- The macro projections in the medium-term economic programme for 2024-2026 look realistic, and suggest accommodative fiscal policy due to the earthquake related spending in 4Q23 and 2024.

- We see upside risks to our 2023 year-end policy rate forecast of 35% and our 2024 year-end policy rate forecast of 45%, as accommodative fiscal policy may require tighter monetary policy to tame inflation.

- We now expect rate hikes to be front-loaded: 500bp hike in September and 500bp in October MPC instead of 250bp previously, considering expected fiscal loosening and upside inflation surprises.

- With fiscal accommodation from 4Q23 due to come amid still elevated inflation and uncertain outlook, we think markets should price greater odds of larger and faster CBRT hikes into year-end. Markets are now pricing 31% probality to another rate hike in Oct-23 meeting.

Medium-term economic programme (MTP) signals macro rebalancing next year

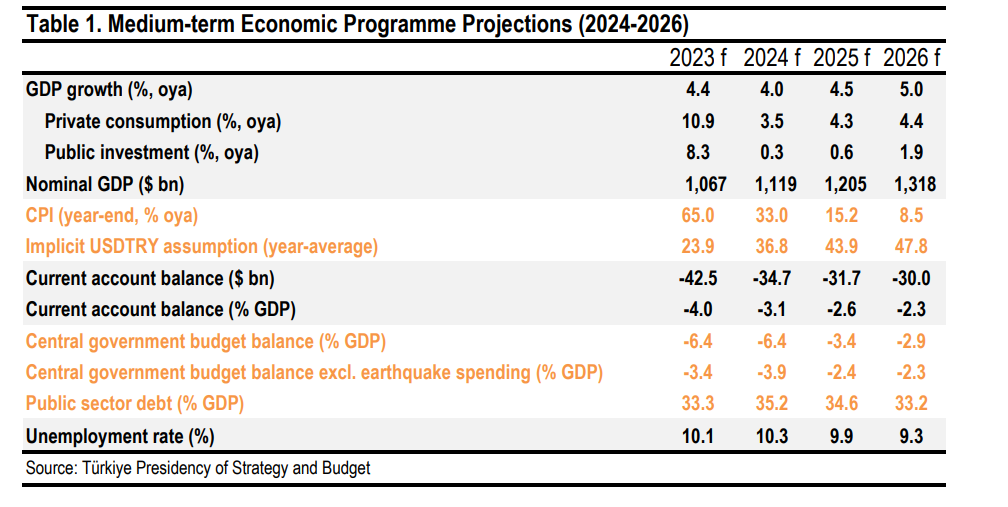

Vice President Cevdet Yilmaz unveiled the medium-term economic programme together with President Erdoğan. The GDP growth target is revised down to 4.4% oya in 2023, 4.0% in 2024 and 4.5% in 2025. Private consumption is set to fall sharply to 3.5% oya in 2024 from 10.9% in 2023, and remain subdued at 4.3% in 2025 and 4.4% in 2026. Public investment growth is set to drop from 8.3% oya in 2023 to 0.3% in 2024 and 0.6% in 2024. Current account deficit is forecast to shrink from 4% in 2023 to 3.1% in 2024 and 2.6% in 2025.

President Erdoğan said that tight monetary policy was needed to bring down inflation

Headline CPI inflation is set to drop to 33% in 2024 and 15.2% in 2025, down from 65% in 2023 in MTP. It seems the CBRT`s inflation forecast of 33% for 2024 year-end is not only a forecast, but also a target. The implicit average USDTRY assumptions calculated from the GDP projections are 23.9 in 2023, 36.8 in 2024, and 43.9 in 2025.

We find inflation targets in 2024 and 2025 ambitious given the GDP growth targets and implicit USDTRY assumptions. That said, President Erdogan supported tight monetary policy in his speech to bring down inflation, which gives more leeway to the CBRT.

Fiscal stimulus requires tighter monetary policy, in our view

Central government budget deficit is set to deteriorate to 6.4% of GDP in 2023 and 2024 due to the earthquake related spending, from 0.9% of GDP in 2022. The earthquake-related government spending is expected to be 3% of GDP in 2023 and 2.5% of GDP in 2024. We believe that accommodative fiscal policy (even excluding earthquake-related spending) ahead of the March 2024 municipal elections requires tighter monetary policy to address the expected deterioration in the inflation and current account outlook over 4Q23-1Q24.

That`s why we expect front-loaded rate hikes in September and October with 500bp hike in each meeting now instead of 250bp hike in each MPC meeting for rest of 2023.

We see upside risks to our 2023 and 2024 year-end policy rate forecast (35% and 45%, respectively) as the CBRT is more sensitive to the inflation outlook.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: https://www.facebook.com/realturkeychannel