A progressive structural reform program, a prudent monetary policy framework and an ambitious fiscal consolidation were the driving forces behind Turkey’s rapid economic progress that eventually carried the country to investment grade around 15 years ago. In time, structural reforms stalled and the monetary policy lost focus. Encouragingly, there is still a policy anchor left: fiscal discipline.

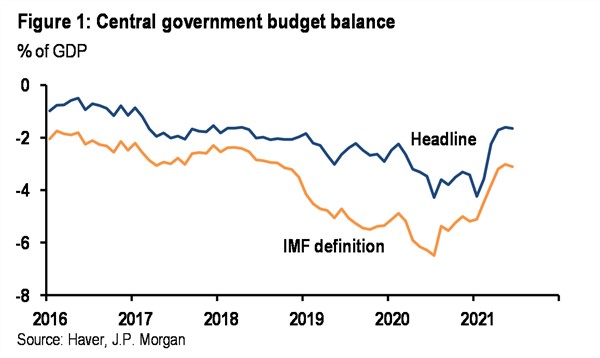

Turkey’s policymakers may have unorthodox views on monetary policy, but they seem to have internalized the need for fiscal discipline. Such commitment to fiscal prudence was clearly seen during the pandemic. The central government budget deficit widened only very modestly to 3.4% of GDP in 2020 from 2.9% in 2019. More importantly, following the rapid recovery in economic activity, the fiscal outlook improved rapidly in the first half of 2021 with the 12-month trailing budget deficit contracting to 1.6% of GDP at the end of June. The trend in the IMF-defined deficit (which excludes one-off payments like transfers from the CBRT) presents a similar picture (Cover chart).

We expect that, in an effort to support growth, the government will ease fiscal policy somewhat in 2H, but still we expect the yearly budget deficit to be 2.7%, significantly below the government’s revised target of 3.5%.

Although the central government budget is the fiscal indicator the markets follow and our data for it are more up to date, the overall government budget data paint a similar story. Turkey’s total public sector deficit actually shrank to 5.4% of GDP in 2020 from 5.6% in 2019 and the 1Q data show further compression in the deficit. Turkey stands out as the country with the most prudent fiscal performance among its peers, in this regard.

WATCH: Turkish Economy IS in Crisis | Real Turkey

Fiscal prudence comes with benefits

Strong fiscal performance comes with three major benefits. First of all, it reduces the Treasury’s borrowing requirement and hence limits the fiscal cost of the recent rise in interest rates. On top of the rate hikes the CBRT delivered at home and the tightening in global financial conditions, the Treasury’s average cost of borrowing rose sharply to 17% from 9% over the last 12 months. Furthermore, the Treasury decided not to borrow long term to avoid locking itself into high interest rates last year, resulting in a heavy redemption schedule in the first months of this year. This practice was abandoned after the current finance minister Elvan took office in November. Hence, the redemption schedule looks lighter in 2H and when it was heavy in 1H, fiscal discipline reduced the pressure on the Treasury and kept borrowing costs under control.

Second, such fiscal discipline provides significant help to the CBRT in demand management. The importance of this cannot be understated given some of the government’s growth-oriented policies (such as the huge credit impulse engineered in 1H20), question marks over central bank independence, and concerns about the adequacy of monetary policy. Finally, strength in fiscal policy provides relief for investors who remain concerned about policy credibility in Turkey. After the sharp outflow in March, there have been gradual but persistent inflows to the Turkish financial markets in recent weeks and we believe the strong fiscal performance has been a factor behind this.

