Emerging markets (EMs) face a variety of additional credit risks stemming from the Russia-Ukraine conflict, with further price pressures and diminished investor risk tolerance being among the most prominent, says Fitch Ratings. For commodity-exporting EMs, these risks may be offset where higher commodity prices result in increased export earnings and an associated boost to tax revenues.

According to Fitch “signs of external financing strains could be a trigger for negative rating action for several EM sovereigns, including Egypt and Turkey”. Turkey will also be adversely affected by commodity price increases.

Below are important bullets from the Fitch wire:

The conflict has pushed energy prices well above our December baseline assumptions (we had expected the oil price to average USD70 per barrel in 2022) and the risk of further price rises is high. For many countries in emerging Europe, if the supply of Russian gas is curtailed in a downside scenario it could lead to factory closures and loss of GDP. Agricultural commodity prices are also likely to be higher than we anticipated, given that Russia and Ukraine are both significant grain exporters.

Energy and food tend to account for a higher share of household spending in EMs than in developed markets (DMs), so EMs will be more vulnerable to this increase in inflationary pressure. We believe food prices could be particularly affected where wheat forms a larger share of consumption and imports are significant, as in Egypt (B+/Stable), Jordan (BB-/Stable), Morocco (BB+/Stable), Tunisia (B-/Negative) and Turkey (B+/Negative). Higher inflation could add to political risks for some EMs. In Kazakhstan (BBB/Stable), for example, an increase in fuel costs after price liberalisation fed into anti-government unrest in January 2022.

Ukraine Crisis Could Cost Turkey $30 Billion

We expect many EMs to respond to increased price pressures by raising interest rates, often with a greater amplitude than DMs, owing to their weaker policy credibility and the greater importance of exchange rates. This will weigh on growth outlooks and slow fiscal consolidation and debt stabilisation or reduction, which are important rating sensitivities for many EM sovereigns.

Fed Interest Rate Hikes Will Hurt Turkish Economy (And Other Emerging Markets) Badly

For countries with short average debt maturities and large debt, higher rates could push up interest/revenue ratios. These are already a credit weakness for a number of EMs. Budget performance may also be weaker than we currently expect, if the authorities use fiscal policy to cushion the effect of higher prices on households and companies.

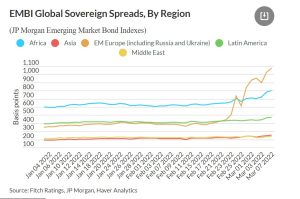

The conflict is likely to boost risk aversion among international investors. This will probably raise the cost of external financing for riskier EM sovereigns in 2022, which we had already expected to increase owing to Fed tapering, rate rises and a stronger US dollar. Raising debt on global markets may become prohibitively expensive for vulnerable “frontier market” sovereigns. Some, like Ghana (B-/Negative) and Tunisia, had already effectively lost market access. We have said that signs of external financing strains could be a trigger for negative rating action for several EM sovereigns, including Egypt and Turkey.

Higher commodity prices may be a net credit positive for some EM sovereigns that export such products. We expect oil exporters such as Angola (B-/Stable), Azerbaijan (BB+/Stable), Republic of Congo (CCC), Gabon (B-/Stable), Iraq (B-/Stable) and member states of the Gulf Cooperation Council to be among the beneficiaries, for example. However, for some agricultural exporters like Brazil (BB-/Negative), potential benefits from higher prices may be reduced by higher fertiliser costs, as Belarus and Russia are major exporters of potash and other fertilisers.

Russia and Ukraine are generally not major destinations for EM goods exports, other than for some emerging Europe sovereigns. However, reduced flows of arrivals from Russia could set back tourism recoveries in markets like Egypt, Thailand (BBB+/Stable) and Turkey in the wake of the Covid-19 pandemic.

Follow our English language YouTube videos @ REAL TURKEY:

https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng