In line with the Bloomberg consensus, we expect the CBRT to keep its key policy rate (1-week repo rate) unchanged at 8.25% on Thursday. More important will be the language used in the interest rate announcement note. The CBRT has recently started referring to normalization of policies and the risks to financial stability. A more explicit reference to the need for prudent policies – though unlikely at this stage – could help to restore some policy credibility.

After nine consecutive cuts, the CBRT had already halted and adopted more cautious rhetoric last month. The last 30 days saw new evidence on the recovery in consumer and business sentiment and more importantly a significant upside surprise in inflation. Furthermore, presumably due to stronger-than-expected price increases, inflation expectations soured further in July. The market consensus (CBRT Monthly Expectations Survey) on 12-month-ahead annual inflation rose to 9.3% from 9.0% while the consensus on end-year inflation rose to 10.2%, significantly higher than the official CBRT forecast at 7.4%. The credibility gap looks really large.

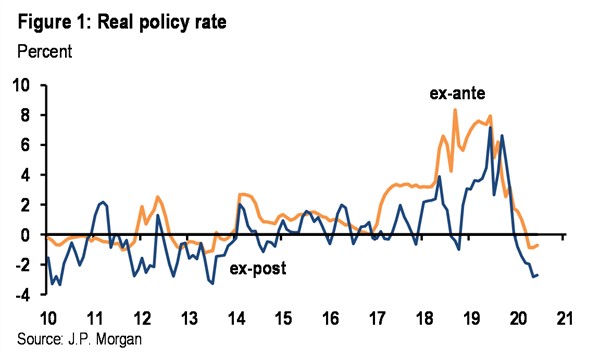

Real interest rate is deeply negative

A final and arguably more persuasive reason for a more cautious policy stance is the fact that the real interest rate offered by the CBRT are negative in both ex-post and ex-ante terms and could potentially get more negative with the worsening in inflation dynamics. This hurts policy credibility and aggravates the pressure on the lira. For all these reasons, we expect the CBRT to keep rates unchanged and sound more cautious than before.

The CBRT has recently taken a couple of – rather timid – steps towards policy normalization. In order for these steps to help restore some credibility, we believe it is imperative for the CBRT to sound visibly cautious. The cutting of the remuneration rate was the first such step. This was more a move of symbolic importance and the actual impact on liquidity conditions was marginal at best.

The second move was more significant: The CBRT raised the FX reserve requirement ratios by 300 basis points across all liability types and maturity brackets for all banks. This partly reversed the 500bp FX RRR cut delivered as a part of a package introduced on March 17 to contain the adverse effects of the pandemic. The CBRT described this latest move as part of the normalization process and an effort to support financial stability.

As a result of this move, US$9.2 billion of FX and gold liquidity is expected to be withdrawn from the market. True, restoring gross FX reserves could be one motivation behind this move. However, the reference to financial stability suggests that the CBRT is also concerned about the rapid loan growth and sees the need for tighter policies. The market needs to see further signs of prudence from the Bank. A more hawkish statement from the MPC this week – though unlikely in our view – could help in this regard.

Good bye to easing cycle

Going forward, we expect the CBRT to remain on hold until the end of the year. With recovering domestic demand and increasing price pressures, the next move will be a hike, in our view. Currently, we have the first hike in 1H21, but a sharper-than-expected demand recovery could lead to heightened risks to price and financial stability, encouraging the CBRT to act earlier.

Excerpt from JP Morgan research note

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/