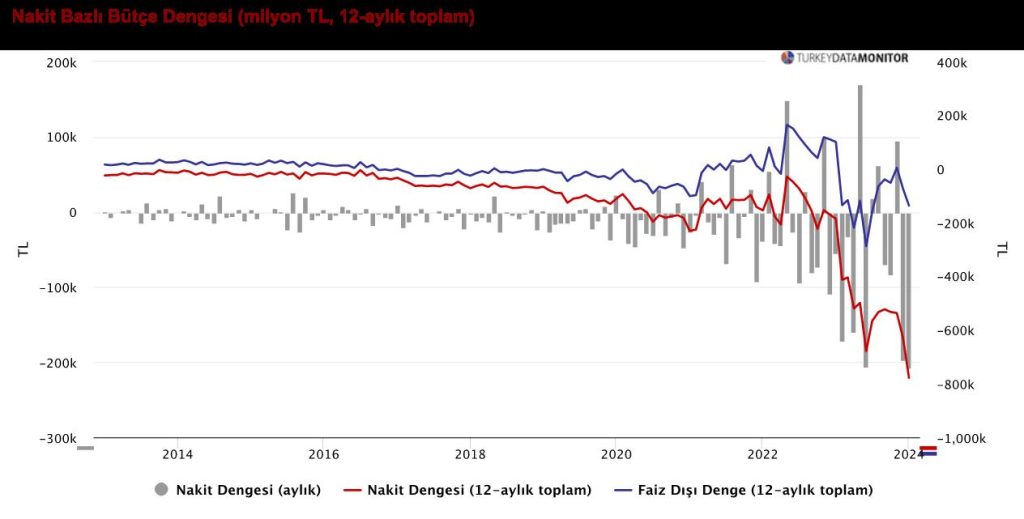

Erdogan is opening the budgetary floodgates wide to win end-March municipal elections. The January 2024 cash-based budget deficit announced by the Treasury on Wednesdas has widened to 206 billion TL, roughly four times the 54.3 billion recorded in January last year. The gravity of the situation can be seen more strikingly from the graph below.

Legend: Grey bars: monthly deficit; red line: budget deficit, blue line: non-interest balance

Details reveal the increase in revenues was 113.5% annually, while growth in expenditures reached 140%, showing that we are not even close to the tight fiscal policy. While the increase in non-interest expenditures was 121%, interest expenditures climbed at an extraordinary level of 439%, boosted by the depreciating TL and increasing interest rates.

Photo: Guldem Atabay

We have been observing that the Treasury has been using its increasing deposit account for a while, in addition to domestic borrowing, to finance this deficit.

After the change of CBRT President, Şimşek once again declared commitment to the disinflation process. However, there is no harmony between the objectives of fiscal and monetary policy. Treatign the dichotomy as temporary fiscal expansion expected from any government before elections would not be a very satisfactory approach.

The myopic tax increases in July 2023, and then the adjustment in minimum wage and wages/salaries of civil servnats, in January 2024 without reducing spending in other budgetary items, have already given a significant acceleration to inflation, which because of stickiness of inflation expecations could become permanent.

Given this kind of public sector driven pricing momentum, the CBRT, which projected CPI inflation to be 70% in May 2024, will sooner or later have to raise its expectation of 36% at the end of the year. Most likely, the May peak will be higher than CBRT guidance and in the 3rd Inflation Report of the year, the CBRT will have to up its year-end CPI targrt to 45%.

If the new CBRT President Karahan really has the intention of strengthening the fight against disinflation beyond liquidity management with the space created by Şimşek, he will have to hike the policy rate from 45% to the 50-55% range immediately after the local elections.

If single-digit CPI inflation in 2026 is a target that we should take seriously, and even if there is seriousness about 14% CPI inflation by the end of 2025, the government must effectively implement selective tight fiscal policy in addition to the continuation of monetary policy interest rate increases.

More tax increases in the absence of a complimnetary effort to spread taxation to a wider base will have an adverse effect on the fight against inflation after this stage. The way to contribute to the fight against inflation by narrowing the budget deficit has to come not through further tax increases, but through measures to restrict current expenditures, excluding earthquake related items. It has to be accompanied by taxation of wealth for instance. Having a primary surplus ex-earthquake expenses, needs to be on the government agenda. Although the period following the local elections is an appropriate time to take these steps, how politically desirable they are is another matter of debate.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/