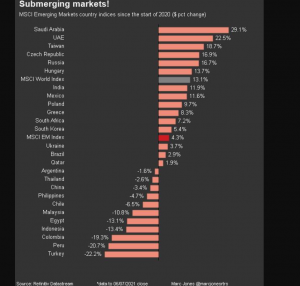

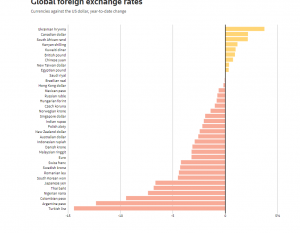

Most emerging market currencies fell on Wednesday, while stocks were set for their worst losing streak in 10 months as investors feared more hawkish signals from the minutes of the U.S. Federal Reserve’s recent meeting.

TL fell to 8.7 vs the dollar, but largely escaped the onslaught. At 5:30 pm Istanbul time Borsa Istanbul main index was up by 0.6%, also bucking the EM trend, thanks to a spate of share buy-back announcements.

MSCI’s index of emerging market currencies fell as much as 0.3% to a two-month low, while the stocks index sank 0.4% and was set for a seventh straight day of losses.

Still, a rebound in base metal prices and a stabilizing crude market helped commodity-linked currencies recover from recent losses, with South Africa’s rand and Russia’s rouble rising 0.2% and 0.5%, respectively.

The dollar had surged late on Wednesday as investors anticipated more hawkish signals from the Fed minutes, after the bank during its June meeting brought forward plans to begin tightening monetary policy.

Rising global cases of the highly infectious delta variant of the coronavirus have also spurred a risk-off mood in recent sessions, weighing on emerging markets.

“Principally the minutes are unlikely to differ hugely from the information provided at the meeting on 16th June … even following careful scrutiny there will not be much reason for any moves in the dollar,” Antje Praefcke, FX and EM analyst at Commerzbank wrote in a note.

“In the short term, therefore, market uncertainty about the delta variant and its possible consequences on the economies is likely to set the tone.”

While rising delta cases in Asia had first sparked concerns over the variant, increased infections in Latin America and parts of Europe have also brewed more uncertainty.

Russia’s rouble was set for its best day in two weeks, after tumbling to a two-month low on Wednesday as a breakdown in OPEC talks prompted wild swings in the crude market. But oil prices appeared to have stabilised on Wednesday.

Russian stocks rose 0.2%. Investors were awaiting Russian inflation data later in the day.

South Africa’s rand shrugged off data showing a dip in net foreign reserves in June. Growing optimism over the South African economy has made the rand the best performing emerging market currency this year.

In Asia, Chinese stocks bucked the trend and ended higher after the country ramped up supervision of Chinese firms listed overseas, and vowed to protect local investors.

The move had caused large losses in U.S.-listed Chinese firms on Tuesday.

Follow our English language YouTube videos @ REAL TURKEY: https://www.youtube.com/channel/UCKpFJB4GFiNkhmpVZQ_d9Rg

And content at Twitter: @AtillaEng

Facebook: Real Turkey Channel: https://www.facebook.com/realturkeychannel/