Annual Turkish inflation came in higher than expected in February, and it’s expected to go higher still in the near term as ongoing price pressures remain, comments ING EM research team. While ING sits on the fence regarding year-end CPI target is achievable, other investment banks also expressed pessimism about inflation after today’s higher-than-expected CPI print.

The below are highlights from ING report:

Higher food prices are a major factor in Turkey’s inflation struggle

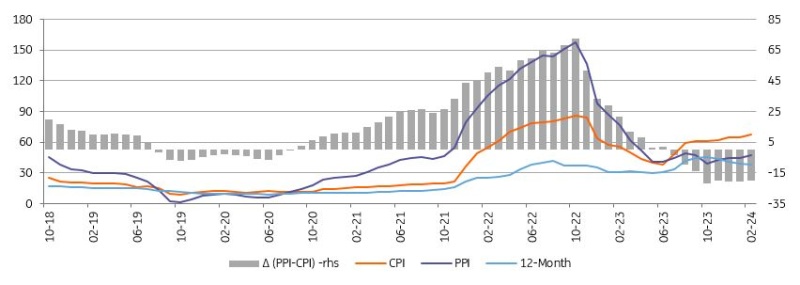

With February’s month-on-month inflation figure for Turkey at 4.53% being above ours and the consensus call, annual inflation came in at 67.1%, YoY up from 64.9% a month ago on the back of across-the-board price increases. While there was an increase of 3.1% in February 2023, the average of February months of the 2003-based index was 0.9%, indicating that the base effect was favourable for this year. Accordingly, cumulative inflation in the first two months reached 11.5% vs the 36% central bank’s forecast for this year, while annual inflation has remained above the CBT’s forecast range of 30-42%.

February PPI, on the other hand, stood at 3.7% MoM, showing an acceleration to 47.3% YoY. However, the decline in annual PPI from close to triple digits last year shows significant improvement in cost pressures thanks to commodity price changes and exchange rate developments.

Core inflation (CPI-C) came in at 3.6% MoM, moving up to 72.9% on an annual basis on the back of pricing behaviour, implications of the minimum wage and public salary hikes, adjustment in administered prices and inertia in services. Relatively subdued exchange rate moves have recently supported the inflation outlook.

On a seasonally adjusted basis, after the spike in January, core inflation improved markedly thanks to the core goods, while services have maintained a solid underlying uptrend. As a result, despite some easing, the headline inflation trend has remained elevated at above 4% MoM. The CBT sees the seasonally adjusted monthly inflation to hover below 4% on average in the first half of this year (around 3% except for January). This implies that disinflation should be more pronounced in the coming months for the CBT forecast to hold.

In the breakdown:

Food again turned out to be the major contributor with 2.03ppt, leading to an increase in the annual figure to 71.1% driven by both unprocessed and processed food.

Housing and transportation followed, with a 0.49ppt contribution each, due to i) continuing pressures in rent and adjustments in prices of some construction materials for the former and ii) increases in gasoline prices and transportation services for the latter. Accordingly, energy inflation maintained its recent uptrend and reached 36% from double-digit negative levels in the middle of 2023.

Catering services lifted the headline by 0.47ppt, reflecting the impact of pressure on food prices and inertia in services.

Accordingly, all groups provided positive contributions showing the ongoing challenges on the inflation front.

As a result, goods inflation moved up to 57.0% YoY, while core goods inflation inched up to 54% YoY. Annual inflation in services, which is generally influenced by domestic demand and wage hikes, maintained an uptrend and reached another peak at 94.4% YoY.

Overall, annual inflation turned out higher than expected in February, while we expect further increase in the near term. Given the deterioration in price dynamics and the underlying trend remaining above the CBT projection for the first half of this year, inflation prints for March and April will be key for the bank’s behaviour, given its clear forward guidance that the monetary policy stance will be tightened “in case significant and persistent deterioration in inflation outlook is anticipated”.

Commentary from major investment banks

JPMorgan: We expect the CBRT to increase the policy rate by 500 basis points to 50% in April (previous expectation was 45%). We expect TUFE to peak at 76% in May 2024 (previous expectation was 73%).

Citi: CBRT’s inflation forecast path indicates that a moderate easing is possible in 4 quarters. However, we cannot completely rule out a scenario that could lead the Bank to review its stance in the second half of the year or earlier.

Goldman Sachs: We think that the CBRT will want to see whether capital flows normalize after the elections before increasing interest rates. Today’s inflation figures have increased the risk that the CBRT will increase interest rates further.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/