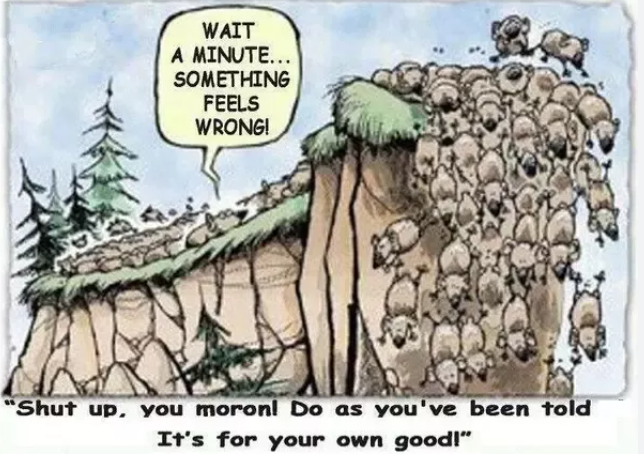

In order to protect the value of their savings, citizens need to be conscious in their investments in the stock market. Every step taken without knowledge carries great risks. Instead of investing based on herd psychology, reading and researching will increase our chances of success.

Reprinted with permission from the author’s blog

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel