Policy makers respond to TRY depreciation by influencing market rates through regulating bank balance sheets. <1M maturity commercial loans rate has risen to 40%; deposit rates close up at 20%; we adjust estimates accordingly;

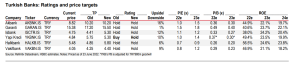

Downgrade YKB to Hold; maintain remainder of coverage at Hold; adjust TPs; depressed multiples fair given macro risks

Adjusting estimates to reflect new measures and changes in rates

In June, policy makers introduced new measures for banks in response to accelerating TRY depreciation. These measures aim to: 1) convert companies’ excess FX to TRY; 2) increase credit rates and cool growth; 3) lower borrowing costs for the Treasury; and 4) help banks with FX liquidity amidst rising CDS rates. We increase our 2022/23/24e earnings estimates 57/54/66%, respectively, on higher lending rate and inflation assumptions. Yet, a concomitant increase in our cost of equity assumption neutralizes the valuation impact. Depressed bank multiples look fair to us as the policy measures create new layers of complexity and the risk of a large macro adjustment remains.

Measures in June aim to slow credit and lower the Treasury’s borrowing costs

Three of the new measures come to the fore. First, BRSA has made companies’ access to TRY loans conditional on the level of their FX holdings. Second, the CBRT’s change to its reserve policy, requiring that banks buy fixed rate, long-term TRY bonds, allows the Treasury to borrow at lower rates compared with CPI linkers, but also widens banks’ duration mismatches at unfavourable yields and increases cash deposit rates. Third, the reserve requirement for commercial loans was doubled, thereby pushing rates on short-term working capital loans towards 40% and slowing demand.

We see relative value in Akbank over its listed peers

Turkish private banks’ 2022e PB of 0.40x may seem low for 43% ROE. Yet, adjusted for inflation and CDS rates, ROE falls to -39%. Bear in mind that Greek banks are trading at 0.40x PB for -2% ROE. We struggle to see why Turkish banks should perform with such comps. We downgrade YKB from Buy to Hold; after its strong performance, the upside risk no longer justifies macro risks. We adjust TPs and retain the remainder of our coverage at Hold ratings.

That said, we see relative value in Akbank as its YTD underperformance seems overdone. We expect Garanti’s valuation premium to keep dwindling given a drop in its float and liquidity.

Excerpt only

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/