WATCH: A Uniquely Turkish Disease: High Chronic Inflation

Strong tax collection; spending discipline

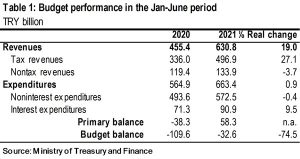

A jump in tax revenues and ongoing spending discipline have been the factors behind the strong fiscal performance in the first half of this year (Table below). Adjusted for inflation, tax revenues rose 27%oya in 1H. Part of this was due to a very weak base. Tax deferrals to businesses along with serious lockdowns in the first wave of the pandemic led to a sharp decline in tax revenues in 1H20. Although more than two-thirds of the deferred tax was collected in 4Q20 and hence the impact on the annual budget deficit was limited, tax revenues were quite weak in 1H last year. Also contributing has been the sharp recovery in demand, the impact of which was visible in the 27%oya increase in VAT and SCT collection. Due to higher global prices and a sharply weaker lira, the sharpest increase was in import tax collection. Interestingly, the strong fiscal performance was secured despite the contraction in one-off revenues such as CBRT transfers. Importantly, the government refrained from spending the extra tax revenues collected and in inflation-adjusted terms there was a small contraction in noninterest expenditures. True, this was partly because some pandemic-related spending was financed by drawing on the assets of the Unemployment Insurance Fund, limiting the impact of the fiscal response on the central government budget balance. Still, spending discipline has been notable.

The strength in fiscal performance has also reflected the way the government responded to the pandemic. The policy response relied initially on rapid monetary and credit expansion, and on extensive liquidity support while direct fiscal support was modest. According to the IMF, spending on healthcare and on direct support to households, firms, and employees has amounted to about 2% of GDP, among the lowest in emerging markets. In turn, the CBRT provided support in the form of rate cuts (cutting policy rate to 8.25% from 14.00% in six months) and quantitative easing. Rapid and cheap lending by state banks and some regulatory changes introduced to penalize banks with slower loan growth led to a substantial credit impulse.

This could produce some fiscal costs, especially in the form of capital injections to public banks, but the immediate fiscal cost was very limited.

Improvement in debt dynamics

The improvement in public finances was not limited to the strong budget performance. The Treasury recently has significantly changed its domestic borrowing strategy and these changes have prevented a meaningful worsening in public debt dynamics. To bring down TRY interest rates and to slow the depletion of the CBRT’s FX reserves, the Treasury borrowed in FX in significant amounts in 2019 and 2020. In fact, 41% of net domestic borrowing was FX-linked in 2019 and this increased to 58% in 2020%. This action increased the sensitivity of debt dynamics to currency moves. There was a sharp change in the Treasury’s borrowing strategy after Lutfu Elvan took over as the Treasury and finance minister in November 2020. The Treasury was a net payer of FX-linked domestic debt so far this year and the policy guidance provided suggests that this practice will continue.

A similar trend was observed in the maturity of new domestic borrowing in recent years. Expecting a swift fall in interest rates and in an effort to avoid locking itself to high interest rates, the Treasury did not carry out any long-term (5-10 years) domestic borrowing. As a result, the duration of domestic borrowing plunged to below 30 months in the 2019-2020 period from around 70 months in previous years. Under Elvan, the Treasury started paying more attention to market dynamics and normalized the domestic borrowing strategy, and the duration in domestic borrowing recovered to 60 months.

Favorable public debt dynamics have been one of the main strengths of the Turkish economy. Mainly on the back of continued fiscal discipline, Turkey’s gross public sector debt fell from 80% at the beginning of the millennium to 46% in 2010 and further to 30% in 2019. Increased fiscal spending during the pandemic and increased reliance on FX-linked and short-term borrowing led to an increase to 42% in 3Q20. But with the fiscal slippage getting reversed swiftly and with much more efficient domestic borrowing strategies, indebtedness started decreasing and this is likely to get more pronounced in the coming months. We note that despite the weaker lira, Turkey posted the mildest worsening in debt dynamics among its peers during the pandemic and its public debt is among the lowest.

All in all, with question marks over the efficacy of monetary policy and the government’s commitment to structural reform, continued adherence to fiscal discipline comes as a source of relief for investors. Such discipline also helps the CBRT in demand management. The narrowing of the budget deficit has been very fast in recent months. We believe some of this will get reversed as spending is eased to help growth dynamics. But still, we think the budget deficit will likely stay around 2.7% of GDP, a figure much lower than the latest government target of 3.5%.

By Yarkin Cebeci, excerpt

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/