Recent growth indicators confirm slowdown in activity

The contraction in August industrial production and the plunge in retail sales in the same month imply that, following the large diversion in both indicators since the second half of 2022 that has contributed to growing macro imbalances until recently, we are likely to see the start of a reversal in this trend. This can be attributed to the impact of an ongoing deceleration in consumer loan growth as higher lending rates and the caps on volume expansion likely started to weigh on domestic demand.

We expect this loss of momentum to continue over the coming period given tighter financial conditions which are supportive of normalising household consumption. Meanwhile, weak external demand is persisting as a result of a more sluggish growth outlook for the eurozone, Turkey’s key export market. A soft landing scenario currently prevails as a result of the gradual tightening of monetary policy through the CBT’s long rate hike cycle from June, as well as the slower simplification process in the macroprudential framework and supportive fiscal policy.

Likely acceleration in spending in the last quarter

September’s budget results reflected a worsening in the budget deficit in comparison to the same month of last year on the back of high non-interest expenditures driven by the acceleration in transfers to SEEs, despite the continued strength of increases in direct and indirect tax collections. Accordingly, the budget posted a deficit of TRT 129.2 billion, worsening from the TRY 78.6 billion deficit in the same month last year while widening to TRY 602.6 billion (2.7% of GDP) on a 12M rolling basis. In the new MTP, the budget deficit forecast for 2023 was revised to 6.4% of GDP. This suggests that a very large deficit of around TRY 1.1 trillion may be recorded in the last quarter of the year. The fiscal stance will remain accommodative in 2024 with another wide deficit at 6.4% of GDP, mainly due to continued earthquake-related spending. The issue here is that the fiscal outlook for next year suggests fiscal policy will not necessarily help the CBT with the disinflation process.

FX and rates outlook

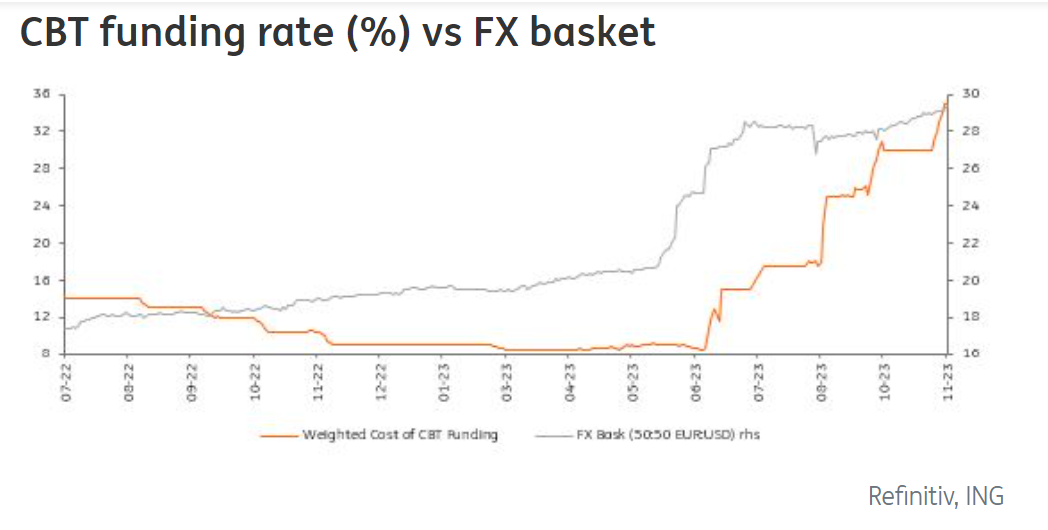

Despite some economists’ expectations and market pricing of a slowdown in rate hikes, the CBT delivered another 500bp in October and maintained its commitment to monetary policy normalisation. Accordingly, the carry to be short remains high. Fundamentals on the balance of payments side are expected to improve in the coming period, given that the policy-induced slowdown in the economy will lead to a correction in the trade deficit and therefore in the current account balance. On the financing side, an increase in capital inflows would support the soft-landing scenario, helping with reserves and the currency. Relatively higher external debt repayments in the last two months of the year will be under watch.

In line with its signal to take steps on quantitative and selective tightening to reinforce rate hikes, the CBT has come up with a set of new actions including broader adjustments to its security maintenance framework. The central bank has already cut auctions to buy bonds in the secondary market, which led to a marked drop in the share of government securities also attributable to an expansion in the balance sheet, with an inflating effect from the recent currency adjustment and upward pressure on yields – especially in the back-end. The regulatory impact on the bond pricing should further decline following the latest changes, with further support to the recent normalisation in yields. Higher inflation expectations and continuing upward adjustment in policy rate expectations also weigh on bond yields.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/