As monetary policy remains excessively loose and as there is no change in the exogenous factors causing inflation, price pressures continue to strengthen. April CPI data provided fresh evidence on this sharp strengthening in price pressures that follow unorthodox policies, lira weakness, credibility collapse and a few exogenous factors like the rise in global energy prices.

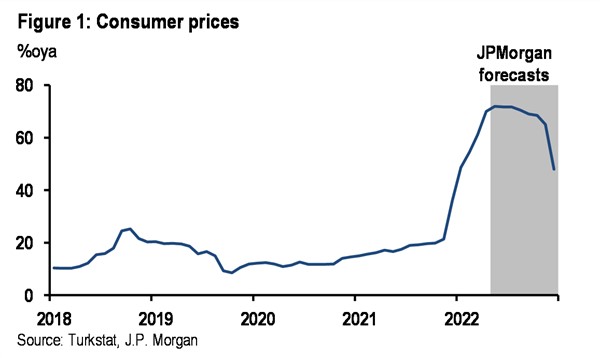

Consumer prices jumped 7.25%m/m (market consensus 5.7%, J.P.Morgan 5.5%), pushing annual inflation up to 70.0% in April. The 13.4% jump in food prices was the main factor behind the upside surprise. This could at least partly be explained by Ramadan but was definitely higher than the usual cyclical rise. Interestingly, core CPI was up by a lower-than-expected 4.5% (consensus 4.9%, J.P.Morgan 4.7%). Although part of the food-related increases will likely get reversed after Ramadan, another high monthly print will likely lead to further worsening in inflation expectations.

Three Scourges of Turkish Economy: Unemployment, Inflation, and External Deficit | Real Turkey

As has been the case in previous months, we expect no policy response. Policy makers believe that time by itself will heal the inflation problem. We see inflation remaining elevated at least until the very end of the year.

We revise up our end-2022 CPI forecast to 49.5% from 43.5% and our end-2023 CPI forecast to 19.0% from 15.0%, with risks still skewed for higher figures.

As inflation continues to rise, the real policy rate offered by the CBRT gets more deeply negative. Currently, the policy rate stands at 14% and a level difficult to explain in a country where inflation is 70%. The CBRT is in no rush to normalize its policy stance while demand remain robust, cost-led inflationary pressures are strong and credibility weakening continues.

In this environment, lira stability – that has at least partly been secured by the FX-protected lira deposit scheme and will likely be supported by strong tourism revenues – will be the main tool to restrain inflationary pressures. We see inflation peaking at 72% in May and staying in the 65-75% range until December, when, due to a very strong base, it could fall to 49.5%. It goes without saying that any lira weakening could furnish a much worse inflation outlook.

The CBRT does not look like it will respond to this surge in inflation. We expect this to continue and we see no policy rate hike at least until the end of this year. The CBRT seems to be putting all its emphasis on lira stability that could follow increased demand (local and foreign) for the FX-protected TRY deposit scheme. Setting aside the associated costs (such as increased FX exposure of the public sector), this scheme alone is unlikely to solve such a complex and difficult inflation problem. This suggests that, until orthodox policies are introduced, inflation will likely remain much above global standards and the lira will remain vulnerable to shifts in local and global risk appetite.

By Yarkin Cebeci, excerpt

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng